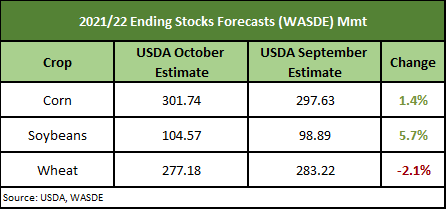

This week the USDA released their October WASDE report with numbers largely in line with expectations. The word pre-release was to expect higher corn and bean stocks (on higher yields) so the market had already started to taper off prior to the report coming out. Wheat however, was bullish on lower production and tighter stocks.

This week the USDA released their October WASDE report with numbers largely in line with expectations. The word pre-release was to expect higher corn and bean stocks (on higher yields) so the market had already started to taper off prior to the report coming out. Wheat however, was bullish on lower production and tighter stocks.

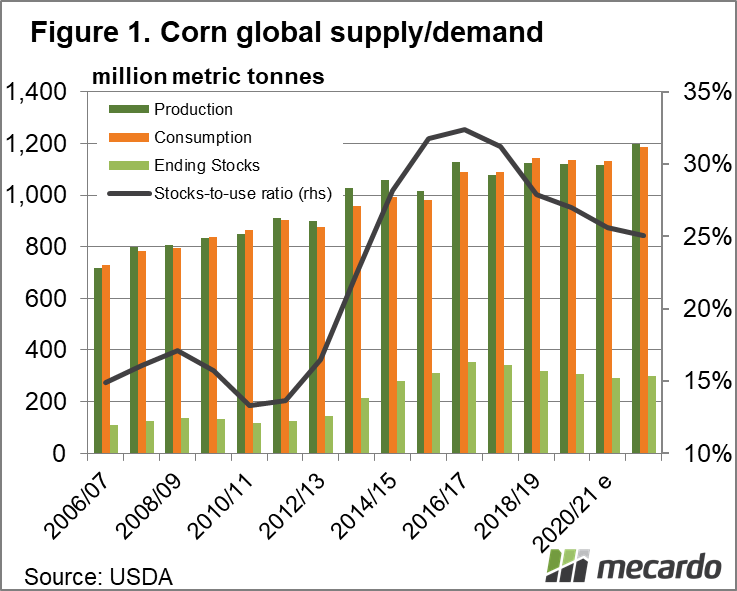

Firstly, corn stocks were increased in the previous WASDE report but the slight uptick in yield and lower feeding numbers has seen ending stocks rise to what the market perceives as a comfortable number. US corn stocks to use are at 10.1%, up from last years 8.3%, but still below the 5-year average of 14.1%.

Soybeans are probably the biggest thorn in the side of the market with a massive crop, overachieving yields and questions over demand. Soybean stocks increased in the previous WASDE report and combined with a decent increase in yields, the soybean balance sheet is suddenly looking much more comfortable than it has for some time. Current stocks to use numbers are at 7.3%, compared to earlier forecasts of 2.6%.

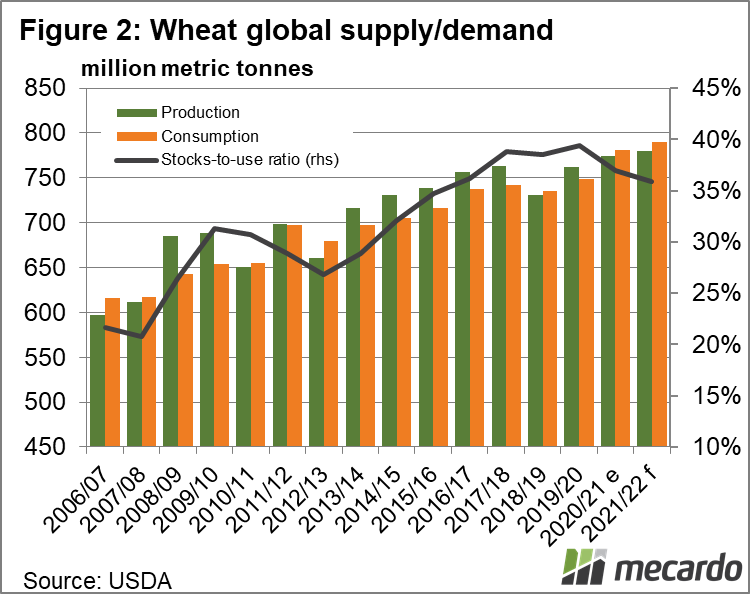

Wheat is marching to the beat of its own drum. While global consumption was lowered slightly based on high prices, production was further lowered by another 4mmt to 775mmt. Global carryout was revised down 6mmt to 277mmt, but it is the major exporters who are now sitting at 52mmt carryout, or 12.6% stocks to use, that bear some attention.

The immediate price action indicated that the wheat market struggled to shake the shackles of the corn and soybean production numbers. However, with demand remaining robust, wheat should be able retain its strength in the midterm as it needs to rebuild stocks.

The focus should now switch to the demand side of the equation and to new season South American production potential. Any problems in Brazil (back to back La Niña anyone?) could cause the market to quickly re-evaluate its position. From a demand perspective, there will be an increasing focus on China in the coming months. Does China step in a buy these dips?

What does it mean?

Wheat stocks are tight. Northern Hemisphere winter wheat seeding is progressing on average pace, with little issue to note at this stage. It is a long road ahead, and any perceived problem could cause the wheat market to respond aggressively. Does the cost of fertiliser see farmers pull back acres? Does Russia adopt a conservative export ban to minimise inflation? Buckle up, it could be a fun ride.

Have any questions or comments?

Key Points

- WASDE report confirms stocks in line with expectations

- Corn and Soybean stock estimates increased.

- Wheat is is the big unknown at the moment, as analysts look towards new South American production potential and the possible return of La Niña.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: USDA, Reuters, Dartboard Commodities , Mecardo