Australia’s strategic export market diversification for lamb and mutton or simply put, “a finger in every pie” approach, has served us well in times of disruption and is seeing the rise of traditionally smaller destinations. With consumers and supply chains facing pressures around the globe, Australian sheep meat, whether destined for pies, pots, or grills, still appears to be in healthy demand overseas.

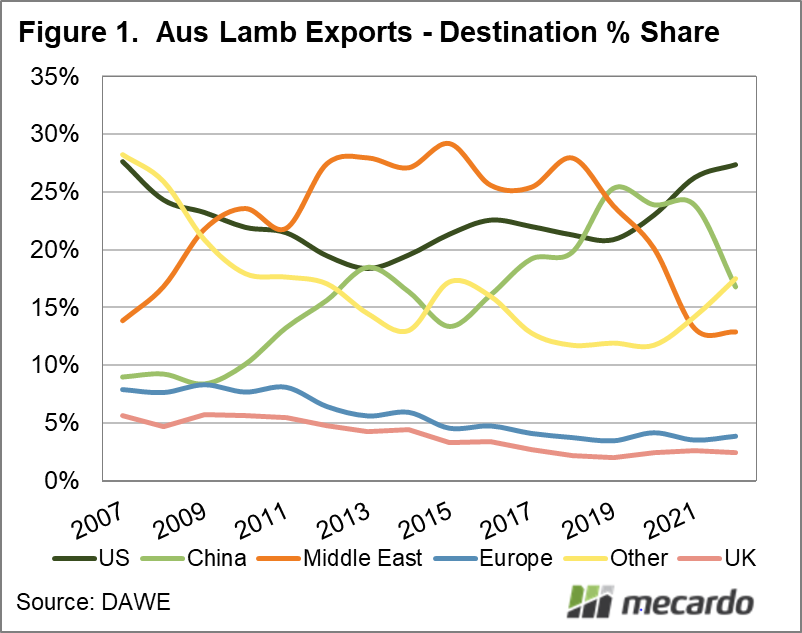

We’ve spoken plenty about the growing demand for Australian lamb in the US (view here), but there’s also an interesting story to tell in looking at some of our other markets. Australian lamb exports outside of the US, Europe, Asia and the Middle East have taken off this year. For the year to date, these ‘other’ destinations made up 18% of the total volume of lamb exported (Figure 1). Not only has the market share increased, but the volumes have increased. 18% more lamb was exported to these ‘other’ destinations in the last three months (Apr-Jun) compared to the average for this period.

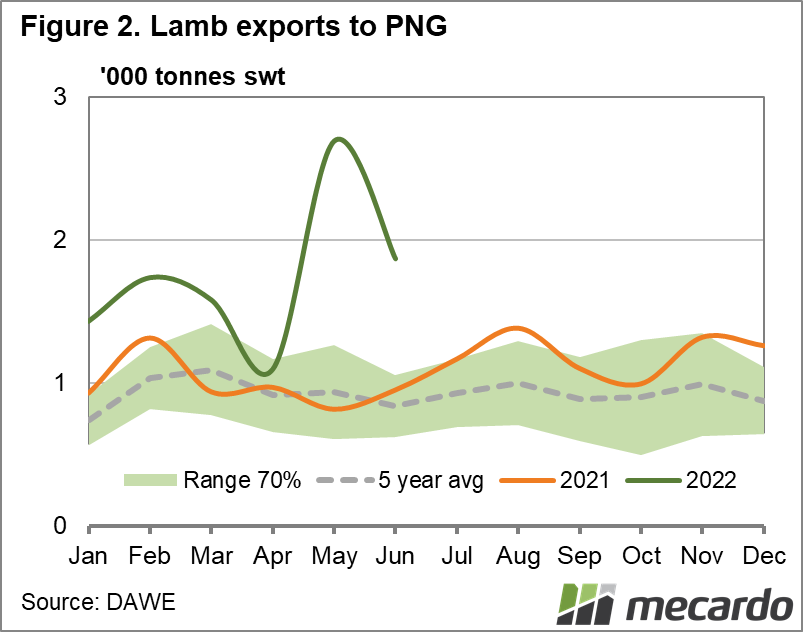

One of the countries with a newfound taste for Australian product is PNG which has taken more of our lamb in the first half of this year, than the full year in 2020 (Figure 2). Japan is another rising star, taking 5% of our total lamb exports year to date and 35% more than the same period last year. Japan hasn’t taken this much Australian lamb in the first half of the year since 2006. There has also been growth in the volumes sent to Malaysia and South Korea.

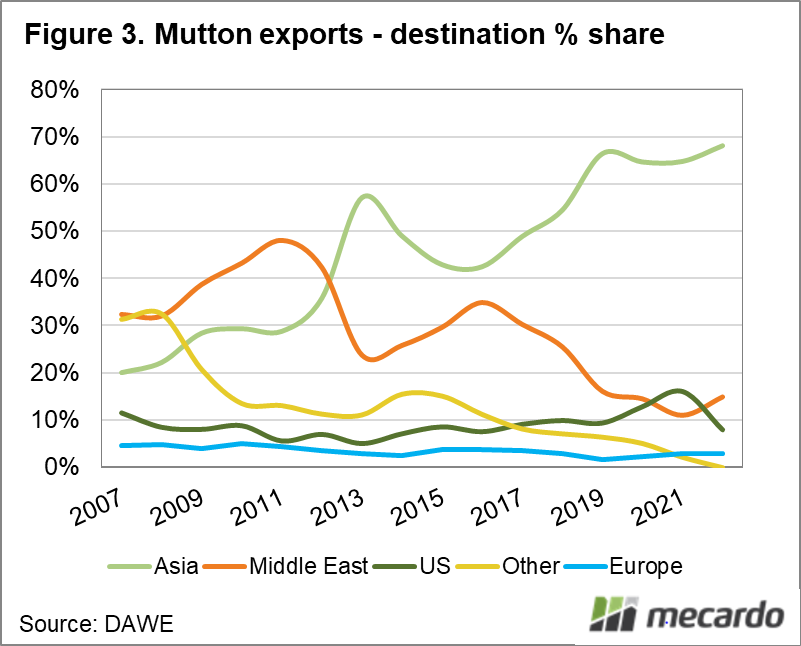

Monthly mutton export volumes have remained fairly consistent so far in 2022, which in itself is unusual. Mutton export volumes typically contract heading into and through the winter period, but this year May and June have seen above average volumes sent overseas.

For the year to date, mutton export volumes have been 8% higher than the same period in 2021, although still well below average levels, reflecting the flock rebuild. Asia continues to be the major destination for Australian mutton at 68% share YTD. For comparison, over the last five years, 60% of Australian exported mutton has gone to Asia. Flows to China continue to sit above average, with the month of June seeing 10% more Australian mutton finding its home in China compared to average.

What does it mean?

For some of these markets, it’s important to remember that Covid is still impacting consumer activity. In Japan for instance, until recently restaurants were closed early, social distance rules were still in place and attendance at events had limits. A return to the restaurant scene is good for high quality meat demand, however inflation is likely to act as a headwind.

Have any questions or comments?

Key Points

- Australian lamb exports outside of the US, Europe, Asia and the Middle East have taken a greater percentage of share this year.

- Year to date, PNG has become our third largest lamb customer.

- Mutton export volumes continue to track above average levels.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: DAWE, Mecardo