While Foot and Mouth Disease (FMD) is no doubt the most talked about subject around sheep yards at the moment, second has to be the lack of winter price rallies. There has been no reward in holding lambs into winter this year, which begs the question as to whether there is incentive to get new lambs off early.

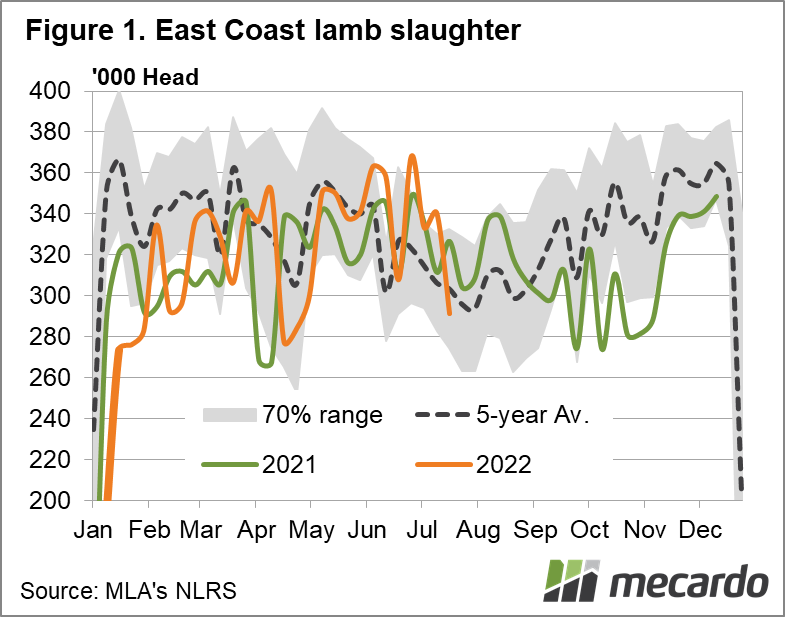

Let’s start with how we ended up with the seemingly endless supply of old season lambs. There is little argument that more lambs were born last year. Survey data showed more crossbred lambs were marked, so slaughter had to be stronger to clear these lambs.

A very good spring saw many lambs which would normally have been sold in spring last year carried over for restocking or heavier weights. Spring lamb slaughter was down 7% on the east coast. So more lambs carried into Christmas.

The Covid wave (not sure which one it was now!) in January limited slaughter capacity at a time when demand is historically strong (figure 1). Lamb slaughter did recover, and as of last week was basically level on a year to date measures, based on Meat and Livestock Australia’s weekly figures.

The backlog created in spring and summer has caused flat and falling prices, and still strong supplies in the middle of winter.

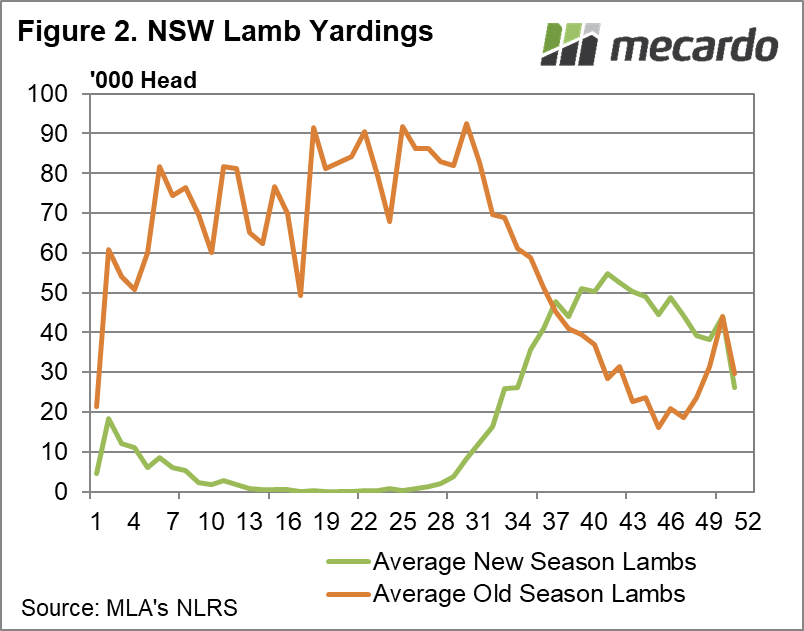

The early new lambs are hitting the market now, albeit in very small numbers. This week there have been a handful of pens spread across NSW saleyards, but they are making strong premiums.

