There’s plenty of positivity around the growing flock and export market opportunities in Meat and Livestock Australia’s (MLA) latest sheep industry projections. For the average lamb producer, however, there’s little respite in the short term as Australia’s cash rate sits at its highest point in over a decade, and lamb prices are expected to remain below the 10-year average for at least the remainder of 2023.

Sheep and lamb slaughter and production levels have all moved from where the start of 2023 projections forecast thought they would be, but the flock numbers have remained at 78.75 million head, which will be the largest flock since 2007. Flock numbers will continue to rise into next year, before dipping slightly in 2025 when the flock will settle 2% higher than 2022 levels according to MLA. This is despite this year’s sheep slaughter being revised up since February by more than 3%, or 237,000 head, taking it to a forecast of 7.82 million head.

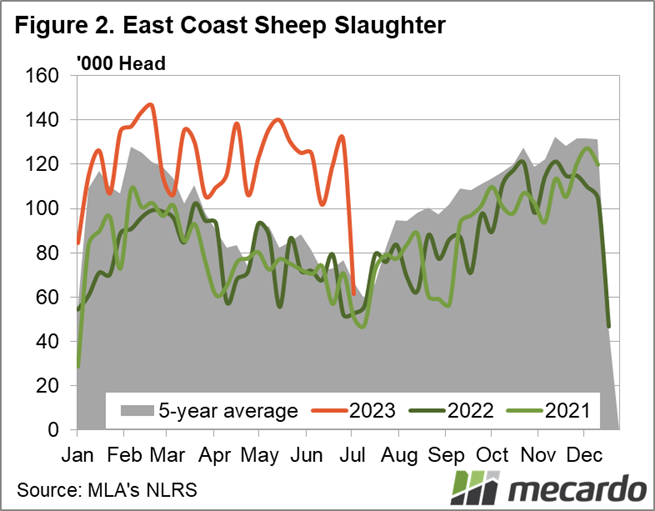

This comes as little surprise, with mutton slaughter currently 60% higher than in 2022 for the year-to-date. The sheep kill is expected to continue expanding as the flock grows and seasonal conditions vary, coming close to being 50% higher than in 2022 by 2025. Production will follow suit, with higher carcase weights also contributing, with sheep weighing 3% above the 10-year average this year, albeit just below the historical highs recorded last year.

