South African sales are scheduled to re-start wool auctions for the season this week, although the ban by China on South African wool imports due to an outbreak of Foot and Mouth Disease earlier in 2022 continues. With this is in mind we take a look at the South African merino clip from last season.

In round numbers the South African merino clip is around 180-190,000 farm bale equivalents, close to 1.5 microns broader (19.3 micron) than the Australian merino clip, with a yield around 63%, average vegetable fault of 1.5% and centred around 60 mm in length (quite short by Australian standards). This information is available on the excellent Cape Wools website. In addition to these measurements, the South African merino clip is unmulesed with around 30% of wool sold last season accredited to the RWS integrity scheme.

In the immediate future South Africa is faced with a ban on wool being sent to China (from last April) due to an outbreak of Foot and Mouth Disease in their northern provinces. As for Australia, most of the South African clip has to go to China for early stage processing so this ban poses great problems for the South African wool industry. From April onwards South African wool sales were heavily disrupted which may disadvantage South Africa in the comparisons below.

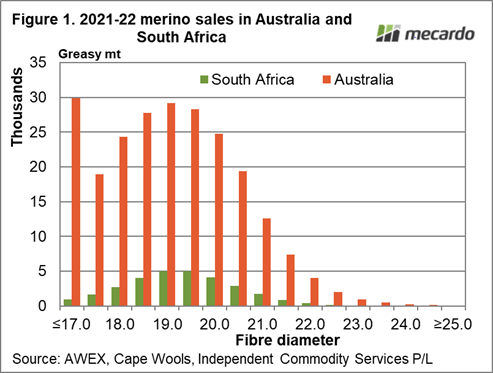

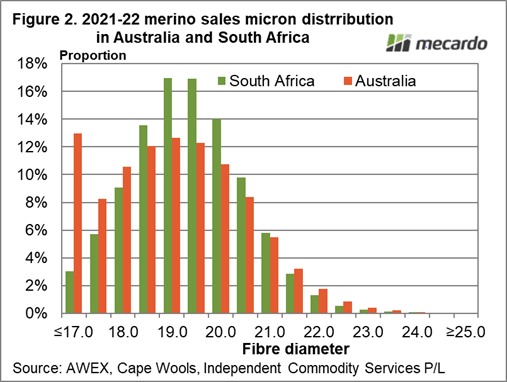

Figure 1 compares the Australian and South African merino clip volumes by micron categories (as published by Cape Wools). Last season the South African merino clip was around 13% of the size of the Australian clip in greasy terms, with the 20 micron category the largest by volume. Only 3% of the South African clip was finer than 17.5 micron, compared to 13% of the Australian clip. Figure 2 compares the fibre diameter distribution of the two clips in proportional terms.

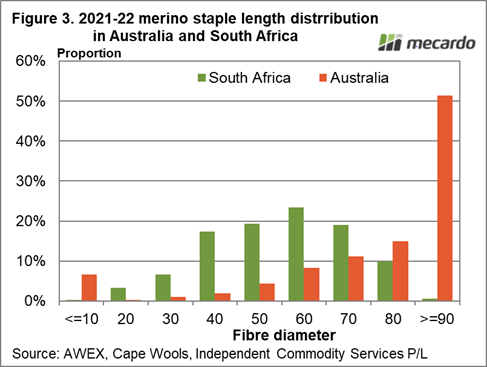

Figure 3 shows where the difference between the clips really begins. It shows the greasy staple length distribution from 10 to 90 mm plus. Last season the 60 mm length category was the largest in South Africa, accounting for 23.5% of volume compared to 8% in Australia. While less than 1% of the South African merino clip is longer than 90 mm, half of the Australian merino clip exceeds this length. In simple greasy volume terms, South African matches Australia for 20-40 mm length merino production and provides little volume for the traditional worsted lengths of merino wool.

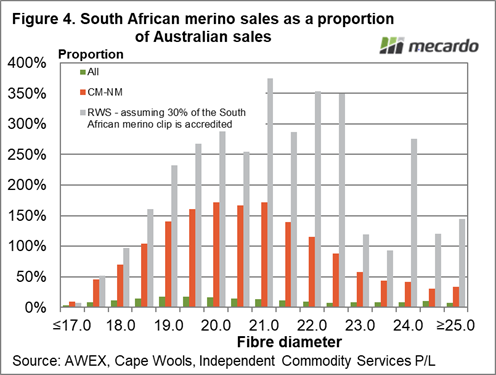

When we filter the Australian volumes for non-mulesed and also compare RWS volumes, the South African merino clip moves to parity. Figure 4 shows the South African merino clip by micron as a proportion of the Australian clip (only 13% in total); it also shows the South African clip compared to the Australian CM-NM merino volumes (sold at auction last season) where South African volumes were 86% of the Australian volumes; and finally compares South African RWS volumes (assuming 30% of the merino clip was accredited) to Australian volumes (similar overall).

What does it mean?

For some specific wool categories, South African production matches Australia, exceeding it in some areas. Therefore supply in South Africa (and access to South African wool) is of interest to the supply chain and therefore the Australian market. In the short term the lack of South African wool may help offset weakness in demand, but it will build greasy stocks in South Africa, and in the longer run may result in the critical mass of merino production shrinking.

Have any questions or comments?

Key Points

- The South African merino clip is approximately 13% of the size of the Australian merino clip in greasy terms, around 170-190,000 farm bale equivalents per season during the past 15 seasons.

- It is much shorter than the Australian clip (averaging around 55 mm greasy staple length), and broader (19.3 micron).

- It is also unmulesed with a relatively high proportion of RWS accreditation.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: AWEX, Cape Wools, ICS