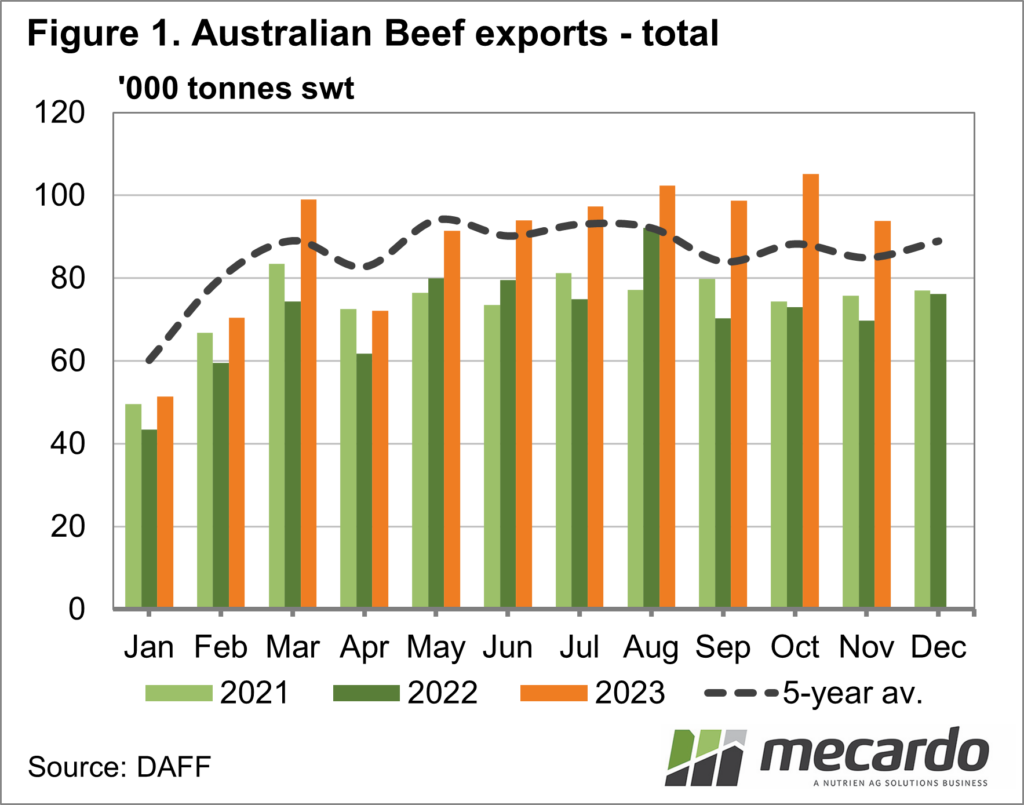

Australian beef exports generally maintained their momentum last month, staying well above both year-ago and five-year-average volumes. The trade did back off from the bumper October, which was the strongest month for beef exports since December 2019, but the global demand appears to be keeping pace with production. This was despite plenty of international market hurdles such as slowing economies, full inventories, and strong exports from competing countries.

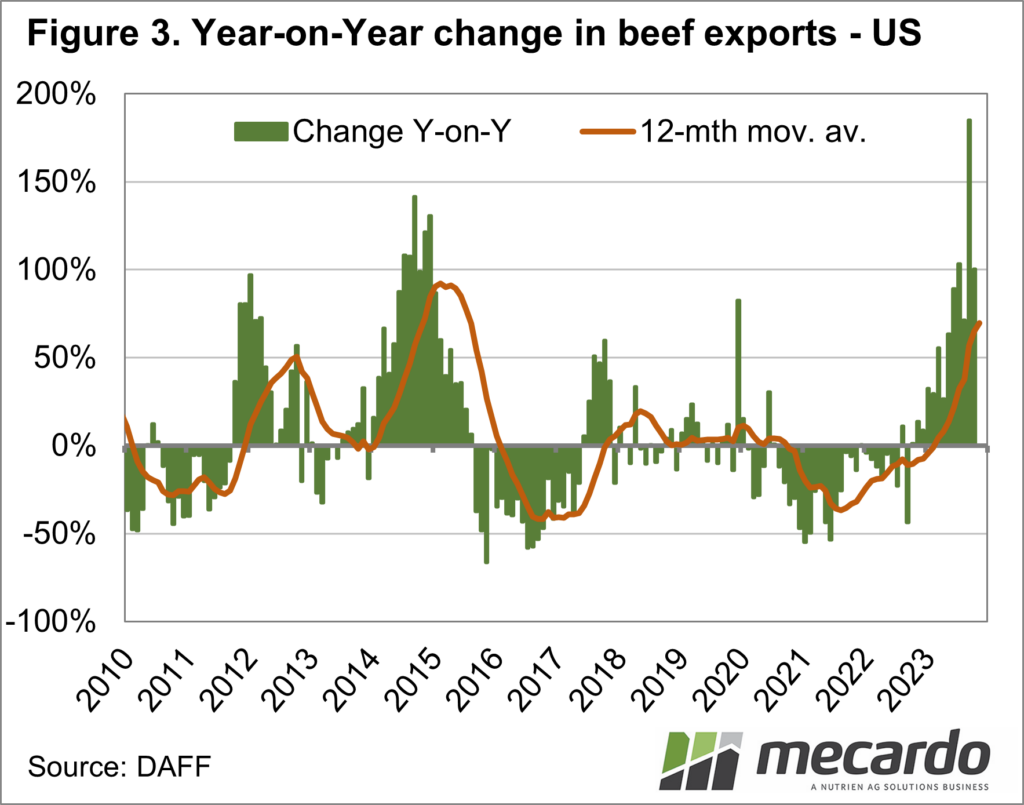

Trade with the US slowed

in November, coming back about 8000 tonnes from the previous month, but still

more than doubled the same month last year, as well as being 42% above the five-year

