The hot, dry and fiery weather seen since the last markets will no doubt impact sheep and lamb markets as they open this week. With the last of the green feed fast disappearing decisions will have to be made on carrying lambs, so here we take a look at the grain feeding equation.

It shouldn’t be surprising, but a quick scan of the last Auctionsplus Lamb Sale before Christmas showed store lambs could have been considered cheap. A lot of lines were passing in or received no bids, but good second and first cross store lambs in the 35-40kg liveweight range could be bought for $125-135 per head.

At Bendigo yesterday lambs made similar prices to the range shown above, with restocker competition reportedly limited.

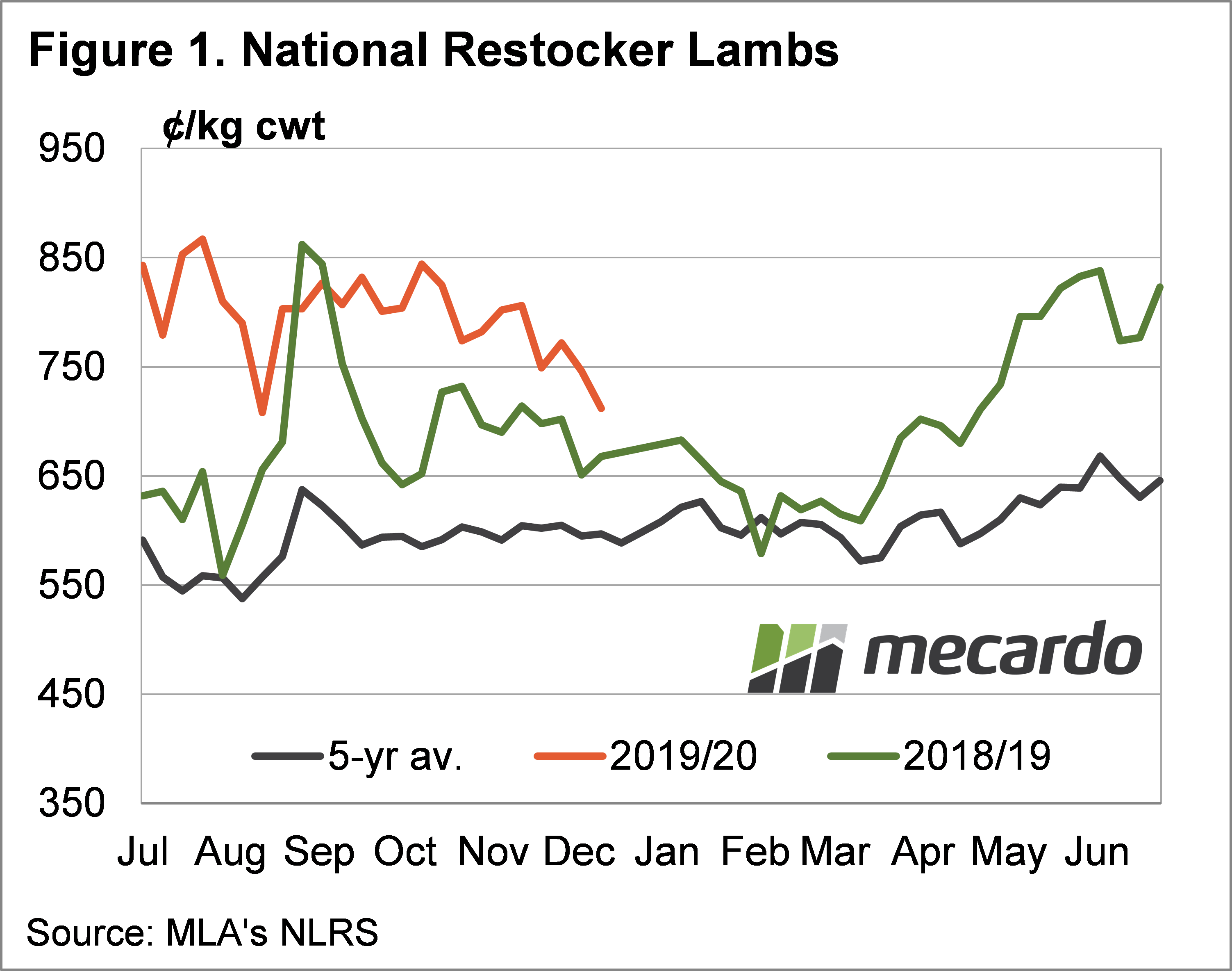

This time last year restocker lamb prices showed a similar trend (figure 1). We all know what happened with lamb prices in autumn, and as it turned out, those that held or bought store lambs made some very tidy profits on them.

This year grain is cheaper, and as always, the missing piece of the puzzle is pricing from February onwards. There have been a few forward contracts about, but there is plenty of conjecture around where prices might head.

The relative level of grain prices depends where you are, as usual. In Victoria a high protein ration for finishing lambs will be $50-80 cheaper than this time last year, thanks to lower cereal prices. In NSW the cost of grain is roughly similar.

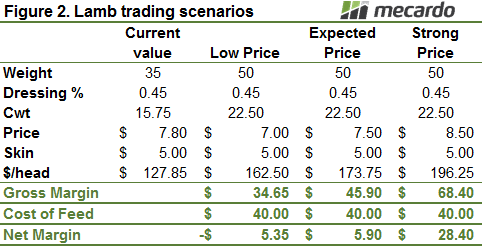

A rough calculation for lambs in the south has it costing $40 to put 15kgs liveweight on a crossbred lamb. This doesn’t take labour or overheads into account, just the cost of feed.

In terms of the price down the track, it is a tricky thing to predict. Lower spring lamb slaughter would normally mean there are more to come in the second half of the financial year. However, the general expectation is that there were fewer lambs born, and the fires will have also had an impact.

We have in the past seen strong rallies in February with contraction in finished lamb supplies as the sucker supplies wanes and shorn lambs are not yet ready.

Figure 2 shows the margins on feeding before and after feed costs as low, expected and strong price levels. We’ve used 750¢ as the expected price, which returns what is likely close to break even after other costs.

What does it mean?

At 750¢/kg cwt there is not much in buying lambs to feed, while it might work for those holding lambs. As the price increases obviously the payoff become more attractive. Lamb prices haven’t been at 850¢ for some time, but that is the upper target for autumn.

There is very good money in feeding lambs at 850¢ selling prices. We haven’t got it on the table, but at 800¢, which is a likely level, there’s $17/head in it using these calculations, which makes it worth doing.

Have any questions or comments?

Key Points

- Store lambs became cheaper towards the end of December, and have opened 2020 at similar levels.

- Grain rations are cheaper than last year, but at current finished lamb prices there is no profit in feeding.

- We have seen strong price rises before, and a lift above 800¢ will make good feeding profits.

Click on graph to expand

Click on graph to expand

Data sources: MLA