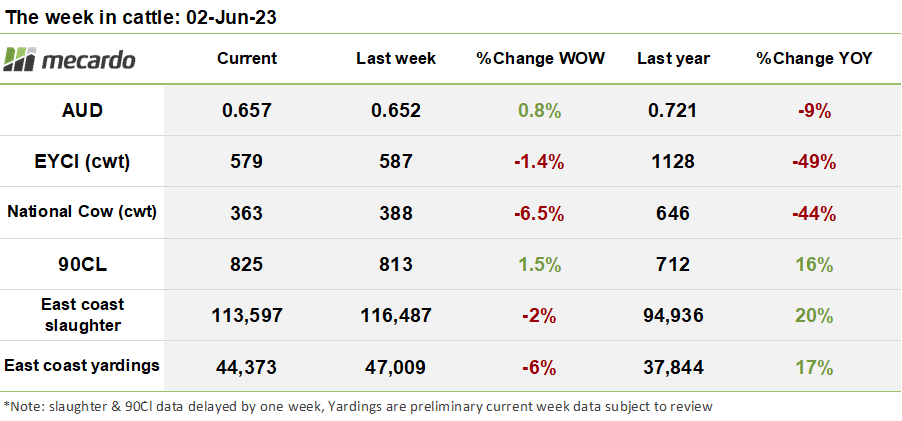

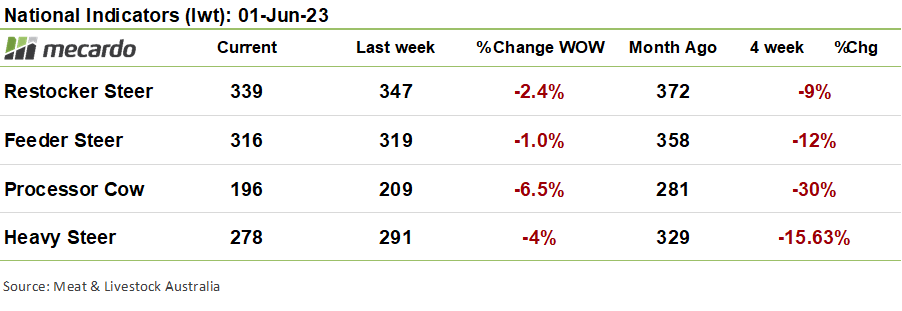

Cattle markets have continued to slide backward, despite reduced supply pressure as yardings fall. Cow prices in particular have been hammered, with the monthly change hitting an eyewatering 30% fall.

The Eastern Young Cattle Indicator (EYCI) slipped back again by 8¢ (-1%) this week to finish the week at 579¢/kg cwt. The usual suspects of Roma Store, Dalby, and Wagga collectively represented 52% of the index. Roma Steer prices ticked up 7¢ (1%) week on week to 688¢/kg cwt, while Dalby prices slid backward 16¢ (2%) to 634¢/lg cwt. Wagga Steer prices took a significant negative turn; giving back all the 6% rise seen last week and more; declining 10% week on week to settle at 610¢/kg.

Turning our attention west, the Western Young Cattle Indicator (WYCI) bucked the negative tone displayed on the east coast, posting a 45¢ (7%) week-on-week gain to end the week on a positive note, at 662¢/kg cwt, with steer prices pushing up 62¢(9%) to hit 749¢/kg cwt.

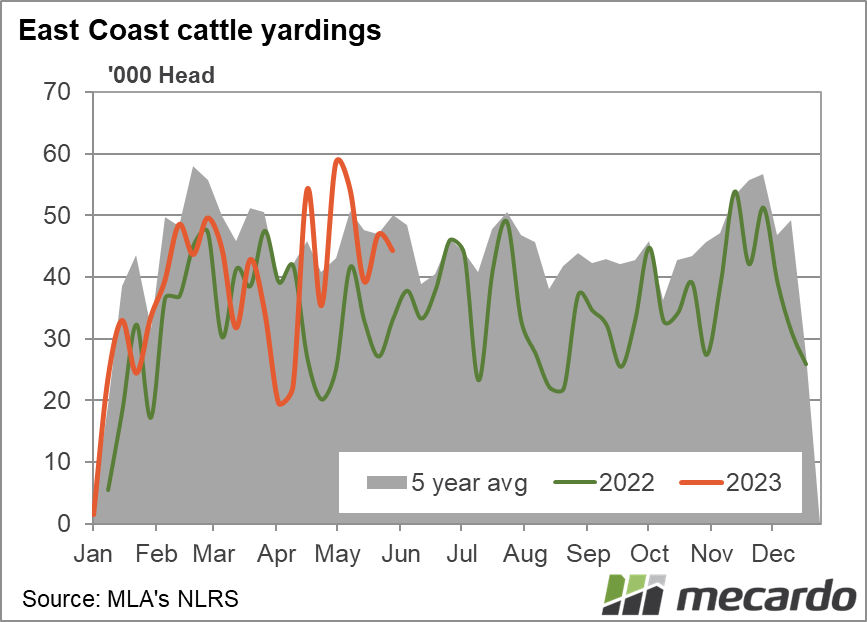

Supply was slightly subdued this week, with east coast yardings down 2.6K head (6%) week on week, with the change primarily driven by a 4K head 21% drop in yardings within QLD saleyards, driven by the lack of incentive provided by the subdued prices on offer, and the promise of rain in the forecast ahead. This was partially offset by increases in NSW and Victoria of 8% and 10% respectively. The drop in QLD supply brought the weekly QLD yardings figure close to 18% below the five-year average for this time of the year. In contrast, NSW offerings were 4% above the 5-year average. Supply to saleyards within VIC has been consistently tracking at 30% typical levels for comparative prior weekly periods for the majority of 2023.

