The four months to October are when most of Australia’s lambs are born, and as such the October lamb survey gives us the best idea of lambs supply for the first half of the year. Recently Meat and Livestock Australia (MLA), and Australian Wool Innovation (AWI) released the October survey results, and we look at the key numbers.

Historically the October survey has shown between 40 and 50% of the year’s lamb crop is born in the four months to October. Winter and spring lambing operations make up the majority of sheep enterprises, and thus produce some of the lambs.

The October survey gives the best indication of lamb supply for the first half of the following year, as most are born in this period.

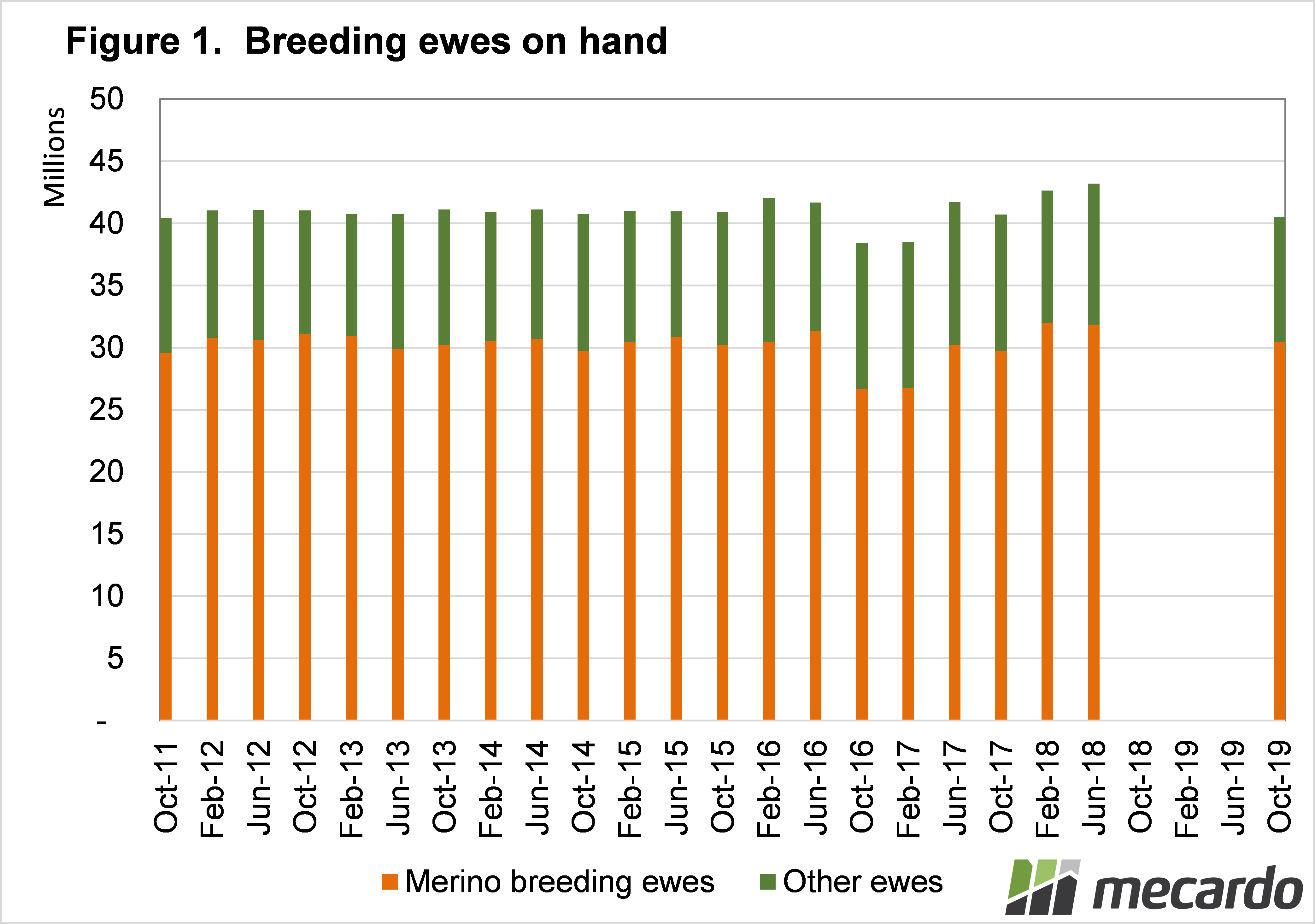

The number of breeding ewes on hand has fallen in the last couple of years, but without data for October 18 we can only compare to the levels of 2017. The total number of breeding ewes are were 0.5% on October 2017 (figure 1), but a closer look into the numbers explains some of the lamb supply trends we are seeing.

