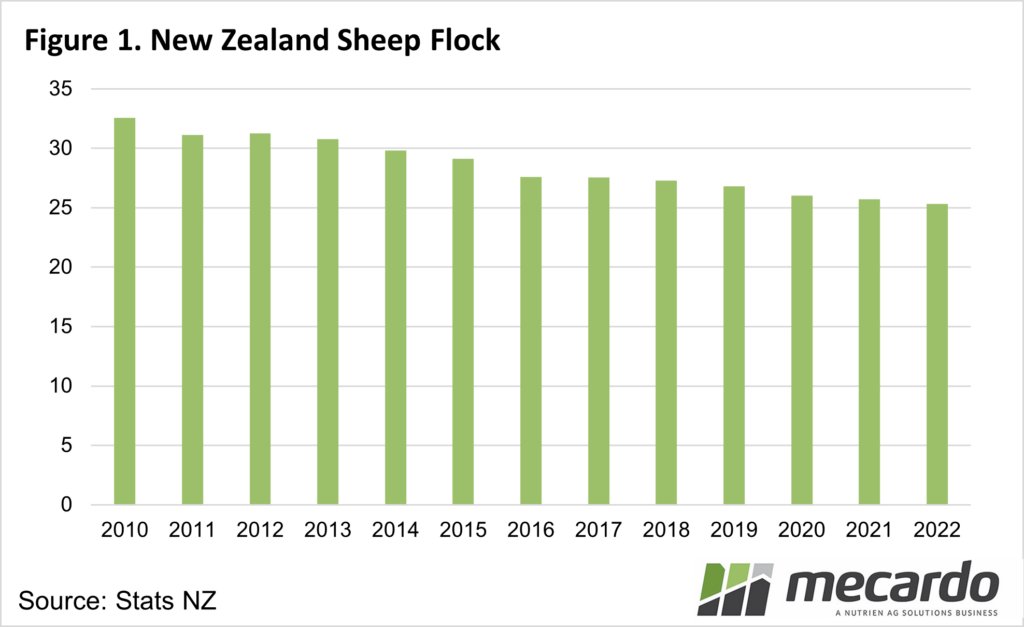

Australia’s major sheepmeat export competitor, New Zealand, has been going through flock decline for a decade and their production has followed suit, albeit at a slower rate.

New Zealand is the second largest exporter of lamb and mutton behind Australia, but according to Meat and Livestock Australia, their flock has dropped by 6 million head since 2012, with their production falling 0.5% on average each year.

While the fluctuations in seasonal conditions are one of the largest drivers of Australia’s sheep numbers, in New Zealand there are other factors at play, including the fact that nearly 30% less land is being used for sheep production since the turn of the century. Breeding ewe numbers were down 6% for the spring 2022 lamb drop, which itself was down 8.5%.

Beef + Lamb New Zealand data is reported on a seasonal, rather than calendar or financial year basis, so the 2022-23 year is referring to October 2022 through to September 2023. Their latest update on the industry was released in March and showed they expect lamb export volumes to drop 2.5% to 284,000 tonnes for 2022-23. This would be 7.5% below 2019-20 levels. The price per tonne is also estimated to fall significantly, however, will remain above the five-year average, which would bring the export value of NZ lamb more than 13% lower year-on-year.

NZ exported a record volume of lamb to the US in 2021-22, but for the first four months of the current season, exports to the US were down 28% year-on-year, and 10 % below the average. While the volume of sheep and goat meat exported from NZ to the US was below year-ago levels from October to May this year (latest data available), it was also equal to or below the five-year average for that period. For January-April 2023 NZ made up 23% of the US lamb market, compared to 20% for the same period last year. In comparison, Australia’s market share has dropped by 2%. And the average export volume also increased, up 13%.

China accounted for 80% of NZ’s mutton exports in 2021-22, and 86% of the volume this season, so unsurprisingly reduced demand from that market has had a significant impact. Volumes are estimated to fall nearly 4% this season, to 84,000 tonnes, down from recent highs of 95,000 tonnes in 2020-21. China has accounted for more than 50% of NZ’s total sheepmeat exports since 2018-19, and therefore they have a significant impact on export outcomes for the country. The second biggest market for NZ lamb in 2021-22 was the UK, and NZ makes up 60% of all sheepmeat imports to the country. NZ lamb volumes to the UK have fallen 37% for the season-to-March, which takes them 46% below the five-year average, and just about halved their market share.

What does it mean?

While there isn’t a lot of growth opportunity for NZ sheepmeat export volumes in the above, the estimated decrease for export lamb and mutton production in 2022-23 mirrors the expected drop in actual export volumes, with the lamb crop estimated to be 1.8 million head lower year-on-year in 2022-23.

Australia faces many of the same global trade uncertainties, especially around China and the US, however expanding production, rather than decreasing like New Zealand, means we can have an increased presence in export markets, and NZ’s will be diminishing.

Have any questions or comments?

Key Points

- NZ lamb exports are estimated to be 2.5% lower year-on-year for 2022-23, and at their lowest volume for at least five years.

- Mutton will drop further because of reduced Chinese demand, with NZ exports expected to be down nearly 4% for 2022-23.

- Low NZ/USD exchange rate is expected to offset some of the declines in global market demand for NZ sheepmeat.

Click on figure to expand

Data sources: Meat and Livestock Australia; Beef+Lamb New Zealand, Stats NZ, Mecardo