Demand for RWS accredited wool continued through January with stable large premiums reported in South Africa which were evident also in the Australian auction market. This article takes a look at the premiums.

In January South Africa sold 9,600 farm bales of RWS wool at auction. In Australia 2,416 farm bales of RWS wool were sold, across a wide range of wool qualities. RWS is an animal welfare standard so the range of wool quality accredited to the scheme runs the gamut from the flashy spinner types to carding stains and across breeds. The variation in quality presents considerable problems in calculating what premiums are operating in the market, with the consequence that premiums tend to be reported on a proportion of the wool offered (the easier to value Merino fleece types).

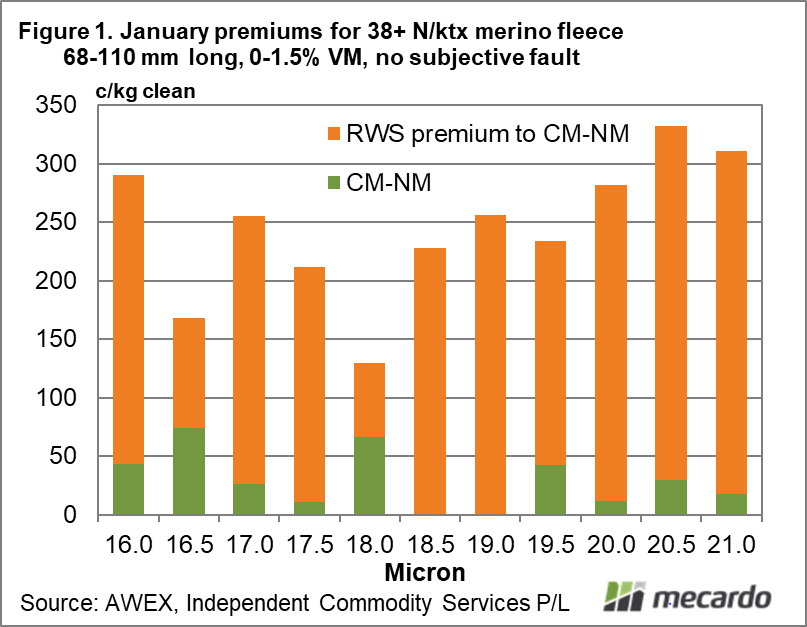

Figure 1 shows the estimated premiums for Merino fleece sold during January in the eastern selling centres (full length, high staple strength, low vegetable fault with no subjective fault) for non-mulesed (compared to non-declared/mulesed/pain relief) and fro RWS accredited fleece (compared to the non-mulesed wool). The premiums run from 16 through to 21 micron. For the RWS lots the simple average premium to non-mulesed wool across all the micron premiums is 216 cents.

Schneider reported last week (view here) that demand for RWS accredited wool was not limited to combing Merino fleece but extended to knitwear and carding types so it reasonable to assume there are premiums operating for these other categories. In January only 1.7% of Merino fleece sold was accredited to RWS so there is still a lack of volume to help calculate what is going on.

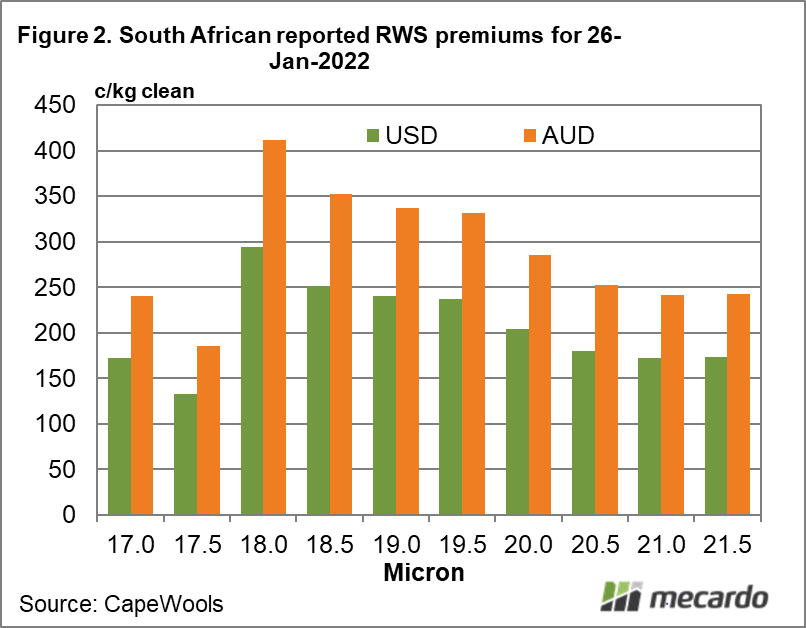

In South Africa there is sufficient volume (as mentioned above) to help calculate the price effect of RWS. Cape Wools publishes a weekly market report for the South African greasy wool market. In late September Cape Wools began publishing the percentage difference between RWS and non-RWS Merino fleece, with a staple strength 29 N/ktx and higher and a staple length 68 mm and longer, with vegetable matter 1.5% and less, by half micron increments ranging from 17 through to 22 micron where data was available. The weekly market report also shows the overall proportion of RWS Merino wool sold. Since late September some 28% of the South African Merino clip has been sold accredited RWS.

Figure 2 shows the RWS premiums reported by Cape Wools for the last week of January. In US dollar terms the average premium looks to be around 200 cents, with a simple average premium in Australian dollar terms of 288 cents. We have to be careful about the quality of wool being used in the calculations, so the key message is that RWS is garnering premiums in the order of 200-300 cents per clean kg in Australian dollar terms.

What does it mean?

As the supply of RWS accredited wool increases it will be easier to calculation premiums across a wider range of wool qualities, but for the moment Merino fleece of good specification can expect to receive a premium of 200-300 cents clean. There are faulty types also picking up substantial premiums, but these are more variable.

Have any questions or comments?

Key Points

- RWS premiums for Merino fleece are currently in the range of 200-300 cents per clean kg across Australian and South African wool sales.

- RWS accreditation extends to wool qualities beyond the standard Merino combing fleece and RWS demand is present for these other qualities

- Australian supply of RWS wool is running around a quarter of the South African volume

Click on figure to expand

Click on figure to expand

Data sources:

AWEX, Cape Wools, ICS