Merino ewes on hand were up 2.5% on October 2017, and ‘Other’ ewes were down 8.5%. ‘Other’ ewes usually have stronger marking rates than Merinos, so for lamb supply fewer ‘Other’ ewes is bad news for lamb supply.

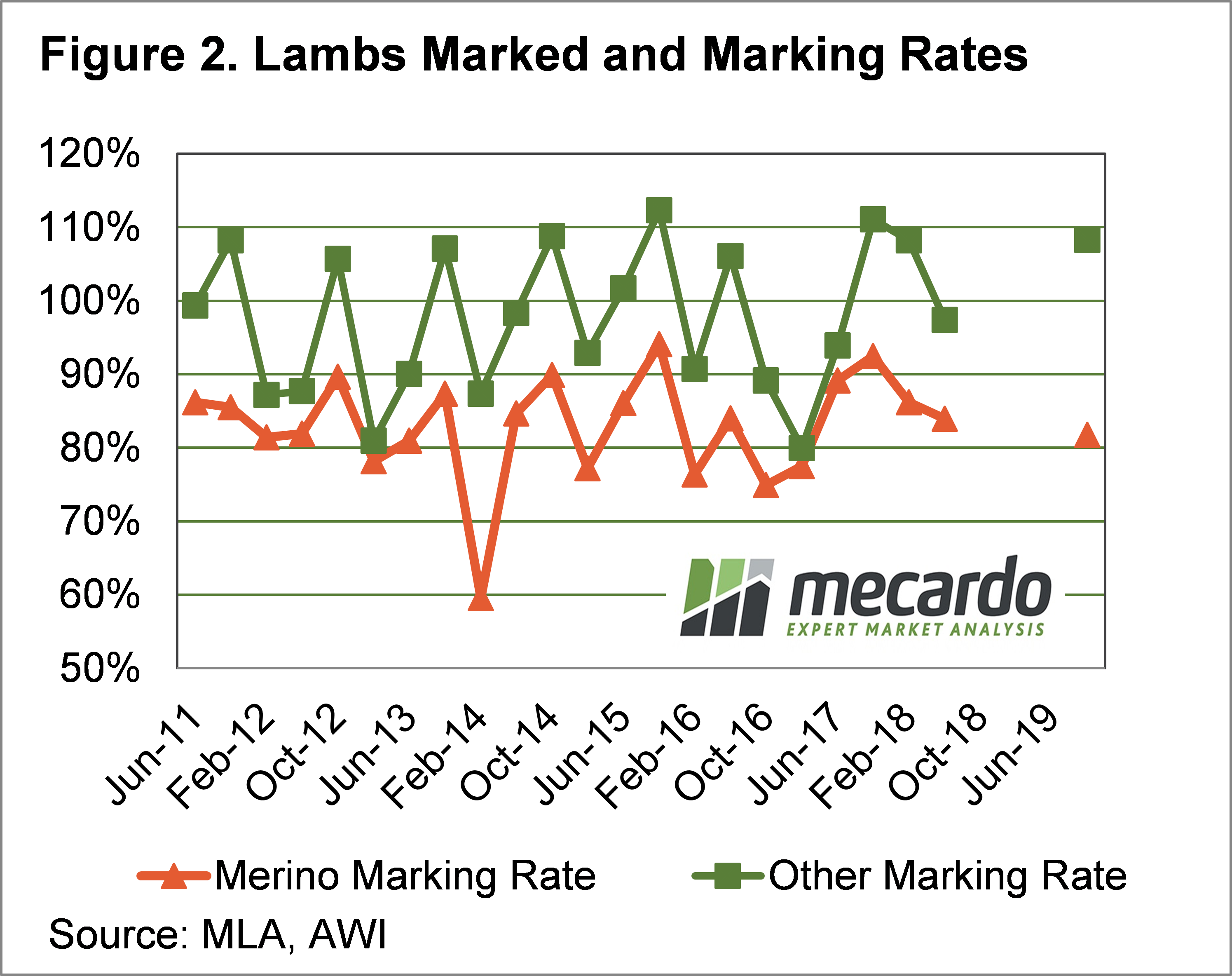

Marking rates for lambs born in October were down on October 17 for both Merino and Other ewes, but by different proportions. Figure 2 shows Merino marking rates fell to 82%, down from 92% in October 2017. Other ewes were down from 111% to 108%.

According to the October survey, there was a small rise in Merino breeding ewes, but a large fall in marking rates. There was a large fall in ‘Other’ ewes, and a small decrease in marking rates.

