Last week we took a look at lamb supply and demand dynamics, and what they might mean for trade lamb prices in the spring. It’s not just trade lambs that growers are interested in, with plenty of lambs changing hands at store weights.

Restocker or store lamb markets have grown in recent years. Rising prices in general, and a better understanding of lamb nutrition has seen more dedicated lamb finishers, and better pricing of store lambs has more growers focus on turning out more store lambs, rather than finishing all their young stock.

Hence, we are getting more interest in where restocker lamb prices are going to be in the spring, as there is more focus on this portion of the market. While there is plenty of variation in possible prices of finished lambs, it’s even wider with store lambs.

Store lambs are generally priced according to where they need to be relative to finished lambs to make money out of them. Thus, grass supply and the cost of grain have a large bearing on the store lamb price relative to finished lambs.

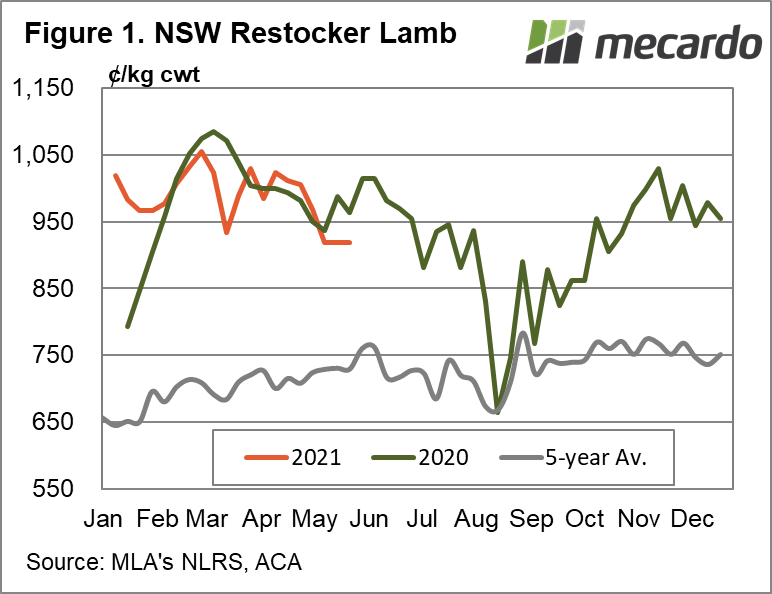

Figure 1 shows the NSW Restocker Lamb Indicator for this year, last year and the five-year average. This is somewhat instructive, and shows autumn generally has higher pricing than the spring, despite what should be tighter supplies of feed. This is due to higher finished lamb prices in general, and the expectation of a winter price rise adding some support.

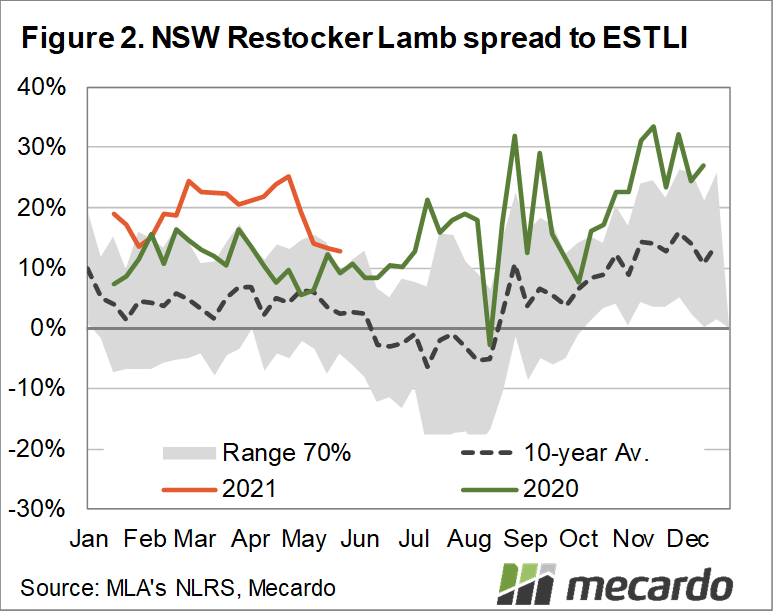

If tells us more to the look at the seasonal spread for restocker lambs versus the Eastern States Trade Lamb Indicator (ESTLI). Figure 2 shows that in spring, restocker lambs are generally at a stronger premium to the ESTLI than in autumn. This fits with better and cheaper feed supplies, meaning stronger demand and weaker supply.

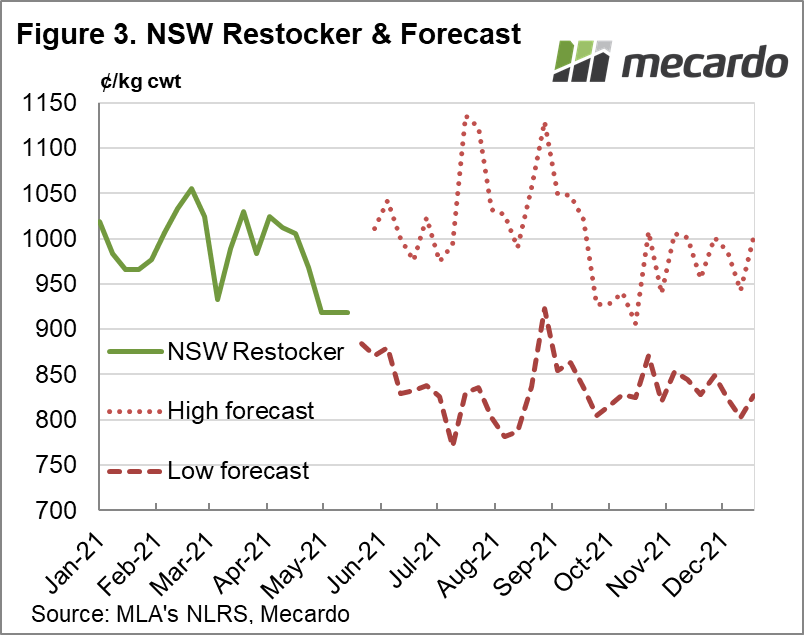

To put a range around restocker lamb prices in the spring we can use the ESTLI forecast published last week (view here) and apply the restocker premium we usually see at that time of year. Figure 3 shows how the NSW Restocker will track if our ESTLI forecast holds, and the five-year average premium prevails.

What does it mean?

Figure 3 suggests spring restocker lamb prices will be lower than early 2021, and in 2020. This does fit with supply forecasts, although a good season could see restocker lambs up around the top line on figure 3.

To put dollars per head on these prices, a 820¢/kg cwt price equates to 3.70¢/kg lwt, or $130/head for a 35kg lamb. Still very good money for producers turning out store lambs in the spring.

Have any questions or comments?

Key Points

- Store lamb prices generally follow finished lamb prices with variation in spread according to feed supplies.

- Restocker lambs generally hold a strong premium to trade lambs in the spring.

- It looks like restocker lambs will be cheaper this spring than last year, but still well priced.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo