Last week we looked at beef exports, and made some comments around US demand now, and how it might increase over coming years. This week we take a look at US cow slaughter, and how it’s impacting the herd, and it’s positive for Aussie beef producers.

The US and Brazil are the world’s two biggest beef producers, so what happens there, has impacts on global supply and price. As a major exporter to the US, and a competitor in Japan and Korea, Australia is particularly exposed to what is happening in US markets.

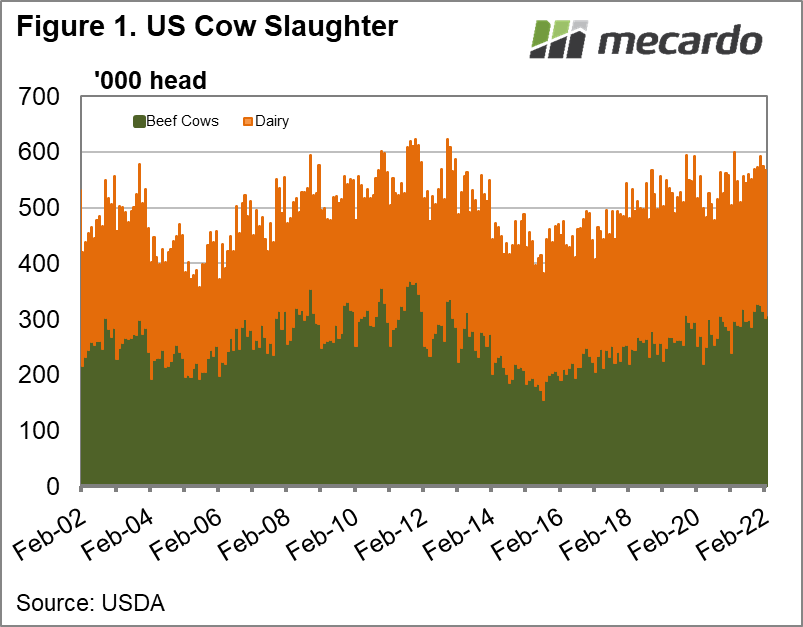

Early in 2022 US Cow slaughter has ramped up (figure 1), with combined dairy and beef cow slaughter in January and February up 7.5% on last year, and 15% on the five year average. This increases the supply of lean beef in the US, meaning they don’t need to import as much. This has seen Australian export 90CL beef prices weaken slightly, but they are still very strong.

Obviously cows are the backbone of any beef herd. If more cows are being killed, not only does it decrease the herd, it means fewer calves in the future, and a significant reduction in cow kills at some point in the future. Figure 1 shows cow slaughter been this high consistently since 2012.

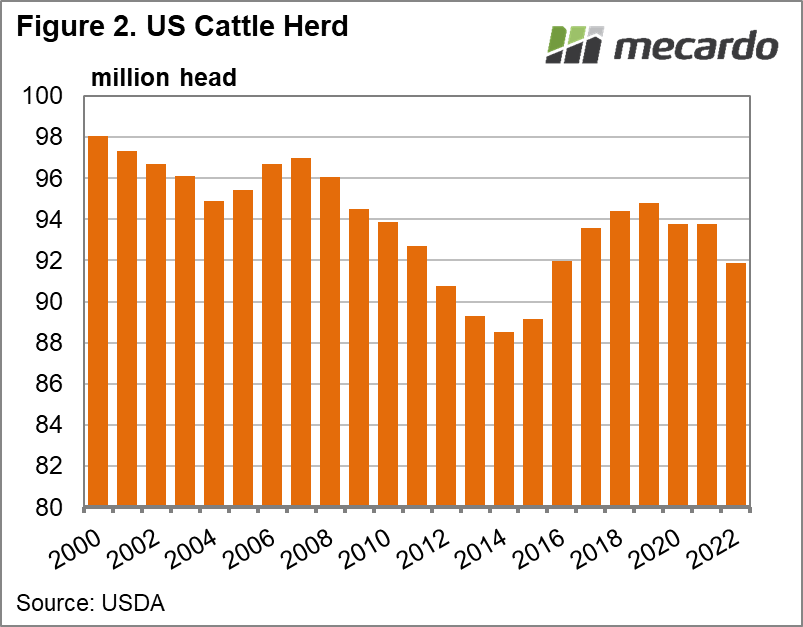

Cow slaughter was already high in 2021, with 6.66 million head being the strongest since 2013. Figure 2 shows that the US January 1 herd fell by 2%, or nearly 2 million head to a six year low.

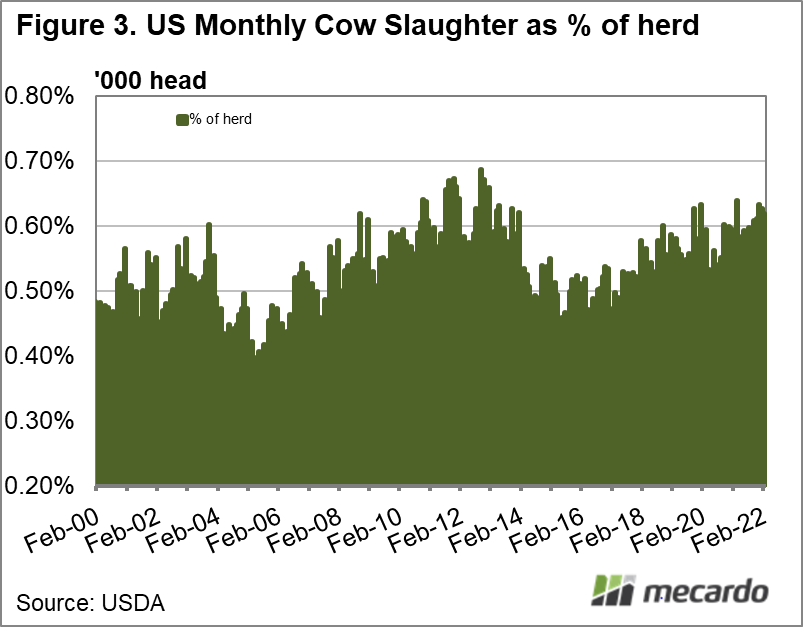

With more cows being killed out of a smaller herd, the herd should shrink even more quickly. Figure 3 shows US monthly cow slaughter as a proportion of the January 1 herd. Steiner showed a quarterly version of this chart in their weekly report for Meat and Livestock Australia (MLA) at the start of April, and made the point that it points towards further shrinkage of the herd.

Cow slaughter relative to the herd was higher in the big liquidation years of 2011-12, and that might be the way the US herd is headed.

What does it mean?

High US cow slaughter now is a bit of a headwind for export beef demand, but bodes well for the coming years. In the medium term it means fewer calves produced, and therefore less high value beef available to compete with our major export markets. When the herd rebuild starts, demand for imported lean beef will strengthen, flowing through to beef and cattle prices here.

While Australian cattle prices are still high, and likely to decline, it is good timing for us to see the US in liquidation while tight supply here is supporting values. In 2023 and 2024 support from the US market will cushion the price decline.

Have any questions or comments?

Key Points

- Strong US cow slaughter has seen our beef export prices weaken early in 2022.

- The US herd fell in 2021, and cow liquidation suggests it will fall again in 2022.

- While negative for prices in the short term, a lower herd in the US will support prices in years to come.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: USDA