Test cricket is over for the summer, so it’s back to watching the markets for us. That said, there’s still headers in the paddocks, and everyone else is still at the beach, meaning there’s not too much to look at just yet. With weaner cattle sales filling up the first two weeks of January, there’s only been a handful of sheep and lambs sold so far this year, and no price indicators generated as yet. So what do we know about what’s to come if you’ve got ovine left to offload?

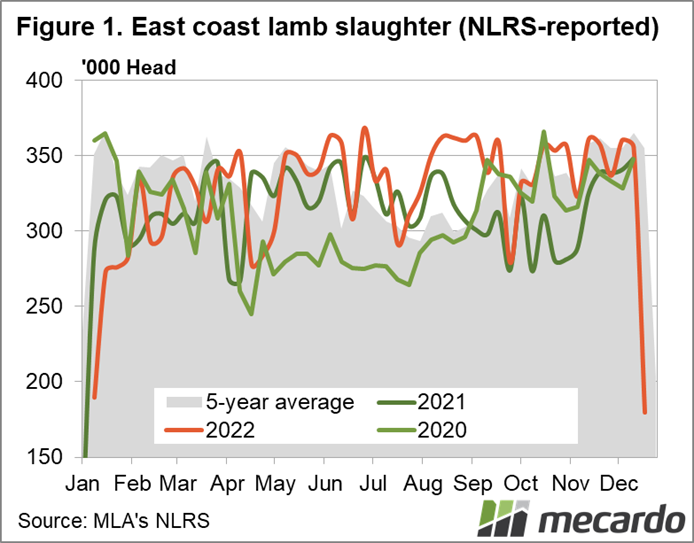

We know that historically January has one of the highest lamb slaughter volumes of the year, with the 10-year weekly totals some of the highest for the year. Barring processor workforce and supply chain woes, demand should remain at those levels for kill-ready lambs with exports likely to have finished 2022 in record territory once again, and the Australia Day domestic spike just around the corner. Figure 1 tells a different story for the past two years, however without Covid-19, and the flock having significantly rebuilt, more traditional throughput should prevail.

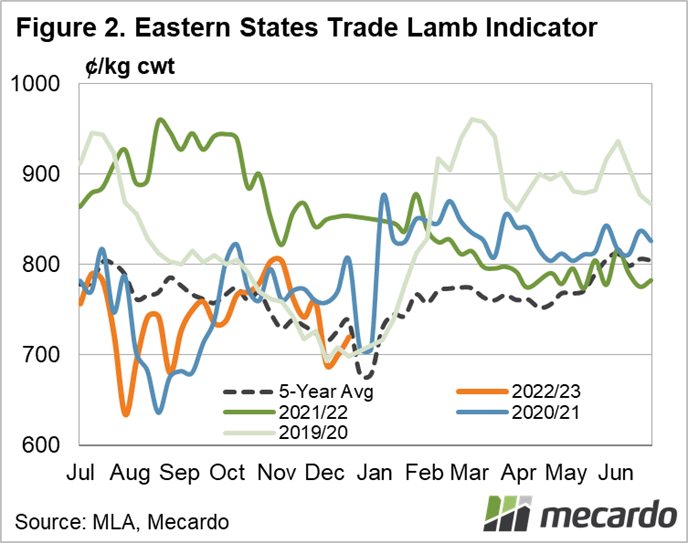

We also know that generally lamb prices begin to rise at this time of year. We can see from figure 2 that the Eastern States Trade Lamb Indicator’s five-year-average’s experiences a surge at the start of the year, and stays on a firmer trajectory through to winter. The outlier obviously being last year, when prices fell for this period after the highs experienced in the second half of 2021. But the spring of 2022 being much more closely aligned to the long-term average for that period, the start of 2023 should follow suit.

And lastly we know what the prices we’ve already seen are telling us – which is strong competition for good quality, but the seasonal conditions have meant quality is still an issue. The five-year-average for this week of January is just shy of 730c/kg for the ESTLI, and last year it closed the week at 846c/kg, while the medium over-the-hook price for lambs was 733c/kg. This week, processors averaged above 800c/kg for 20-22kg old lambs, 720c/kg for young lambs in the same weight category, and sent direct grids are sitting at 780c/kg (for 18-32kg lambs).

What does it mean?

While producers didn’t see the record high prices in the spring of 2022 like they did in 2021, this does mean it is likely the price cycle will align itself more closely with the historical peaks and troughs, and returns should be firm to stronger throughout January.

Have any questions or comments?

Key Points

- January tipped to return to strong sheep and lamb slaughter as 2022 lamb exports set to reach near record highs.

- Typical 2022 spring price trend bodes well for firmer prices to start 2023.

- Opening lamb sale of the year receives strong competition for heavy trade and export lambs, less so for store stock

Click on figure to expand

Data sources: MLA