Both Australian, and international canola prices are currently at unpreceded levels for the new crop season due to strong global demand, high oil prices in Europe, and the drought in the Canadian prairies constraining supply. But what about next season, in 2022/23? What can be done to manage price risk?

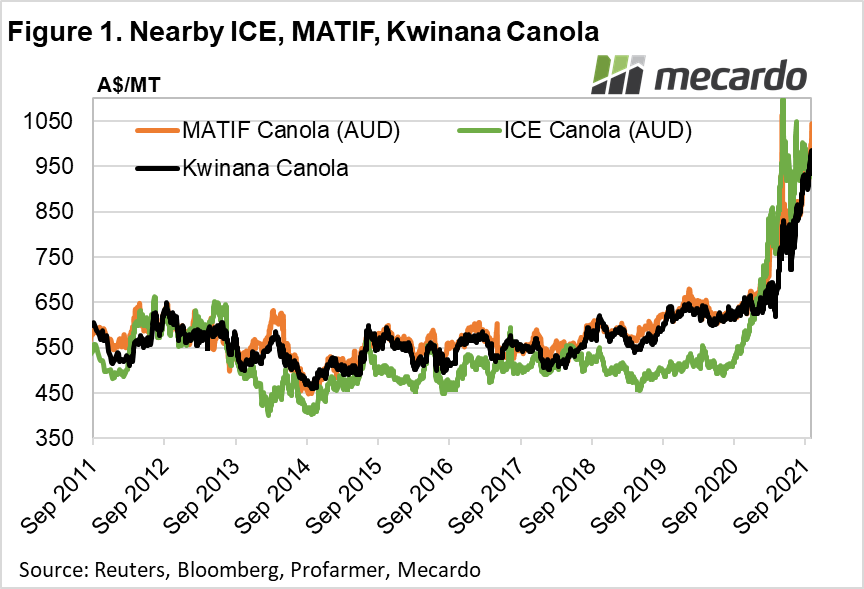

Currently, indicative port delivered new crop canola prices range from $860/MT in Adelaide, to $985/mt in Kwinana. In the international markets, nearby Canadian ICE futures trade at A$972/MT, while EU MATIF nearby canola sits at an eye-popping $1,021/MT. (figure 1)

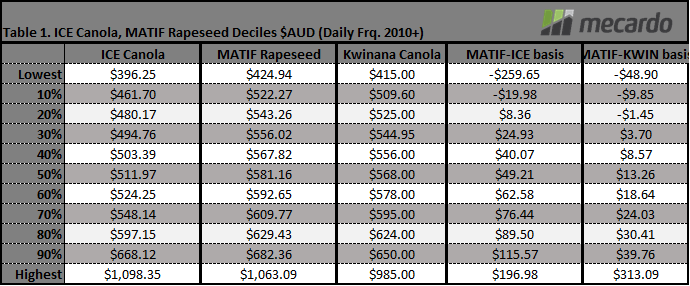

Needless to say, with current prices being at Decile 9 or better, it’s a good time to be growing canola. Unlike the Australian wheat market which we examined last week, Australia does not have any exchange-listed canola futures contracts to use for locking in forward prices. As such, we need to look to international markets for available risk management instruments, which include the European MATIF rapeseed futures, and Canadian ICE canola futures.

Both contracts generally move in the same general direction, but historically speaking, nearby European MATIF canola prices have commanded a A$50/MT premium over their Canadian ICE counterparts. (figure 1, Table 1). Also, given Australia’s canola export prices are more heavily linked to the fortunes of the EU market, naturally, Australian port prices generally follow MATIF prices more closely than Canadian ICE prices. On average, the basis spread between nearby MATIF price and Kwinana port prices sits around a $A13/MT premium over Kwinana. At present, that premium sits at $43/MT. (Table 1, Figure 2)

What do forward futures prices look like at the moment?

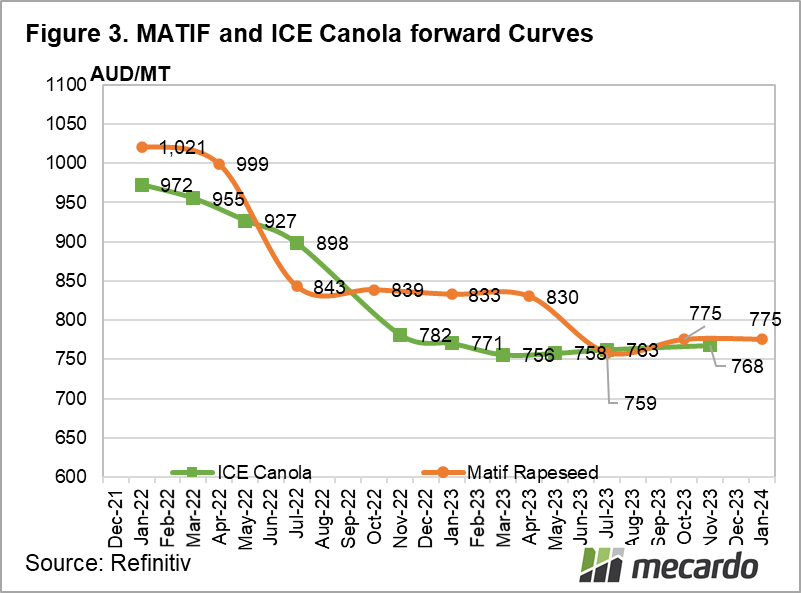

The EU harvests its canola crop in the June-July period, and as such the EU MATIF forward price drops off a sharp $155(16%) from the ~A$1,000/MT mark in APR-22 to A$843/MT for the JUL-22 contract to coincide with the new crop. (figure 3)

In Canada harvest begins a little later and runs over the AUG-OCT period, so the big change in the Canadian ICE futures curve occurs between the JUL-22 and NOV-22 contract, where the price falls A$117/MT (13%) from ~A$900/MT down to A$781/MT. (figure 3)

If we move our focus forward to the next season out, 2023/2024, the EU MATIF forward curve takes another A$71/MT(9%) dive down to A$759/MT as the next EU crop comes in. Both markets indicate that there is the expectation that Canola prices will remain at very elevated levels in the coming seasons, so these prices could be considered attractive, and worth hedging if managing price risk fits within your farm’s risk appetite and objectives.

For example, If you were to sell MATIF JAN-23 rapeseed contracts at A$833 to manage price risk for the 2022/23 crop, provided that MATIF basis remains at a A$43/MT premium over Kwinana prices, you could effectively lock in an effective sale price of A$790/MT. However, there is basis risk to think about, which can change the result. If MATIF basis moved to a $40/MT discount to the Kwinana price, the result would be an $873 sale price. Similarly, if the basis increased to an $83/MT premium to Kwinana price, a poorer result would ensue, at a $750/MT effective sale price.

If we look at table 1 though, all three effective Kwinana sale prices in this scenario are in the decile 9 to decile 10 range, which is a high price, compared to the last decade of history, which might be tempting for some.

What does it mean?

Producers have the opportunity to reduce downside price risk for the canola 2022/23 crop by selling JAN-23 MATIF contracts if it fits within their risk profile and objectives. By hedging price risks, there is the potential to lock in historically high decile 9 prices for canola now, assuming the basis between Australian and EU MATIF prices does not change substantially between now and the settlement date.

Have any questions or comments?

Key Points

- Futures markets and forwards are available to hedge, or lock in prices for future canola production.

- Futures markets indicate Canola prices available at decile 9 prices for the 2022/23 crop

- Options to hedge price risk include international futures markets such as Canada’s ICE, and the EU’s MATIF.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: Refinitiv, CME, ASX