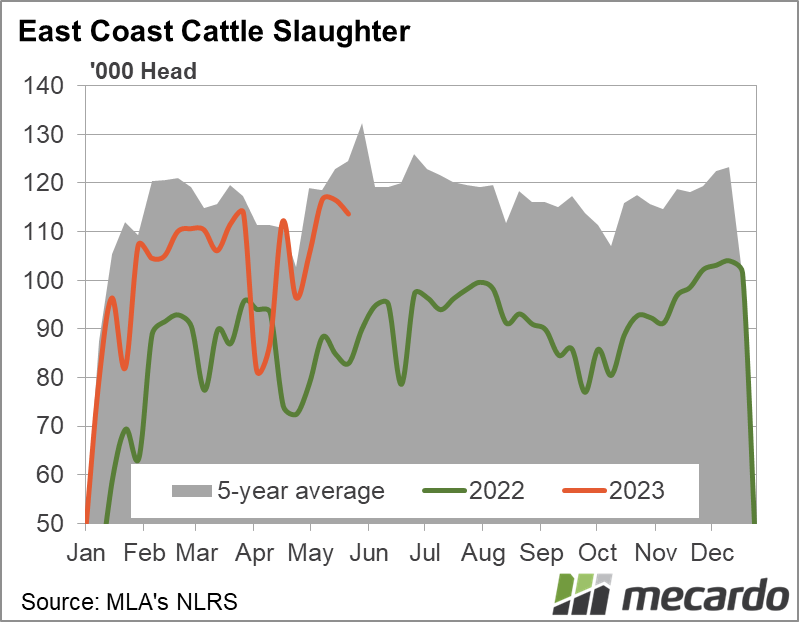

The latest release of slaughter statistics which pertained to last week has remained sluggish, reducing by 2% week on week to sit at 114K head. Given around this time of the year can post some peak average slaughter levels, another directionless week is increasingly dashing hopes that processors will find sufficient export outlets to support a significant and sustained increase in production.

The national indicators took the lead from the EYCI and have continued to slide further into negative territory. Cow prices suffered the most this week, backtracking 8¢ (6%) this week to bring the four-week price reduction to a whopping -30%. Heavy steer prices declined by 4% to notch up a total 16% fall over the last month.

The US imported 90CL frozen cow price provided the one significant bright spot on the marketplace this week, posting a 13¢ (2%) recovery to reach 825¢/kg swt. The recovery was minor but welcome, driven by a 1¢/lb increase in the US price to 246.5¢/kg. The 29th May Memorial Day holiday, typically a traditional time for Americans to wheel out the grill may have helped push prices higher, with a Numerator survey indicating that three out of four Americans intending to celebrate in some way, with more focus this year on attending and hosting parties and BBQ’s. However, Steiner Consulting’s weekly US beef market report suggests that the US market for imported beef largely remains a buyer’s market, with some sellers adopting aggressive discounting strategies to shift volume. Overall, the observation has been that large buyers have mostly sat on their hands and appear to be waiting for the market to offer consistently better value.

The week ahead….

Supply is beginning to show signs of reducing, as producers hang back from marketing cattle in the face of the subdued price environment. The short-term benefit of rain and the confidence it brings will help some sellers buy extra time to make some hard decisions, but the longer-term outlook is predominantly leaning towards drier and harder times ahead.

Signs of a sustainable improvement in the global macroeconomic outlook, to end uncertainty will be a necessary factor to assist exporters in moving products at current price levels. This will support growth in slaughter demand going forward to match the expanded herd, and future supply pressure emanating from deteriorating pastoral outlook.

There’s going to be a changing of the guard at Mecardo, as I’m moving on, and cattle commentary will be taken over by my colleagues here at Mecardo from this point forward. I’d like to extend my thanks to all our regular readers for their interest and support. The great questions, insights, and conversations I’ve had with our subscribers and my colleagues within the industry have been greatly appreciated and helped deliver hundreds of articles and market commentary over the past three years of my tenure here.

Please support the wider Mecardo team by keeping the questions coming and taking the time to call them up to suggest subjects or theories that the Mecardo team can help put a spotlight upon that would be of benefit to the industry and market.

- Adrian Ladaniwskyj

Have any questions or comments?

Click on graph to expand

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: MLA, Steiner, Mecardo