Figure 2 shows week 29 is when, on average, new season lamb yardings start to rise. Old season lamb yardings fall rapidly from week 30. This week is number 30. New season supply timing does vary by up to a month.

This year earlier supply out of South Australia, might be offset by slower growth rates in the wet parts of NSW. The key to prices over the next month is how long strong yardings of old season lambs continues from now.

For more on this topic listen to our latest episode of Commodity

Conversations

What does it mean?

Lamb slaughter fell heavily last week, but based on our rough calculations the backlog isn’t cleared yet. New season lamb suppliers might not be in any hurry, with a good season and lower prices possibly seeing them hold off.

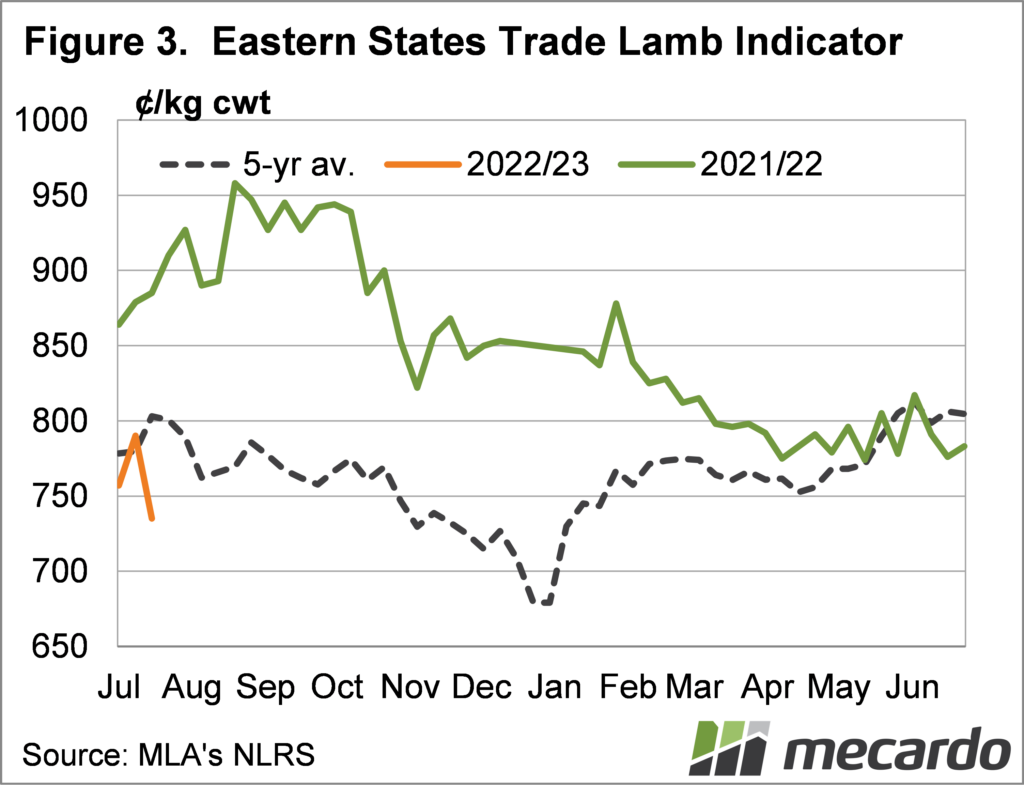

Figure 3 shows a weakening Eastern States Trade Lamb Indicator (ESTLI) this week. Historically the trend is down from here. If there are plenty of old season lambs left the trend might continue, before we see a jump as new season lambs come to dominate the market.

Have any questions or comments?

Key Points

- Processors are still working through a backlog of lambs created last summer.

- New season lambs supply start to increase from now, but won’t peak until October.

- If old lambs keep coming, prices will continue to trend downwards.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, ABS, Mecardo.