Last week the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) released their March Crop Report. Harvest was better than expected, as crop volumes grew on the last update to a new enormous record.

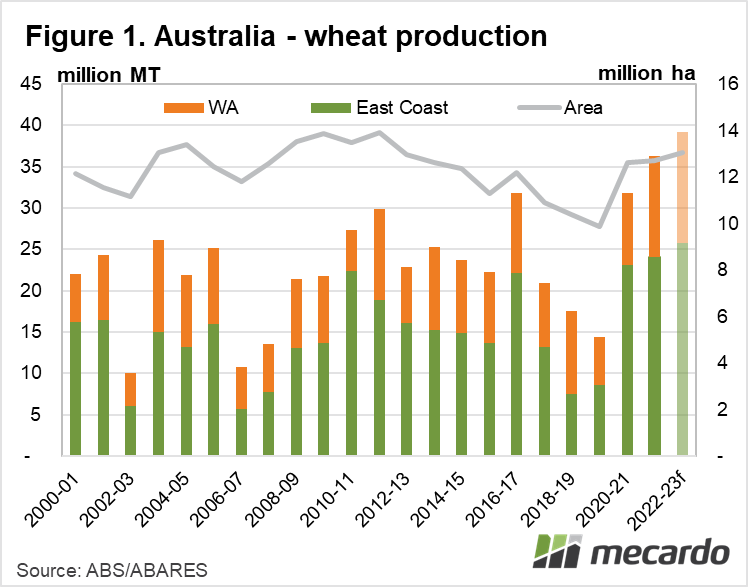

The Australian wheat crop grew with every update of the ABARES crop report last year, and it has continued to grow in 2023. We should be getting close to a final figure now, with the latest update adding a further 2.6mmt, or 7.2%, to hit 39.19mmt.

NSW saw the largest adjustment on the December report. As the floods receded, and harvest got rolling, NSW production was increased by over 1mmt, or 12.3% to reach 10.26mmt. WA harvest seems to be largely as expected, with no change there on the last report.

WA did drive the record National total however, seeing 11% more wheat harvested than last year. Figure 1 shows the growth on last year’s record, with the east coast producing 7% more wheat. The cropping area was slightly larger, but most of the increase was due to yields.

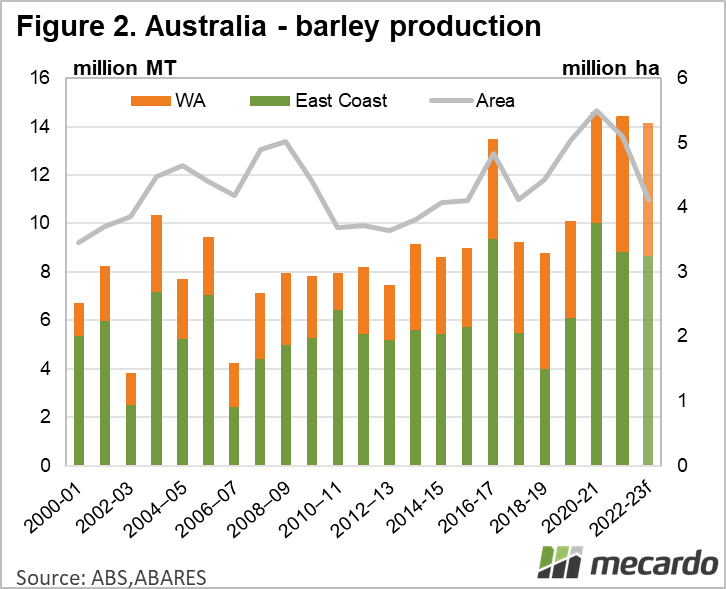

The Crop Report pegged barley production at 14.1mmt, up 6% on the last update, driven again by a 13% increase in NSW. Figure 2 shows barley still couldn’t emulate the highs of the last two years, but with a much smaller area, yields were a record at 3.43t/ha. This was a 21% increase on last year, which is a huge jump.

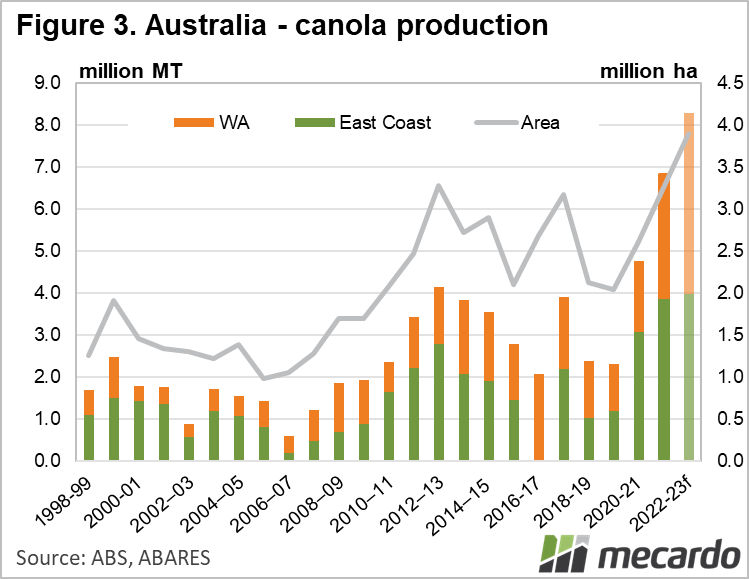

Canola also achieved record yields, but only by 0.02t/ha. The canola area grew markedly this year, as shown in figure 3, and this drove production to a record 8.2mmt. WA canola saw a big jump on the December report, with production growing 19% to see it eclipse last year’s record at 3.9mmt.

The east coast grew slightly more canola than the west, and again yields were better than expected. The year on year increase on the east coast was a massive 46%, with the 4.3mmt produced easily accounting for the previous record set just last year.

What does it mean?

The huge winter crop of 67.3mmt is unlikely to be repeated any time soon, with a season that is too wet obviously better than a season which is average. The main thing to take out in terms of supply next year comes from looking at rotations. It will be interesting to see if canola area can be maintained, or if we will see more barley as crops rotate.

With cereal and canola prices a bit closer this year, we’d expect canola production to decline, and prices move back closer to international benchmarks.

Have any questions or comments?

Key Points

- The ABARES Crop Report showed another jump in winter crop production forecasts.

- NSW drove increases in wheat and barley, while WA had a large canola increase.

- There should be more barley and less canola planted this year, with impacts on prices.

Click on figure to expand

Click on figure to expand

Data sources: ABARES, Mecardo