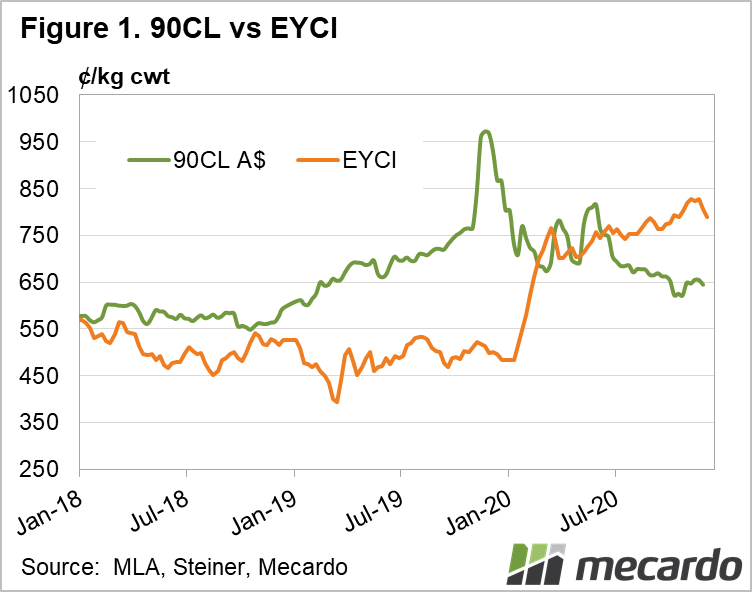

Australian cattle prices keep on keeping on and have been the most expensive in the world for the past five months. The Eastern Young Cattle Indicator (EYCI) is 172¢/kg above the US 90CL price, having reached a record premium of 180¢/kg at the start of November. And while the two price points do generally follow similar paths (with the 90CL the higher of the two) they are now headed in different directions, with the EYCI 57% higher year-on-year, and the 90CL 30% lower in Australian terms.

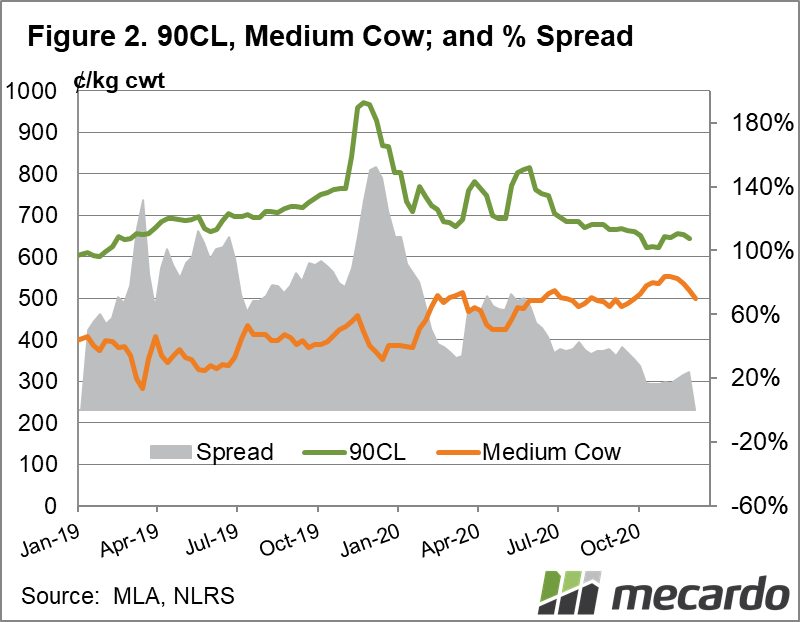

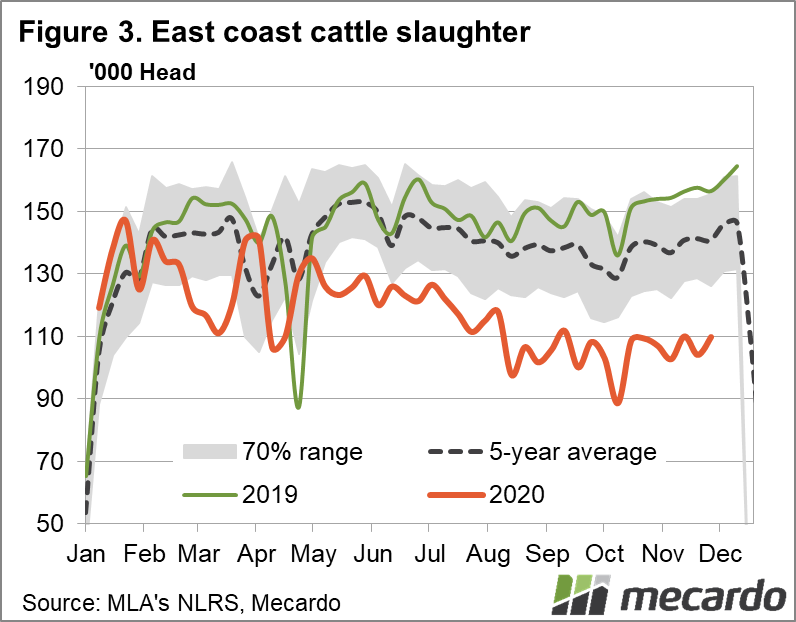

While producers in the south east have now experienced prolonged improved seasonal conditions (on an annual basis), earlier in the week we reported that the average female slaughter rate is still at 53% – well above the 47% benchmark most commonly used to indicate a herd rebuild phase (view article here), which is impacting both the domestic cow price, and possible supply forecasts in the short-term.

If we look at Figure 2, we can see the price differential between the 90CL and the National Medium Cow Indicator has also dipped significantly, trading at below 20% for October and November. With domestic restockers now regularly paying upwards of $3000 for breeding units, the National Medium Cow price reached a record 553¢/kg cwt at the start of November, and is now sitting at 499¢/kg cwt.

The latest reporting from Meat & Livestock Australia and the Steiner Consulting Group highlights the following current factors in the US-Aus beef price equation. Firstly, the latest full Steiner report reports that imported lean beef prices are remaining steady due to a lack of supply and Australian packers (and NZ packers) having product sold through to January. Despite the supply dearth and sky-high pricing, the US has imported only 4% less beef from Australia year-on-year. On the flip side of that, a Covid-19 surge in the US is impacting the dining capacity, creating uncertainty in the beef demand outlook for the country. While the manufacturing beef that makes up much of the Australian product sent to the US may not be largely impacted by this, it is also winter in the US, which usually indicates a slow-down on grilling and therefore intake of Aussie product.

What does it mean?

There’s plenty of factors in the current US-Australia price comparison that point to something having to give, which would usually mean downward pressure on the domestic cattle market. However here in Australia aside from some supply pressure on price this week, there is little if no indication that this will happen in any significant way in the short term. Slaughter figures for the year are nearly 20% lower than 2019, and with the female portion of this yet to hit rebuild levels, supply looks to only be getting tighter in the new year.

Have any questions or comments?

Key Points

- Australian cattle prices remain at global premium, having been the highest in the world since June.

- Low supply continues to drive cattle prices, overriding any push back from export markets or potential Covid-19 impact.

- The Eastern Young Cattle Indicator is trending at its highest premium range above the US 90CL price.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo.