2023 has set the record for the most amount of mutton exported since 2000, with over 200kt expected to be exported from Australia. While 2023 marked a challenging year of extreme supply and weaker demand for mutton, some positive signals are appearing in the Sheepmeat market.

Mutton exports for 2023 have reached levels not seen in decades. December’s

data hasn’t been released yet, but even without the 12th month, 2023

is the largest year of mutton exports since 2000. January to November monthly

export totals averaged 27% above the long-term average, or 4.4kt more mutton

exported each month.

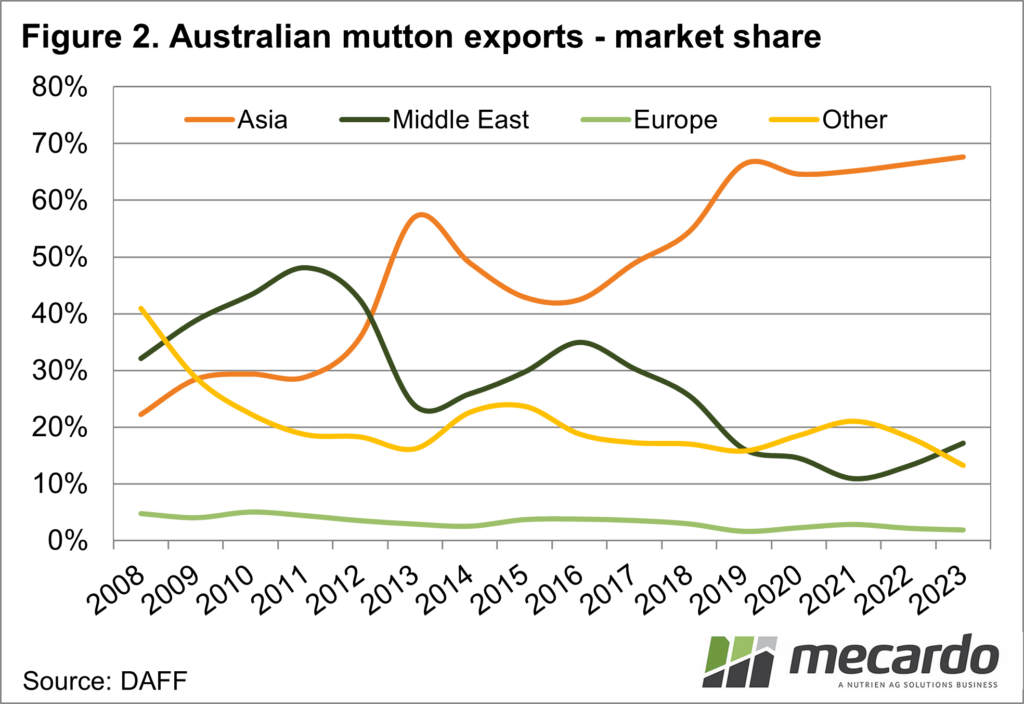

The extra volume of mutton being exported is predominately heading for

Asia. China, the largest importer of Australia’s mutton increased their quantity

by 73% on 2022 amounts (Jan to Nov). The Middle East also increased its intake

by 86%, with Saudi Arabia increasing its volume by 91% on 2022 and the United

Arab Emirates by 60%. The United States is a smaller customer and had a decline

in mutton exports from 2022 to 2023, falling by 8%.

There is no question about the long-term opportunity for Sheepmeat

demand. Consumption globally is on the rise as developing countries increase

their meat consumption and consumers in wealthier countries become more

familiar with the product. OECD-FAO expects global sheep meat consumption to

increase by 15% to 18.1 million tonnes (MT) over the next decade.

Australia’s recent free trade agreements

with India and the United Kingdom have improved the opportunity for Australian

agricultural products such as mutton, through the removal of quotas and

tariffs. The FTA with the European Union is still in the negotiation stages,

but these agreements could add more upside for the demand side.

