Last week we did some analysis on the MLA and AWI Wool and Sheepmeat survey. There were some interesting results in the breeding ewes on hand numbers, and lambs marked, both pointing towards a shift away from Merino’s. This week we found more evidence in the lambs on hand, and expected sale data.

We already identified that the MLA/AWI survey for February was showing fewer Merino ewes joined to Merino rams, and fewer merino lambs marked in the four months to February. We know that summer is the slowest time of the year for lamb marking, but there is more data pointing towards more meat lambs being on the market this year, and fewer merino lambs to join the flock.

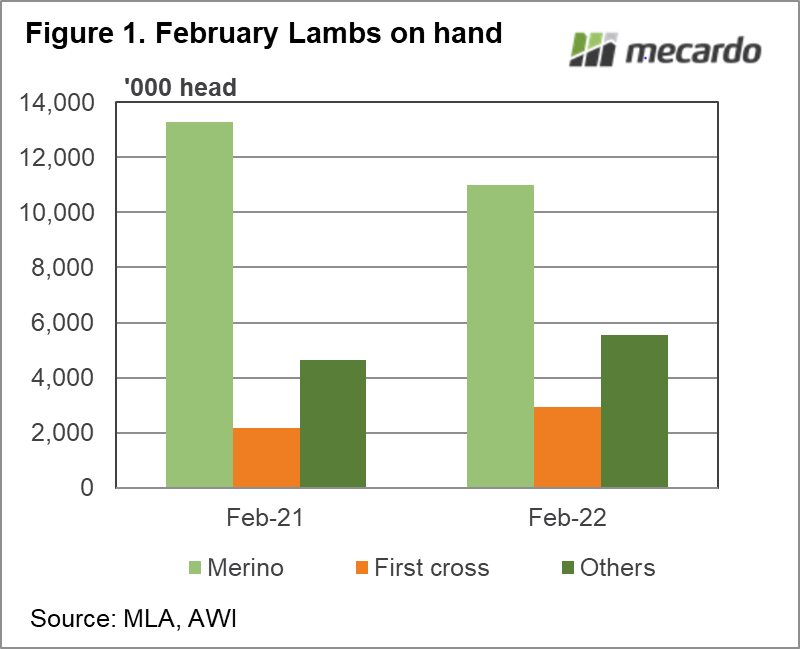

Figure 1 shows ‘Lambs on hand’ at the end of February. Last February is included for comparison, and it’s not looking pretty for merinos. At the end of February there were 17% fewer Merino lambs on hand. There were 2.26 million fewer merino lambs on hand despite a much better season.

Part of the reason for fewer merino lambs was a shift to first cross lamb production. First cross lambs on hand were up 31% on 2021, an additional 756,000 head. There was also a 20% increase in ‘other’ lambs, mostly made up of pure meat and composite breeds. Expanding flocks and better seasons likely added the 934,000 head to the ‘other’ lamb numbers.

The increase in first cross and other lambs didn’t quite make up for the fall in Merino numbers, with the total number of lambs on hand down 567,000 head or 3%.

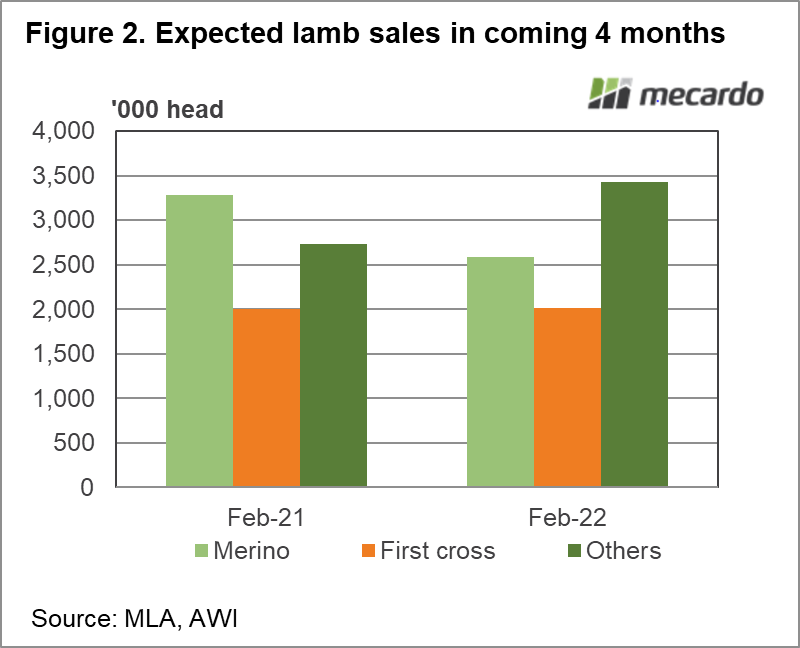

Those watching lamb markets might be concerned about more meat lambs being on hand. Expected sales of ‘other’ lambs in the four months from March to June was 26% higher than 2021 at 3.43 million head (figure 2). This is helping keep a lid on lamb prices.

First cross lamb expected sales were basically the same as 2021, with most ewes seemingly being kept for lamb production.

The number of merino lambs expected to be sold was down 21% on last year, which might see merino prices narrow the gap on meat lambs. Interestingly the number of lambs expected to be sold was basically the same proportion of the lambs on hand as last year. This year 24% of merino lambs are expected to be sold, last year it was 25%. Most are still being kept as replacements.

What does it mean?

In the short terms there are likely to be more meat breed lambs on the market, and we have already seen this to an extent. This might delay the winter supply tightening, and keeps a lid on winter price rises.

In the longer term, fewer merinos basically means less fine wool. It is concerning that in a flock rebuilding phase, merino numbers appear to be shrinking. Good for wool prices in the medium and long term.

Have any questions or comments?

Key Points

- The MLA/AWI survey showed merino lambs on hand were well down, meat breeds up.

- Expected sales of meat lambs was well up, and is helping keep a lid on prices.

- In the medium and long term fewer merinos should see shrinking fine wool supplies.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, AWI, Mecardo