When data releases aren’t what market analysts generally expect, significant reaction is the norm; and a surprise downgrade in the US soy Crop condition this week did not disappoint, with the resultant concerns over potential tighter supplies of oilseeds, sparking up soybean prices into recovery mode and dragging Canola prices up in its wake.

The USDA NASS crop progress report delivered an unexpected result this week, pegging the US soybean crop condition to have deteriorated, against the collective wisdom of the bulk of market expectations.

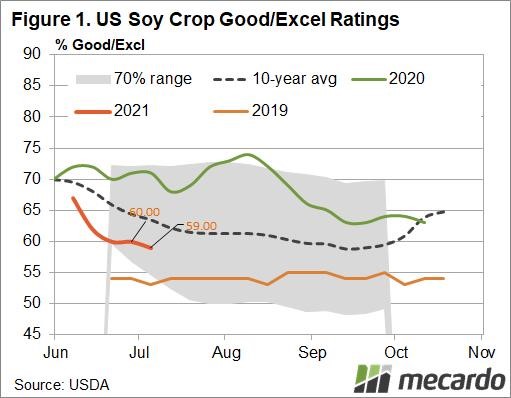

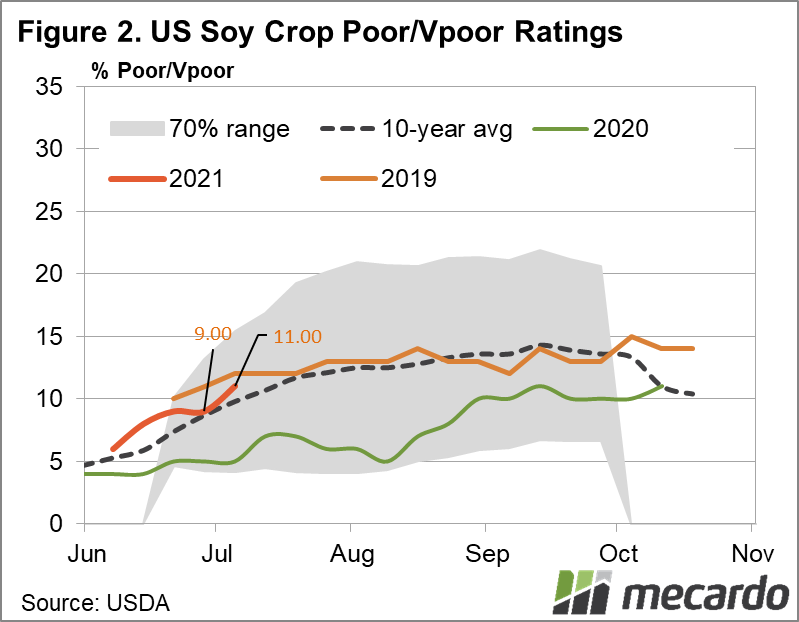

The general consensus till this week was that the good/excellent rating would remain steady, or improve, but instead, it dipped 1% to 59%, (fig 1) and the poor/very poor rating increased 2% to 11% (fig 2). US soybean crop condition is slightly below average at this time of year, with around 64% good/excellent typical.

The consequence of the surprise condition downgrade was a solid reaction on US futures markets as a direct result, as fears of lower yields at harvest, and hence tighter oilseed supplies drove bullish sentiment among traders. The response was stoked by concerns that the significant soybean acreage in northern USA could be more significantly impacted by persistent drought in those areas.

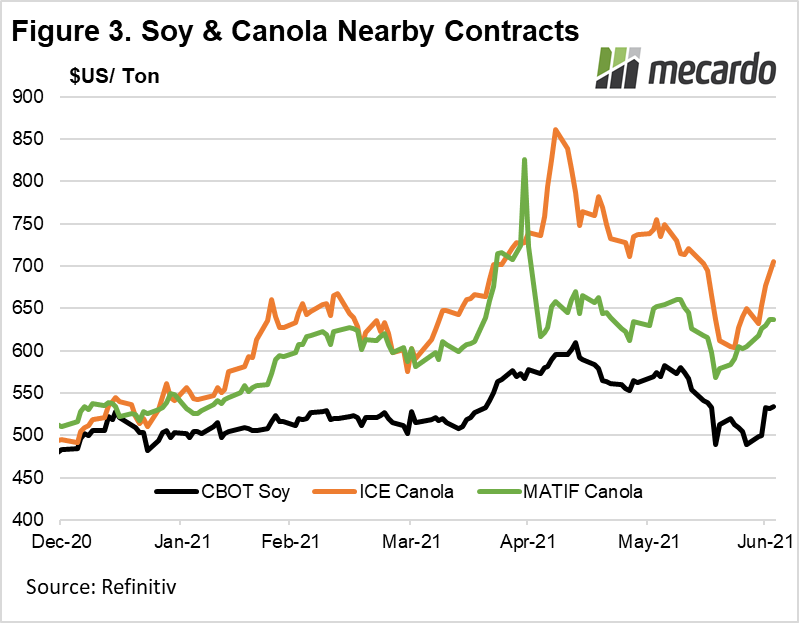

After suffering a horror drop of 6% earlier in the week, nearby soybean prices recovered a respectable 1.7% on the back of support the support of the news of poorer US crop conditions, with some contracts further out on the curve faring slightly better.

Nearby ICE Canada canola nearby futures benefited from the turnaround, lifting 2% to $US 682/ton, while the impact on EU Matif futures was more modest, which lifted $4.50/ton to reach $US 602/ton.

What does it mean?

A poorer than expected condition report for the US soy crop indicates a potential tightening in the world market for oilseeds, which supported the soybean market, and helped stage a recovery.

This assisted the oilseeds complex in general, dragging up Canola prices in its wake. All eyes will be on the next US Soy condition reports, and weather forecasts, particularly for the Dakota states, watching for another any sign of another possible downgrade that could spell further yield reductions.

Have any questions or comments?

Key Points

- US soy crop condition worse than expected, market improves

- ICE, MATIF canola lifted up in wake of Soy recovery

- Market will watch closely for more signs of dry weather and more downgrades

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: USDA, Refinitiv, Mecardo