average. It has also maintained the majority market share for the year-to-date,

taking 21.5% of Australia’s beef exports, and taking more than the annual

totals of the previous two years, with still a month to go. According to the

Steiner Consulting Group, despite there being much anticipation about the US

herd going into a rebuilding phase, their domestic cow slaughter for the week

ending November 18 was both the highest weekly total for the year and higher

for that week year-on-year. This means they had plenty of domestic lean product

to compete with Australian imports.

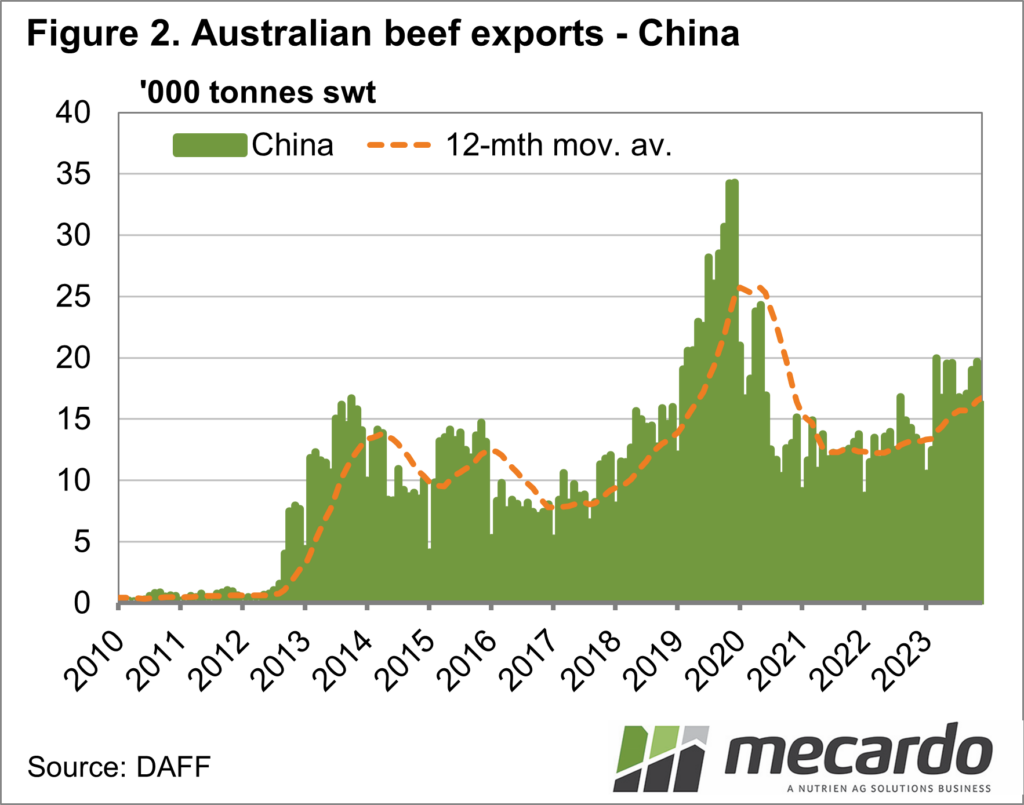

Australian beef exports

to China also fell compared to October, to sit about 9% below the five-year

average for the month. However, that average figure is fairly skewed by the record-high

figures recorded in 2019, meaning it was still the second-highest November

volume in those five years, and the third-highest on record for the month.

China is also now in equal second place for market share alongside Australia’s

traditionally number one market, Japan, with China’s year-to-date imports up

nearly 30% compared to last year. This all said, Rabobank’s latest global beef

quarterly expects Chinese imports to continue at the end of the year and into

early 2024, due to higher domestic production and high inventories. The lifting

of restrictions on three Australian Abattoirs previously on the trade blacklist

is a very positive sign for red meat trade between Australia and China.

Looking at our

historical number one beef export market Japan, volumes for November were still

23% below average, but definitely picked up compared to earlier in the year.

Year-to-date, beef exports to Japan have fallen by 5% compared to the same

period in 2022. According to Steiner, a 30% increase in beef inventories in

Japan for the last quarter of 2022 and the first quarter of 2023 had continued

to impact imports to the country up until the current quarter, but as of

October, they had got inventories back to 6% lower year-on-year.

What does it mean?

Australia’s beef slaughter and production is expected to keep rising in 2024, and if this eventuates it will continue to support strong export volumes, aided by competitive prices and a low Australian dollar. If the predicted lowering of US production also comes about, it will further support Australia’s competitiveness in its major markets.

Have any questions or comments?

Key Points

- Australian beef exports in November were at their lowest monthly level since May, but still about 34% higher year-on-year for the month.

- The US has maintained the most market share for both the month of November and the year-to-date, despite taking less Australian beef than the previous month.

- Beef exports to China took the second-highest November volume of Australian beef on record, albeit only just over half of the record set in 2019.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, Rabobank, AMIC, Steiner Consulting Group, Mecardo