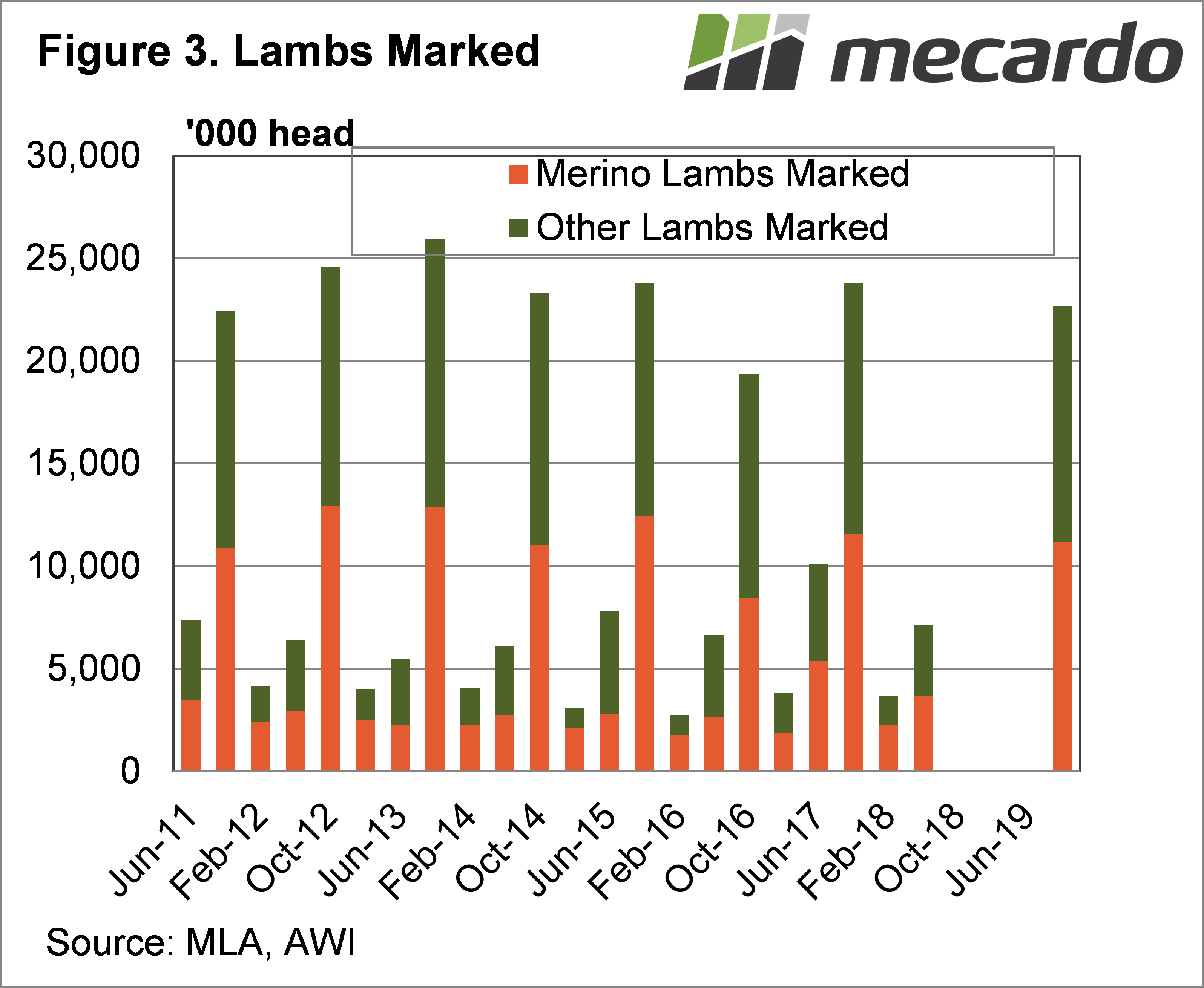

The end result is the number of lambs produced being down 5% on October 2017. There were 3% fewer Merino lambs, and 6% fewer other lambs marked, which is 1.1 million head of Merinos, and 700,000 fewer other lambs.

What does it mean?

With no October 18 data it’s a little difficult to make comparisons, but we are already seeing the results of tighter lamb supplies. The spring and summer have seen fewer lambs slaughtered, and that trend is likely to continue, especially given the rain in recent weeks.

Lamb prices are already strong, and given there are fewer lambs out there, and demand remains strong, it is hard to see prices easing far until supply improves in the second half of the year.

Have any questions or comments?

Key Points

- Breeding ewe numbers are down, with other ewes well down October 2017.

- Lamb marking rates were also lower in October, seeing lambs marked down 5%.

- Tighter lamb supply, and more lamb retention, prices should remain stronger than last year.

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: MLA/AWI , Mecardo