There remains plenty of volatility in wheat markets as we move towards the US winter wheat harvest. Prices tried to come off eight-year highs but managed to bounce back above 700ȼ. Here we take a look how increased international values have translated into new crop prices here, and how we should be hedging.

The latest issues with the US crop are rain in the wrong places. Harvest is getting wet in winter wheat areas, while dry spring wheat areas are not receiving rain. Normally wheat prices ease at this time of year as harvest ramps up. It’s not unusual for wet weather to see prices rally.

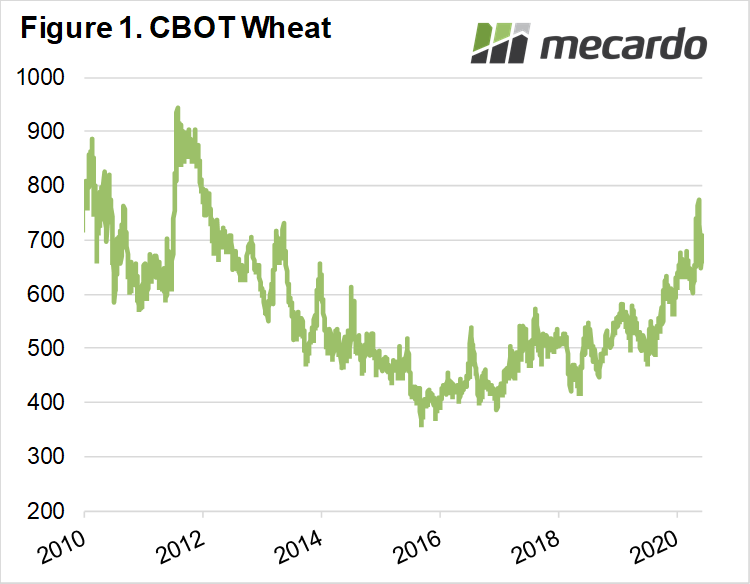

Having hit a peak of 773ȼ back at the start of May, the CBOT spot soft red wheat (SRW) contract fell to 648ȼ on the 26th of May. Since then wheat has rallied back above 700ȼ (figure 1).

Historically, wheat prices are very good. Figure 1 shows that prices have rarely been higher since 2013, and the fall during May shows that the market is likely overpriced coming into harvest.

Traditionally many analysts don’t like hedging when prices are rising during the northern hemisphere harvest. When the rising prices are due to dry weather and deteriorating crops coming into harvest, prices tend to keep rising as panic buying sets in.

When price spikes are due to rain on the harvest, it can impact quality, but doesn’t tend to decrease yields, and prices decline again once harvest is back up and running.

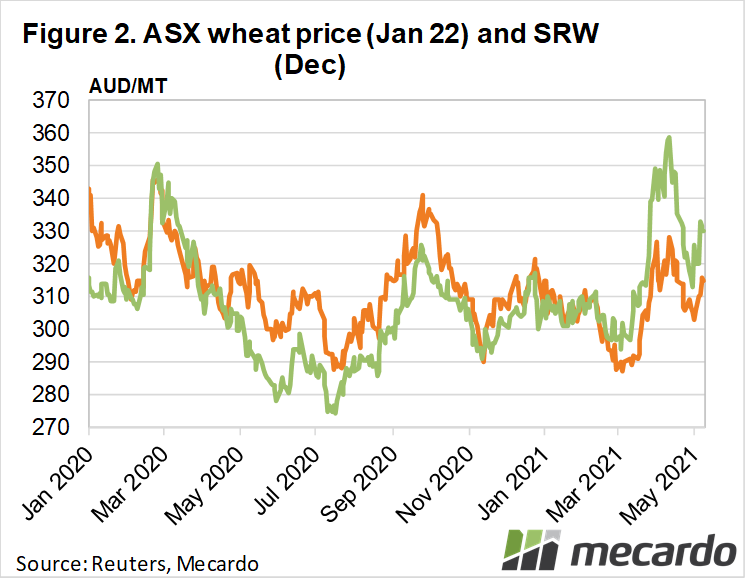

So if prices are strong perhaps those with crops in the ground receiving rain this week should be thinking about hedging. Figure 2 shows how ASX Jan 22 wheat has tracked SRW. The ASX remains at a discount, which is unusual for this time of year, but remains a hangover from last year’s massive crop.

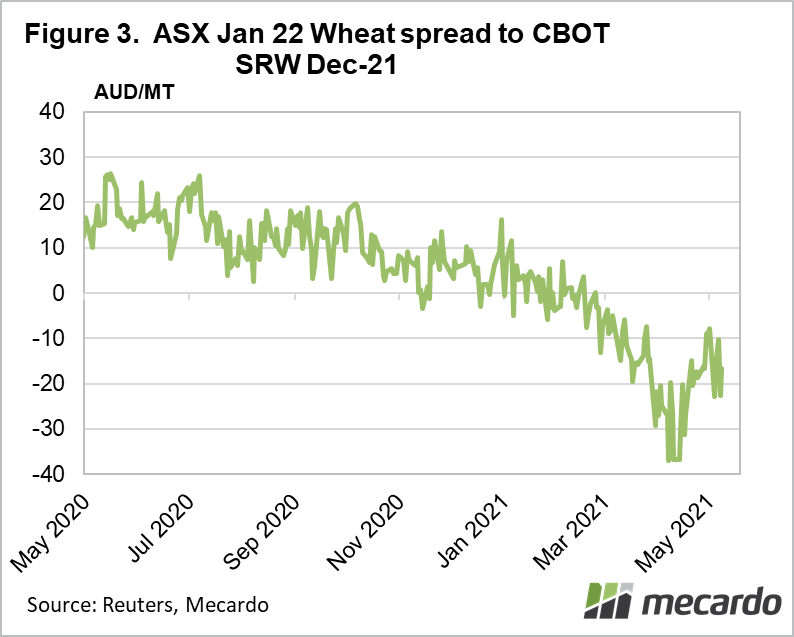

Figure 3 shows ASX basis, or discount to SRW, is around minus $15 per tonne. The long-term average ASX basis is positive $10-20, and it’s rarely below minus $20, so there isn’t much to gain from locking in ASX or physical prices for sellers.

What does it mean?

Swaps or futures traded direct on the CME exchange are preferable to physical prices or ASX futures at the moment. Selling swaps at $330t leaves basis open, and prices likely stronger than currently available.

For those consuming wheat the opportunity lies in locking in the basis. Buying outright at $315/t for new crop now might be seen as expensive in absolute terms, but combining with selling SRW, locks in historically low basis, no matter where markets go from here.

Have any questions or comments?

Key Points

- Chicago wheat has rallied back above 700ȼ thanks to wet weather in the wrong areas.

- When prices rise due to delayed harvests, they usually ease again one harvest gets going.

- Local basis remains wheat, which makes it good buying for consumers, while sellers should use swaps or US futures.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: USDA, CME, Mecardo