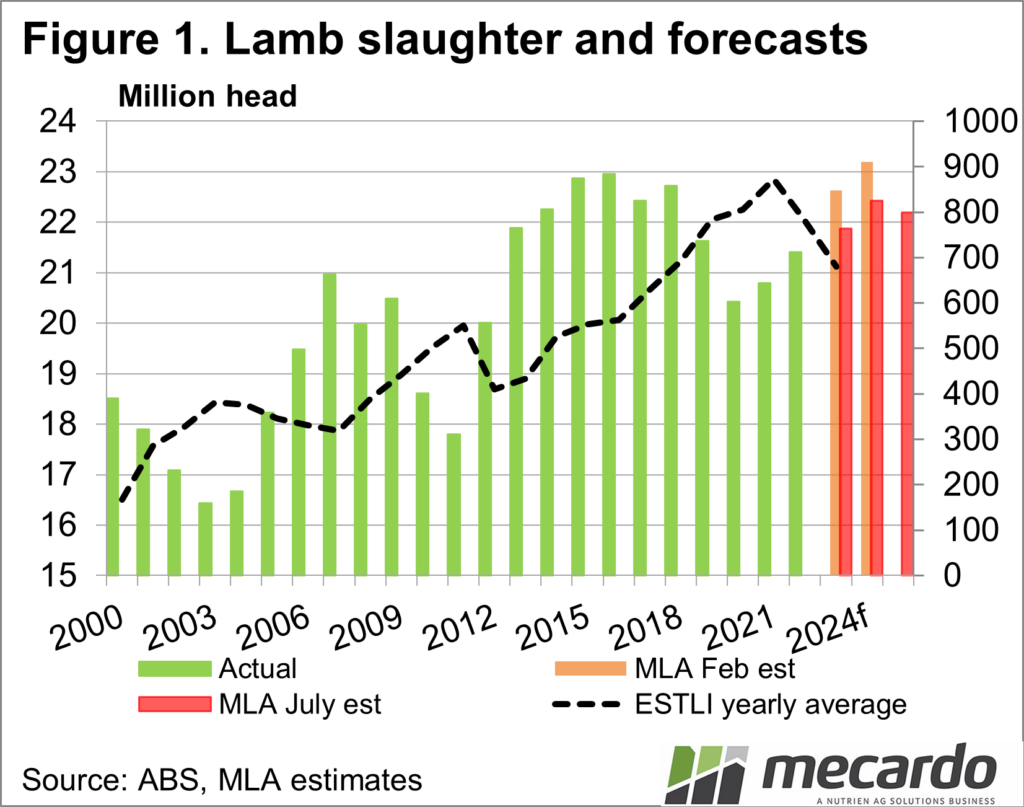

Lamb carcase weights are forecast to sit at 7% above the long-term average this year, but again will be down year-on-year and expected to continue to fall out to 2025. Lamb slaughter has been revised down since February by 3%, as mutton has been taking precedence on the kill floor. It is still expected to be higher year-on-year for 2023, but now by only a touch over 1%.

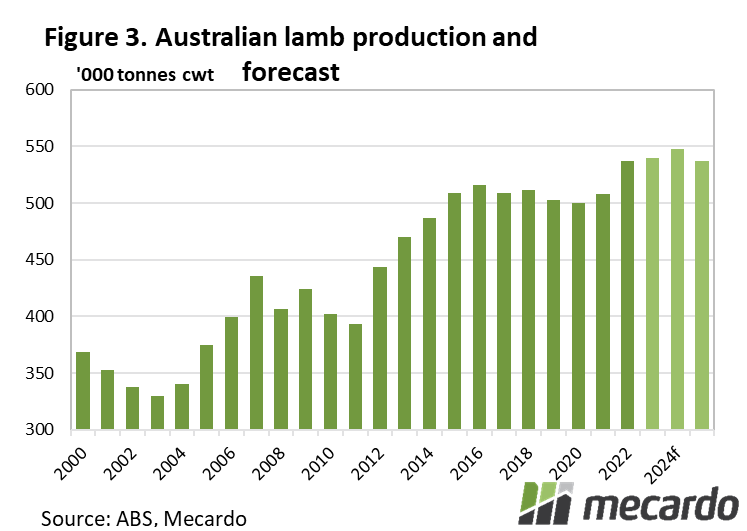

Lamb production has also been scaled back since the start of the year, but the forecast of 540,000 tonnes for 2023 will still be a record high since at least 1972. Lamb exports will follow suit, forecast to reach a record high of 300,000 toned shipped weight this year, and 310,000 tonnes in 2024. They’ll fall away slightly in 2025, but still be 7% above 2022 levels.

The price forecasts have returned in the latest projections, with MLA using six industry analysts to forecast where both the National Trade Lamb and National Heavy Lamb Indicators will sit in three and six months. And while both prices are expected to increase through to the end of the year, they will still be below the long-term average. Heavy lambs are predicted to be up nearly 10% by December 31, to 553¢/kg, with trade lambs rising slightly less to 537¢/kg.

What does it mean?

The growing flock and continued positive seasonal conditions (so far) this year mean all signs are pointing towards another big lamb crop in 2023, and supply will remain ample for the time being. If you combine this with the fact that lamb production is at record highs, despite slaughter not being so, there isn’t much incentive for processors to push prices higher. As new season lambs hit the market in the next month or so, the small price increase that is forecast will most likely be mainly driven by competition to secure improved quality and weight.

Have any questions or comments?

Key Points

- Sheep flock predictions remain firm for 2023 at 78.75 million head, but less growth is expected through to 2025.

- Mutton slaughter is currently 60% higher year-on-year and expected to continue to increase.

- MLA’s multi-analyst price projections expect lamb returns to rise through to the end of the year but remain below 10-year-average.

Click on figure to expand

Click on figure to expand

Data sources: MLA, ABS, Mecardo