As we move towards the end of the 2019-20 growing season, the United States Department of Agriculture (USDA) World Agricultural Supply and Demand Estimates (WASDE) report shows little month on month change. There is plenty to discuss on year on year levels, before the new season WASDE appears in April.

There was a small decrease in world wheat production in the February WASDE report, and a small decrease in consumption, leaving ending stocks and stocks to use at very similar levels. Figure 1 shows that 2019-20 is going to finish with supply outstripping demand and stocks to use lifting slightly to 38.1%. The stocks to use for this season is looking like it will equal the record high set in 2017-18.

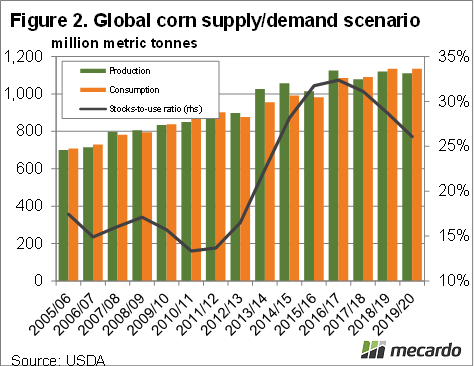

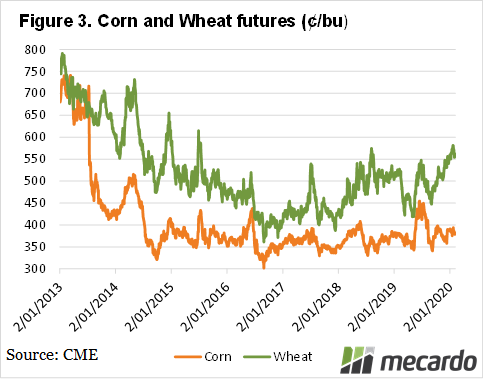

So how is it that wheat prices are above $300/t in US markets, when supply is at record levels? Figure 2 gives a pretty good indication of what is happening. Corn and wheat are substitutes in many feed markets, and world corn supplies have taken a hit this year.

The February WASDE estimated world corn production would have a small lift of 0.8mmt, but consumption was up nearly 1.8mmt, pushing ending stocks 1mmt lower. Corn consumption has been higher than production for three years in a row now, pushing stocks to use to 26.1%.

World corn stocks to use hasn’t been this low since 2013-14, and low corn supplies are supporting wheat prices.

Figure 3 shows wheat has seen some upside over the last year, while corn is up on the 3 year average, but down from the highs of mid-2019. The trade war with China might have kept a lid on corn prices, but wheat is not a large import commodity for China.

What does it mean?

Strong wheat supplies leave prices in a relatively precarious position. Some of the recent upside is due to concerns surrounding the new crop, which will be coming out of dormancy soon. A big spring wheat crop from Black Sea regions is still a possibility, which would pressure prices lower.

The window is still open for wheat hedging, and given current supplies, and prices above $300/t, looking at the WASDE might give more reason to kick off a hedging program for the 2020-21 crop.

Have any questions or comments?

Key Points

- The WASDE released this week showed wheat stocks to use moving back to record highs.

- Corn stocks to use hit a six year low, but prices are relatively low.

- Current wheat pricing looks good, especially if new crop production is strong.

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: MLA, Mecardo