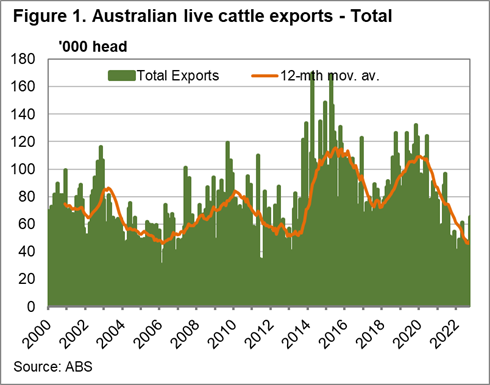

We last looked at live cattle export figures for the first four months of the year, which showed they’d ended 2021 at decade lows. We now have data for the first 10 months, and numbers haven’t improved.

For the year-to-October, live cattle exports are 30% lower year-on-year, with only 474,617 head leaving Australia. In comparison, more than 675,000 head had been exported for the same period in 2021, and more than 900,000 in 2020.

Despite comparing poorly to last year, October was actually the busiest so far in 2022, with the most cattle exported for any single month. And at 30% below the the five-year-average for October, it came in closest to average for any month of 2022. However if we look back at the year-to-date, the number of cattle exported for the first 10 months of the year is a pretty significant 45% lower than the five-year-average. As a point of reference, live cattle exports for the year-to-October were higher in both 2011, when the Australian Government banned the trade with our main market Indonesia for a period of time, and in 2012, when that trade relationships was still being rectified. This year’s numbers for the period are roughly 15% lower.

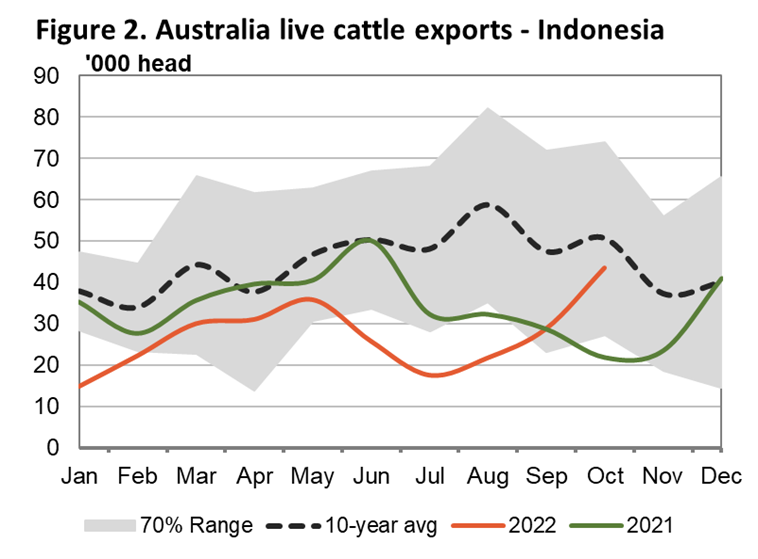

Currently holding 57% of the market share, Indonesia obviously has the biggest impact on live cattle exports out of Australia. Year-to-October exports to that market are 21% below 2021 levels, and the second lowest in the past two decades, with less cattle sent live to Indonesia in that period in 2012. Again, October actually had the highest monthly total for the year so far, only 14% of the five-year-average for the month, and more head than for the same month in 2021 and 2020.

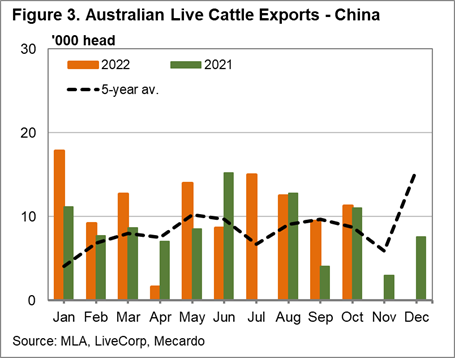

In other markets, Vietnam has gone from 33% of Australia’s live cattle exports in 2020, and 25% in 2021, to less than 10% so far this year. Year-to-October cattle exports to Vietnam were 72% below year-ago and five-year-average numbers for the same period. Exports to Vietnam have dampened due to an oversupply coming out of Thailand, as exports from there into China have been cut-off due to Covid-19, and they are a cheaper product.

China, on the other hand – which takes more live breeding cattle than slaughter stock – has picked up some of that market share, jumping from 14% last year to nearly 24% in 2022. With more than 112,000 head exported to China so far, this is 23% more than the same period last year, and about 10,000 head more than the five-year average for the entire 12 months.

What does it mean?

Different markets are being impacted by different things, but Australia’s high domestic cattle prices are playing a role in all of them – and particularly in Indonesia, the backbone of the sector. While prices have been high for some time, other high cost inputs and the impact of the FMD outbreak have added to the price crunch of Indonesian importers and feeders.

There are reports of cattle being held close to Australian ports continuing trade over the wet, so they could continue to build on October’s better results. However the significant downturn in exports for the year will eventually start to hurt prices domestically – so far the good seasons have been able to absorb them, but it will result in extra finished cattle next year.

Have any questions or comments?

Key Points

- Live cattle export numbers are tracking at 30% below year-ago-levels for 2022 so far.

- Numbers on the rise in October, but were still well below the five-year-average.

- Indonesia maintains majority market share, with live exports to China on rise.

Click on figure to expand

Click on figure to expand

Data sources: ABS,

Photo Credit: Emily Bozier “Laguna Grazing”