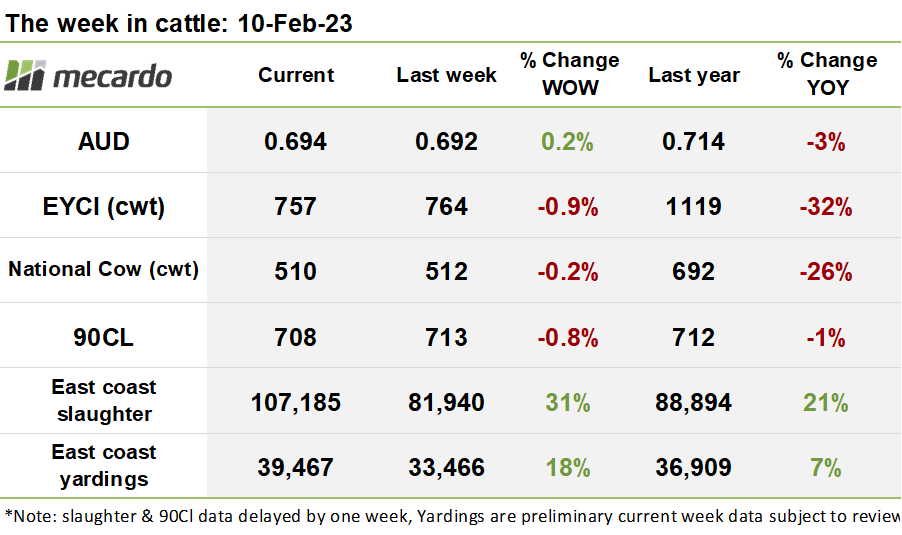

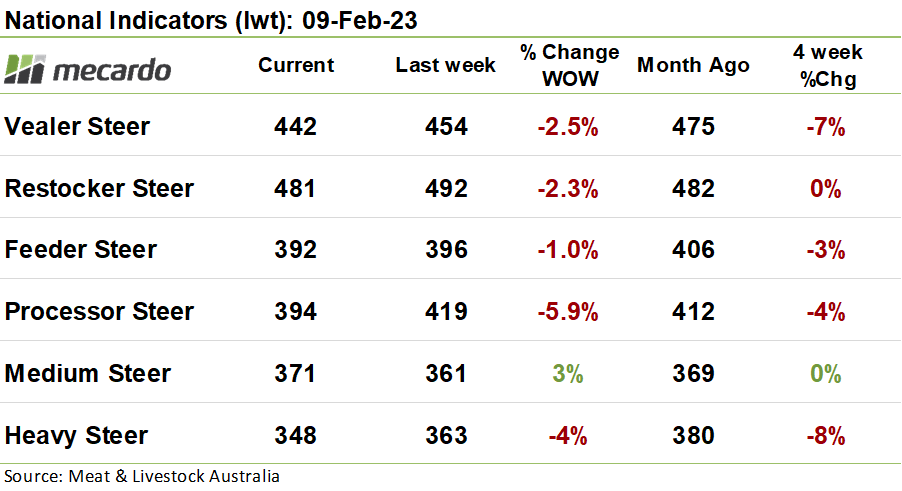

The price of most specifications lost ground this week, with the trend toward quality, and selective buying driving wider price ranges for cattle. Reliable supplies of boxed beef purportedly offered onto the domestic market also dragged on supermarket buying activity. The bright spot is undoubtedly strong slaughter figures indicating capacity for sustained underlying support to prices going forward.

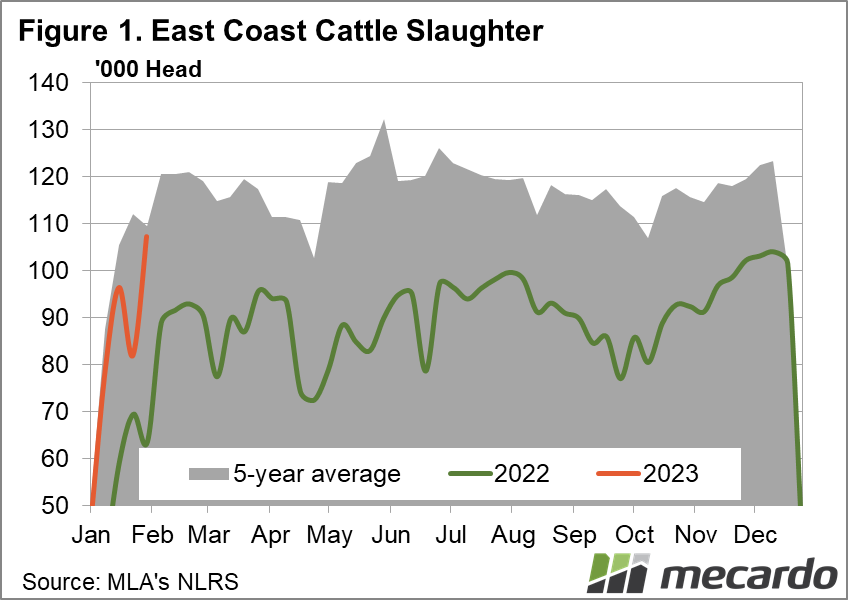

East coast slaughter statistics continue to follow a rising trend, pushing up 31% from the prior week to 107K head, which is 21% above the level seen at the same time last year. Despite reports of rain impacting cattle movements, and processor production slowing from Rockhampton to Townsville, QLD volumes still leaped 31% week on week. Even more promising for finished cattle demand is that last week’s figures were only 2% below the five-year average.

