Australia’s mammoth wheat and barley crop has freight and storage facilities straining under the load, with little room to spare. On top of this, shipping rates worldwide are at extreme levels, putting pressure on the ability of Australia to export minor crops such as pulses. This coupled with a COVID impacted economy, and weak demand from the largest pulse consumer in the world, India, points to a weak outlook for Australian pulses.

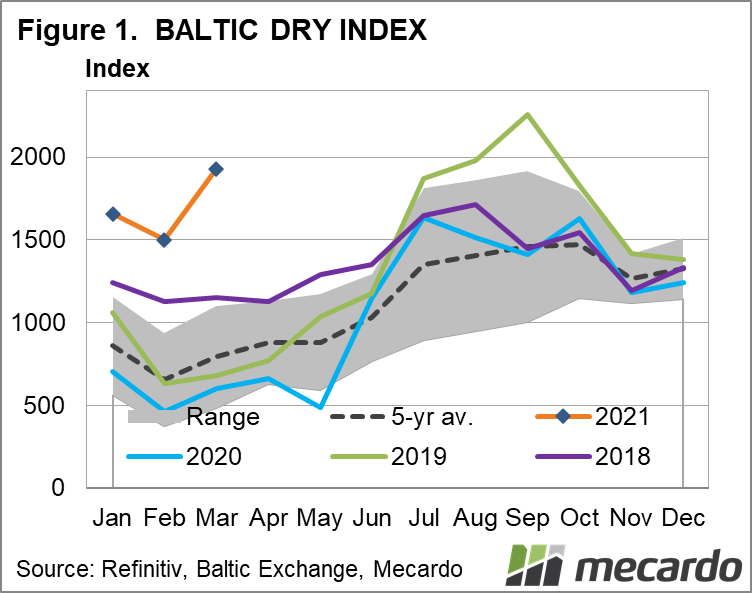

The Baltic Dry Index (figure 1), a key indicator of global ocean shipping rates has been rising steeply since February. After putting on 29% it is approaching levels not seen since the height of the COVID-19 crisis in mid-2020.

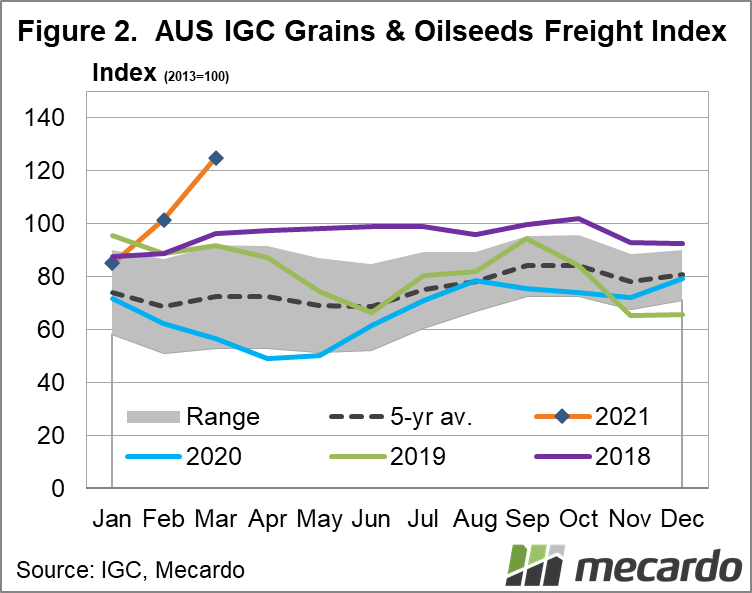

Closer to home, the International Grain’s Council Australian Grains and Oilseeds Freight Index, (A-GOFI) (figure 2), has also risen 53% since the start of 2021, which, at 72% above 5-year average rates, are unprecedented record highs.

One of our regular contributors on Mecardo, Nick Booth, of Next Level Grain Marketing, recently talked to Peter Semmler, of Agrisemm Global Brokerage, who reported that container demand is so high, that certain shipping companies are sailing with empty containers on board to cash in on more profitable shipping routes. Campbell Brumby, from Southern Grain Storage, said that this practice of loading empty containers was particularly prevalent in the case of Chinese owned units, and that it had several thousand tonnes of faba beans in storage that it intended to export by the end of May, but does not expect the situation to resolve before Q3-21.

Backing up these claims are statements from United Malt, and Sunrice of backlogs of product awaiting export, and that demand for shipping space, and containers are consistently outstripping supply, driving higher freight costs. In particular, Sunrice has forewarned that its ability to fulfil orders from international markets in the lead-up to Ramadan in early April has been materially curtailed.

John Fossey, from DWCI, said that a surge of imports of consumer durables (such as whitegoods and electronics) had caused containers to pile up in suboptimal locations, and as such have led to delays in repositioning them to meet demand.

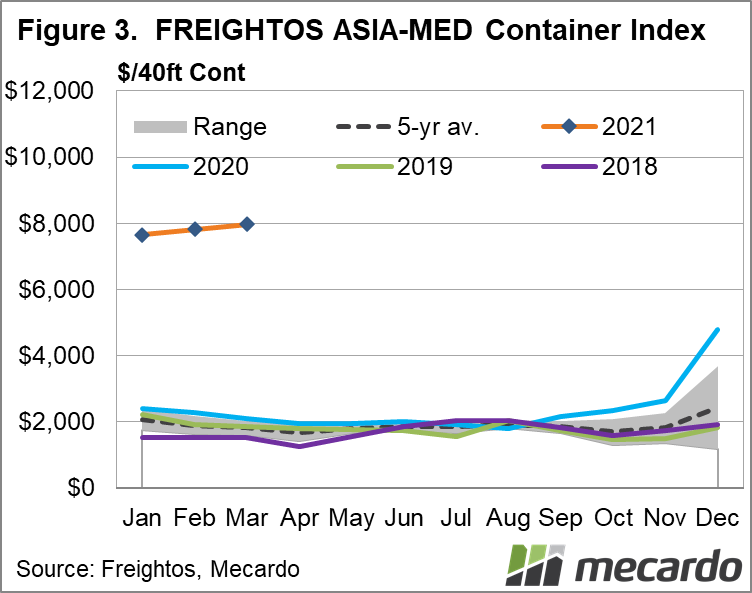

To put this into perspective, the Freightos Asia to Mediterranean freight Index (figure 3) pegs the shipping cost of a 40-foot container at an eyewatering $8,000 – around four times the typical average cost. This highlights the probable level of congestion along key shipping routes from Australia toward northern Africa and the Mediterranean, including Egypt.

Global pulse demand has also been severely dampened by the impact of COVID-19, with the Indian economy’s woes being of particular relevance as it experiences high unemployment, and the populace suffers reduced incomes. Lower spending power, coupled with a reduction in weddings and celebrations have all translated into lethargic demand for pulses.

Although expectations are that India should have ample supplies available for the coming year, one bright spot does exist. NDVI data on Indian crop production is suggesting that the rabi crop for 2021 may not be progressing strongly, with overly wet weather potentially to blame.

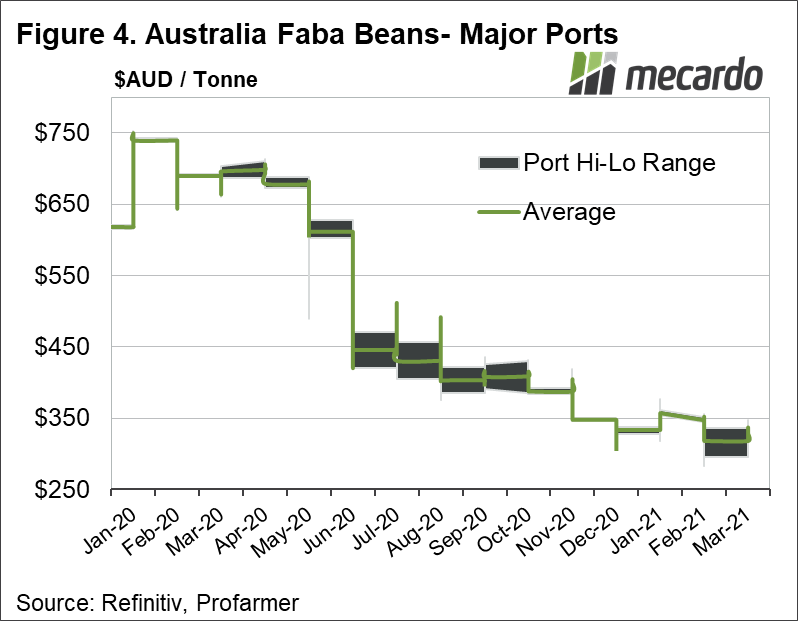

Indicative Faba bean bid prices have tracked steadily lower from highs of $460/ton in August 2020. (figure 4) More recently, they have drifted $-20(6%) since mid-February, down to $332/ton, as growers offload stores of pulses ahead of the price risk posed by the rabi crop pulse harvest in April/May.,

What does it mean?

Congested ports, and a shortage of food-grade containers in Australia, have negatively affected the ability of niche commodities such as pulses to be exported. There is, however, an expectation that the shipping crisis will resolve itself in the second half of 2021. Although, this will not be in time for Australia to easily offload its pulse stocks ahead of the all-important rabi harvest in India, which is likely to pose a risk to market prices.

Have any questions or comments?

Key Points

- Australia’s bumper crop is contributing to shipping congestion

- Container demand and shipping rates are high

- Congestion is impacting the pulse container trade.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources:

Reuters, IGC, Freightos, Grains Central, Next Level Grain marketing, DWCI, Agri Semm, Mecardo.