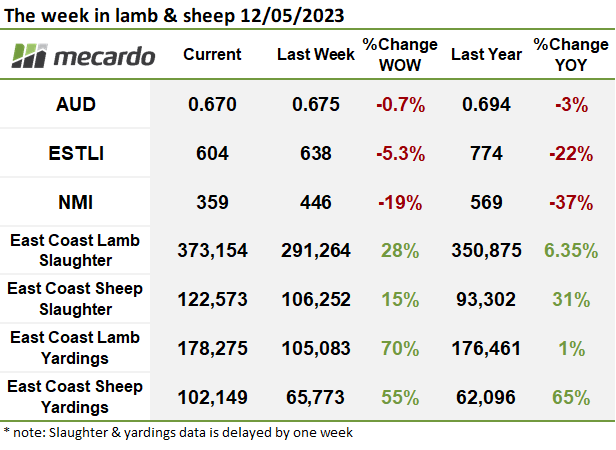

It’s been a rough week that has left sellers feeling sheepish. Prices tumbled across all categories of lamb and mutton. Slaughter numbers are holding strong and with plenty of stock heading to market, the pressure is once again kicking in.

The Eastern States Trade Lamb Indicator (ESTLI) lost 34¢ over the week to settle at 604¢/kg cwt. In the West, Trade Lamb prices also moved lower, but by a more tempered 6¢ week on week to 501¢/kg cwt.

The National Heavy Lamb Indicator dropped 22¢ (-3%) over the week to 667¢/kg cwt, the lowest it’s been since August 2022. The National Restocker Lamb Indicator fell 59¢ (-11%) over the week to 478¢, with restocker lambs selling cheaper in all states except WA. Restocker lamb prices are 228¢ or 32% lower than the same time last year.

Light lambs faced a similar fate this week, falling 52¢. This puts the National Light Lamb Indicator at the lowest level since mid-2016.

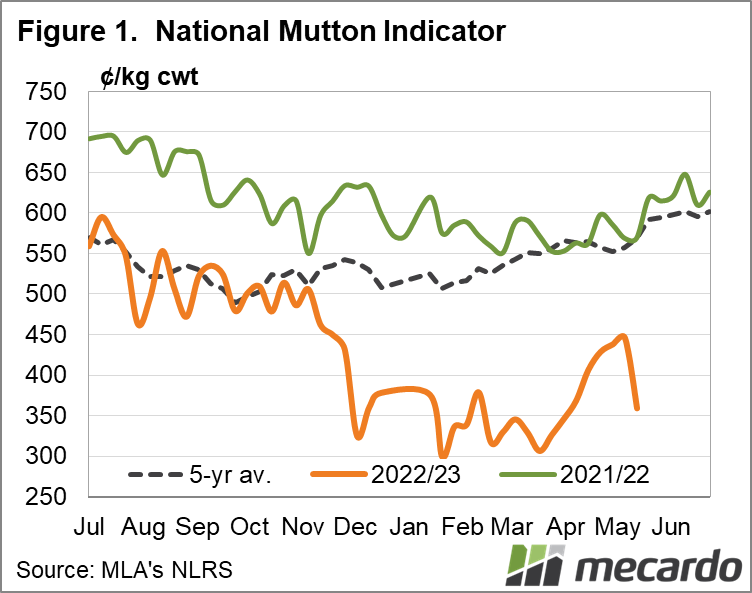

Mutton also lost much of the ground it had made up over the last month. The National Mutton Indicator dropped a heavy 86¢ (-19%) to 359¢/kg cwt.

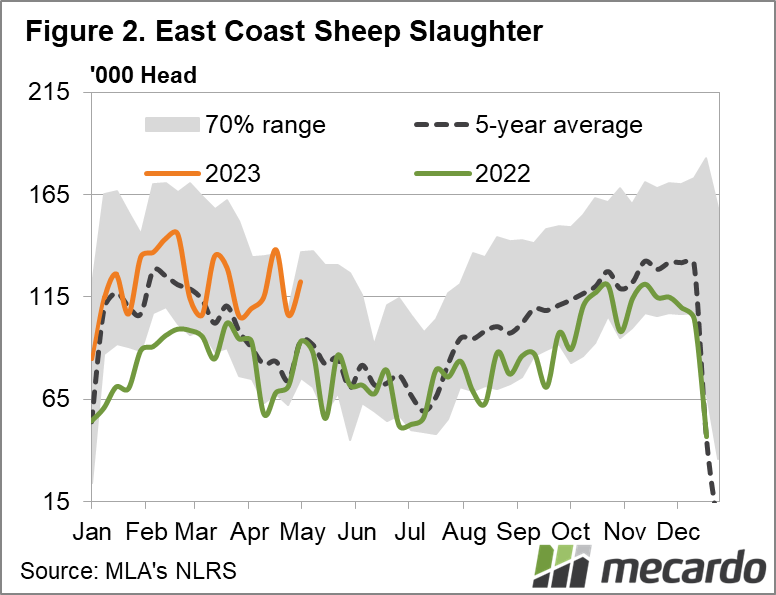

Early yardings reports show a lift in lamb throughput from 196K to over 208k nationally this week, while at this point sheep throughput looks to be back by around 10K head. Slaughter is also continuing at strong levels, particularly for sheep. For the week ending the 5th of May over 122K sheep were processed in the east, and over 46K in the west. This is the largest weekly total kill of sheep in Western Australia at least in the last three years. This reiterates the point made by Leon Giglia, Region Livestock Manager, Western Australia for Nutrien Ag Solutions in last week’s episode of Commodity Conversations (Listen here), “We are hitting spring flush numbers and it’s never been seen before…kill space is a real issue”.

East Coast sheep slaughter is tracking around 31% higher than the five-year seasonal average. Lamb slaughter in the east last week was also up 6% year-on-year and 9% higher than the five-year average.

The week ahead….

After the whitewash of this week, we can only hope for a bounce in the weeks ahead. Last year it wasn’t until July that we really saw supply tighten up and prices rally, so we may be sitting with a cheaper market for a while longer.

Have any questions or comments?

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: MLA, Mecardo