The Eastern States young cattle index (EYCI) inched down again this week, shedding 7¢ (1%) to close the week at 757¢/kg cwt. Steers fetched 784¢/kg at Dalby, 848¢/kg at Roma, 790¢/kg in Dubbo, and 794¢/kg in Wagga Wagga.

Reports from Roma indicated that while buying remains very selective for young and medium-weight cattle, some export processors are travelling further to pick up quality heavy cattle. Wagga also recorded stronger competition for heavy cattle. Further south at Mortlake, quality waned this week, especially for trade cattle specifications, but demand for grown steers was firmer, with interest in cows also solid. An ample supply of sharply priced boxed beef is also being picked up by supermarket buyers, reducing demand for feeder cattle.

The Western Young cattle Indicator (WYCI) dropped 54ٕ¢ (7%) to 777¢/kg cwt on account of cheaper vealer prices, while yearling steers also traded down 111 (16%) to 686¢/kg. The reason for the big fall was quality driven, with reports of a lighter offering in the yards.

In a reversal from last week’s positive trend, the majority of national indicators followed the EYCI, dropping into the red zone. Restocker steers lost 11¢ (2%) to settle at 481¢/kg, however, this is about on par with opening prices this year. Processor steers saw a 25¢ (6%) fall over the week, but bear in mind the index only covered 74 head this week.

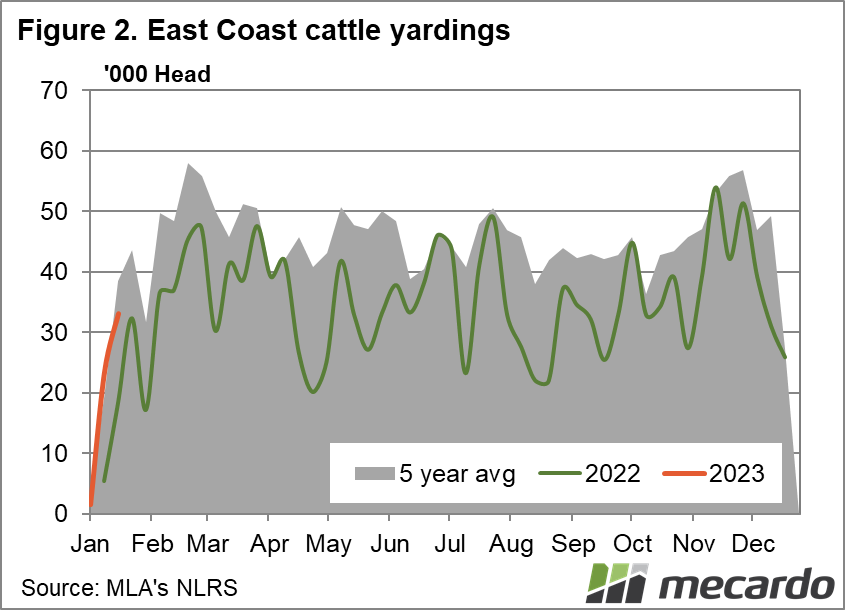

Supply continues to grow, seeing an 18% increase week on week to 39K head, with all the additional volume coming out of VIC and NSW. QLD numbers remained on par with last week. Young cattle offerings were copious, with EYCI-eligible cattle reaching the highest since the start of last December, which would have contributed to the softer pricing. Feeder steer supply was also ample, up 30% week on week. Some pockets of the country are experiencing tighter supply, with rain in western and northern QLD stifling offerings, which has reportedly caused some feedlots to up their bids.

The US frozen cow 90CL price fell last week in both US and AUD terms, downshifting by US 3¢(-1%) to 229¢/lb swt over the week and losing 6¢(<1%) in Aussie dollar terms to close at 708¢/kg swt. The fall in prices may prove to be transitory in nature, however, as US domestic beef prices are rising. Last week, Steiner reported that buyers relaxed their more aggressive stance of prior weeks, contributing to softer prices. The US beef cow herd was estimated to have fallen by 3.6% from 2022, with 28.9m head being the smallest herd since 1962. This suggests that supply constraints that may last beyond 2025 will help provide support to prices for years to come.

The week ahead….

History suggests that slaughter will continue to accelerate for the next couple of weeks, so we could see some good support for finished cattle occurring. This is especially the case if processors in QLD curtailed by adverse weather & road conditions find headroom to operate normally again. The sentiment across all specifications does seem to remain quality driven, with discounts applicable for less desirable lines.

Have any questions or comments?

Click on graph to expand

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: MLA, Steiner, Argus, Mecardo,