Amongst the information produced by the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) is data on cropping areas and livestock numbers. The two are related, and as such it’s interesting to investigate shifts in the use of land over the years.

Record canola plantings last year, and record barley back in 2020-21 prompted a look at where the acres for these plantings were coming from. There is a finite amount of arable land in Australia, so for cropping areas to increase, something has to make way.

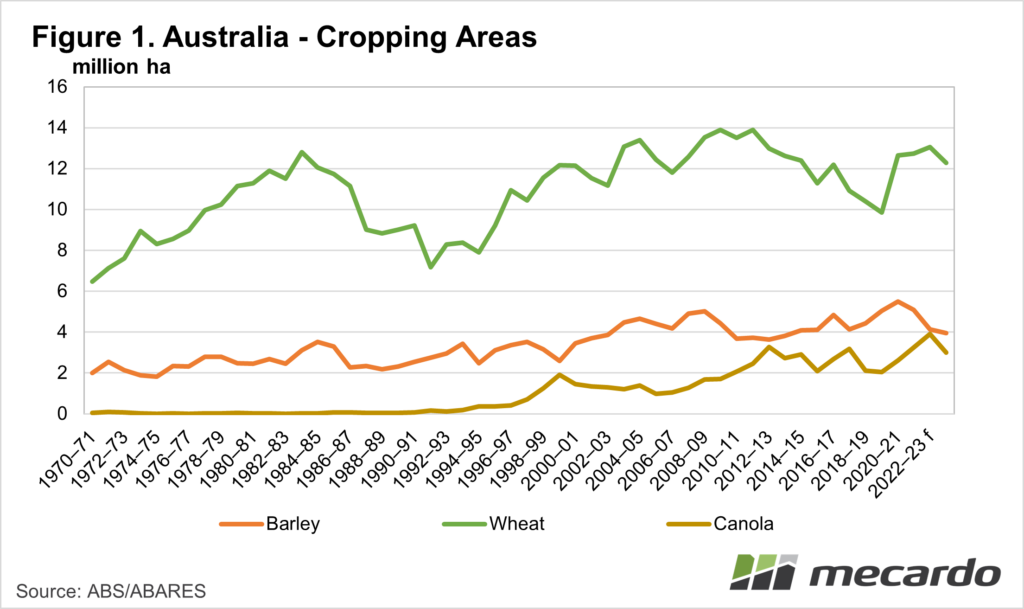

Figure 1 shows ABARES data for wheat, barley, and canola plantings from 1970 to now, including ABARES forecast for 2023 to 2024. After three years when total crop plantings were over 25 million hectares, ABARES is forecasting total crop plantings to fall back to 23.69 million hectares.

The lower plantings will be led by a 6% decrease in wheat, 4.6% in barley, and a massive 23% fall in canola plantings. The forecast of a drier year is no doubt expected to see plantings decrease, but the early start some are experiencing might change this.

In the longer term, figure 1 shows total cropping area has increased by 66% from 1990 to 2022. This is an increase of 10 million hectares. To put this in some perspective, Tasmania’s total area is 6.8 million hectares, while Victoria’s is 22.7 million.

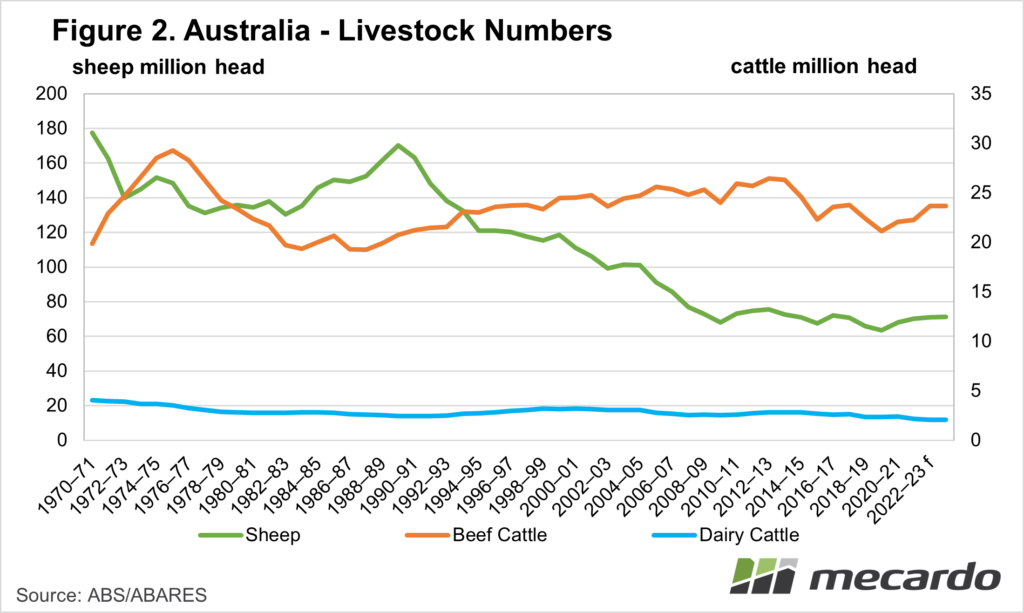

Australia fell off the sheeps back in the 80s, with the flock in decline until 2009 after which it steadied somewhat. Figure 2 shows the fall in sheep numbers has coincided with increasing cropping areas and beef cattle numbers.

Many mixed cropping/sheep farms have become sole cropping enterprises, and cropping has pushed into some higher rainfall country, displacing sheep. The good sheepmeat prices of the last few years have arrested the trend, and we might be in a holding pattern unless we see a large structural shift.

What does it mean?

Falling crop areas next year, and likely lower yields will result in lower wheat, barley, and canola production. We know international markets set prices, but lower local production will at least mean a stronger basis.

It will be interesting to see if the sheep flock can increase above the 76 million head mark of 2012-13. It would probably require some taking back of country from cropping, which could happen, but recent falls in sheep and lamb prices might have more than a few mixed farmers reconsidering flock expansion plans.

Have any questions or comments?

Key Points

- ABARES is forecasting a fall in cropping areas for all three major crops this year.

- Cropping has taken a lot of country off sheep over the last 30 years.

- Lower crop volumes will be positive for basis, but prices remain driven by international markets.

Click on figure to expand

Click on figure to expand

Data sources: ABS, ABARES, Mecardo