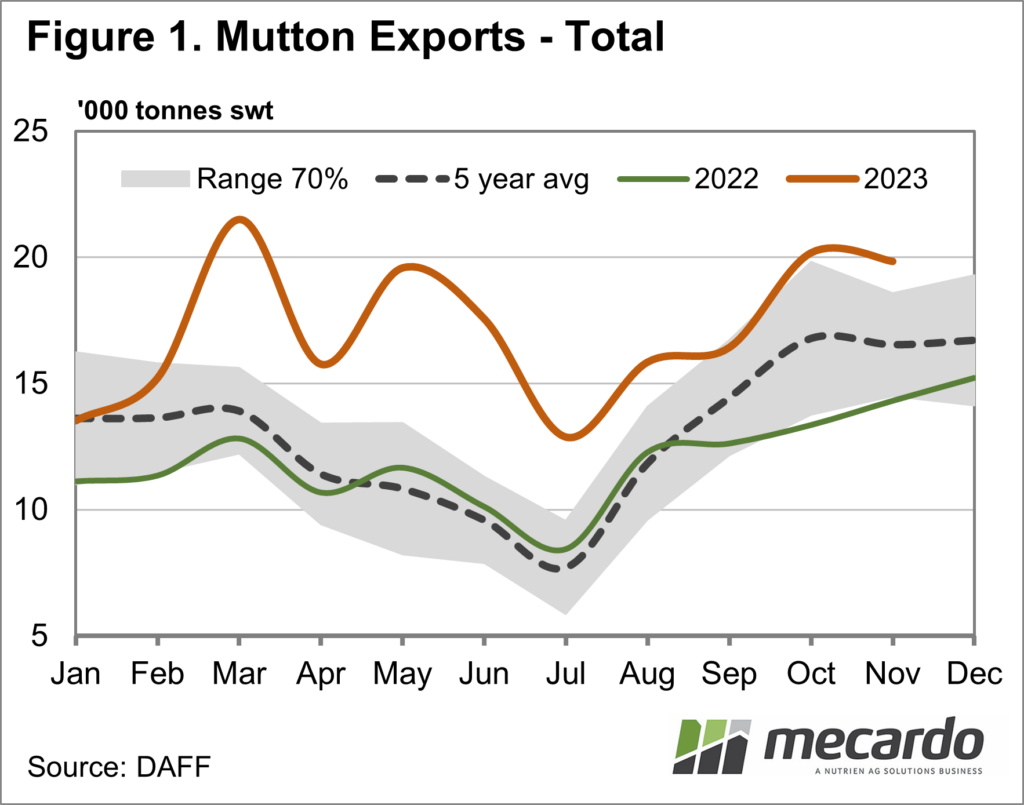

Throughout the 2023 season, total mutton

exports trended above the 2022 season and the 5-year average (Figure 1). The percentage

change year on year between the 2023 and 2022 seasons was highest in June,

which had a YoY increase in total mutton exports of 73% (up 7.5kt from 10.1kt).

This is traditionally a time when mutton exports typically reach their yearly

lows as sheep supply drops off through winter.

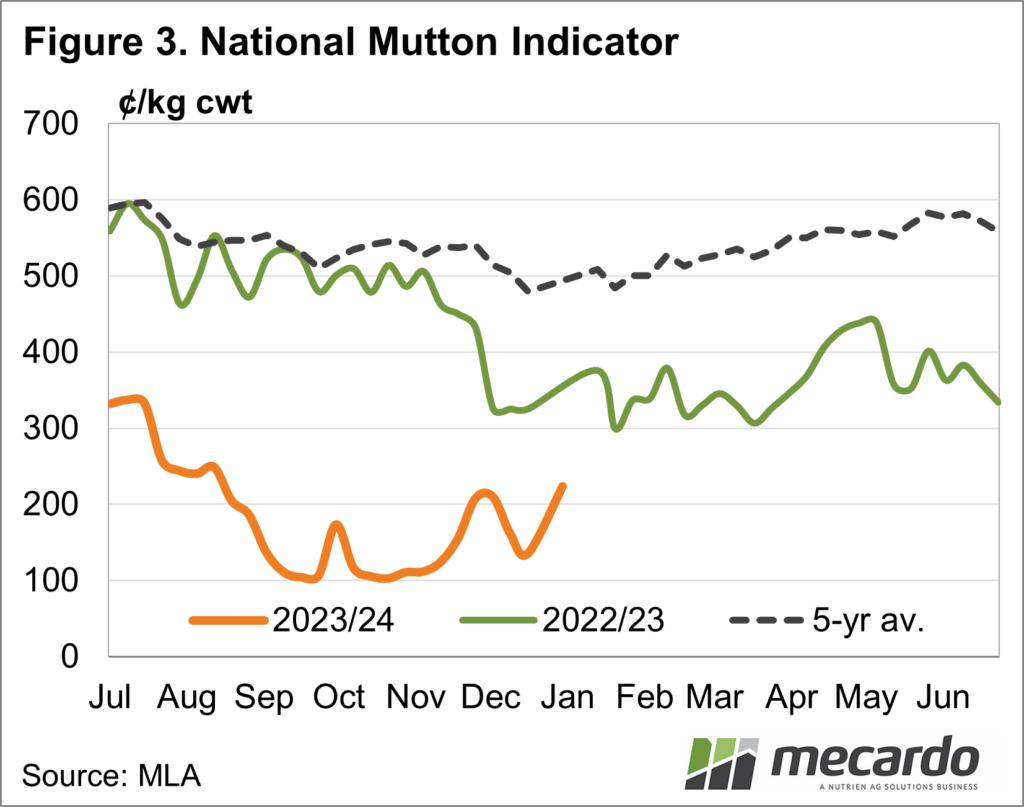

The Australian flock has been through a

growth phase, rising from 63.5m head in 2019/20 up to 70.2m in 2021/22

according to the ABS. Slaughter rates have also been increasing for mutton with

the monthly average reported by MLA NLRS for 2023 up 17% on the 5-year average.

This level of supply, combined with demand-side challenges triggered the downward

price trend since July 2022. The National Mutton Indicator (NMI) fell from

600c/kg to as low as 102c/kg in late 2023. However, the latest export data

shows that our overseas customers have been willing to soak up the additional

supply at this new cheaper price point.

What does it mean?

The large selloff of sheep in 2023 is expected to see the flock contract in 2024. On the demand side, the processor appetite for lamb improved in the close of 2023 and opening sales of 2024.

While the lamb price rally (more on this next week) is yet to be reflected to the same extent for mutton, an improving outlook suggests there is room for more price upside.

Have any questions or comments?

Key Points

- Mutton exports to set a record for highest quantity exported in a calendar year.

- Multiple demand side factors are driving the increase in exports.

- Shifting dynamics in the market point to price upside in 2024.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, DAFF, ABS, OECD-FAO, Mecardo