It’s been a funny season for lamb supply and those with “steaks” in the supply chain have had to manage the ups and downs. While processors are usually well equipped to manage the seasonal nature of lamb supply, a delayed southern flush and some volatile spring supply, along with difficulty securing labour have tested operations.

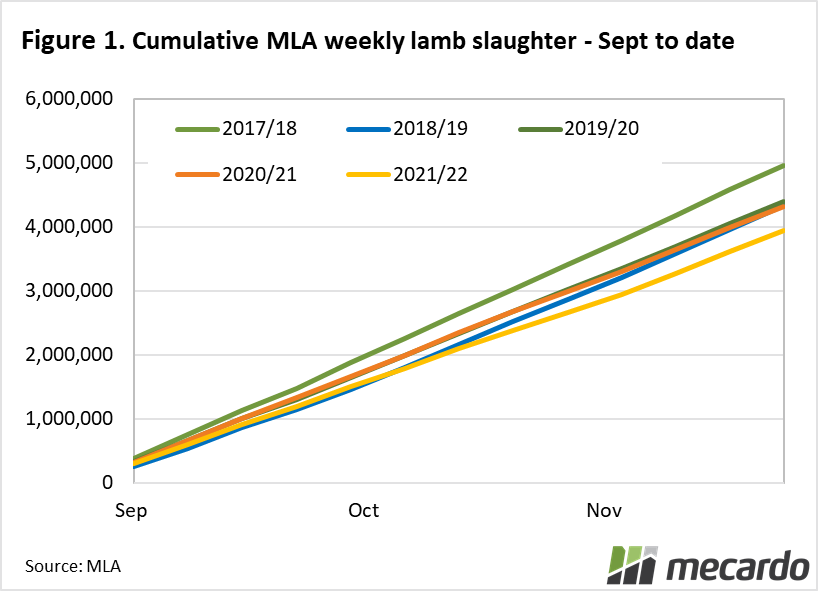

We’ve looked at the number of lambs slaughtered this season to date and when the supply glut may hit in a separate article (here). It does raise the question though; how behind track is lamb supply this season?

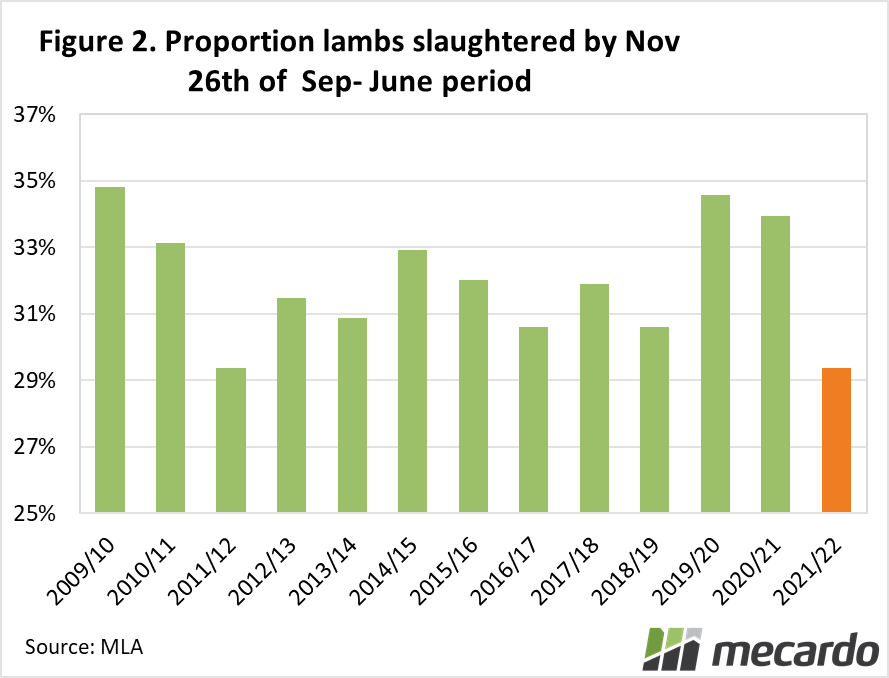

For this analysis we’re going to compare the periods from spring to the end of financial year (Sept to July), in an attempt to remove some of the impact of the unusually strong winter supply this season. On average over the past 10 years, 32% of the total number of lambs processed over the period has occured by this point in the season.

While we don’t know the exact number of lambs that will be slaughtered from September this year to end of June in 2022, Meat & Livestock Australia’s projections can give us an idea of what to expect. With MLA’s FY 2021/22 lamb slaughter estimates of 21,541,000 head and assuming 75% of actual lamb slaughter is reported in their weekly slaughter figures, we can then use the weekly MLA slaughter figures to track our progress. This estimates that from September to date this season, we have only processed about 29% of the expected lamb slaughter.

While a few percentage points below the 32% average might not seem like much, it is the lowest level on a seasonal basis, in the last decade (Figure 2). This fits into the narrative that lamb growth rates are slow this season, and challenges in securing labour have some processors operating below normal capacity.

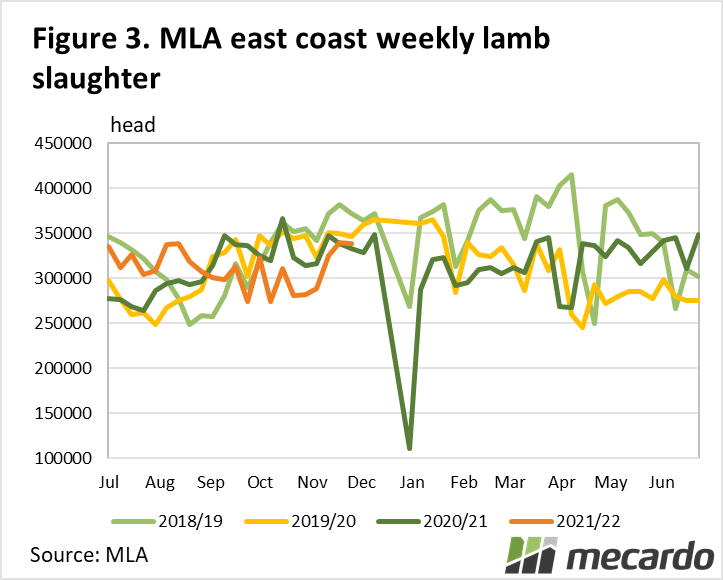

Lamb slaughter has increased in recent weeks but there are a lot of lambs still to be processed if MLA’s projections are correct. For the remainder of 2021/22, we would need to see lamb slaughter 13% stronger than the same period last year. While a big jump on last year, we would only need to go back to 2018/19 to find lamb slaughter rates at equivalent levels (Figure 3).

What does it mean?

The concern from here is that limited labour availability may continue to keep some processors from operating at optimal levels. Labour is the challenge hitting every corner of agriculture this year. For producers, season is now on their side and the end demand is there which is likely to limit downside if processor buying is somewhat restricted. It’s likely to prevent much upside either, until labour shortage issues are addressed.

Have any questions or comments?

Key Points

- The proportion of lambs slaughtered during spring compared to the projected total for the season is the lowest in a decade.

- Delayed southern spring flush and labour constraints are impacting slaughter.

- Lambs slaughter rates would need to follow a pattern similar to 2018/19 for the remainder of the season, to meet projected slaughter levels.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, ABS, Mecardo