The price of sheep and lamb meat can be a bit of a mystery to growers. While we can get somewhat of a picture from United States Department of Agriculture data, we need to wait for export value data for a broader view. With the November data now available, we can see why lamb prices have found solid support over spring and summer.

Lamb and mutton export value data is published on the Meat and Livestock Australia (MLA) statistics database, sourced from World Trade Atlas. Export value tells us how much money lamb and mutton exports brought in on a monthly basis.

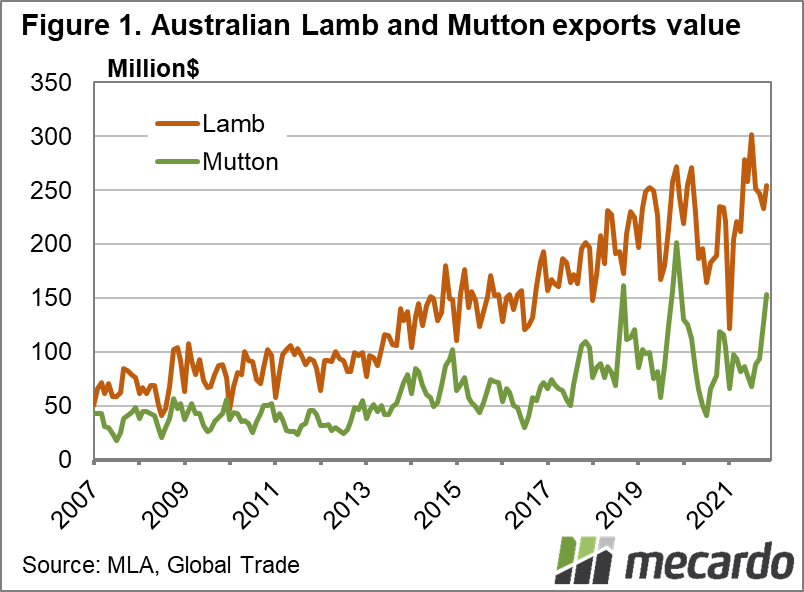

Figure 1 shows the long term lamb and mutton export values. Export value is a function of volume and price. We can see that in 2020 the lamb export values were weaker, and this was due to weakening demand, and lower supplies. Lamb export value has since bounced back, and has spent much of 2021 at or near record levels.

The mutton data shows a solidd jump in export values late in 2021 thanks to a very strong lift in export values to China, mostly thanks to increasing volumes. The unit value of mutton has been relatively steady compared to lamb proceeding this recent spike upwards.

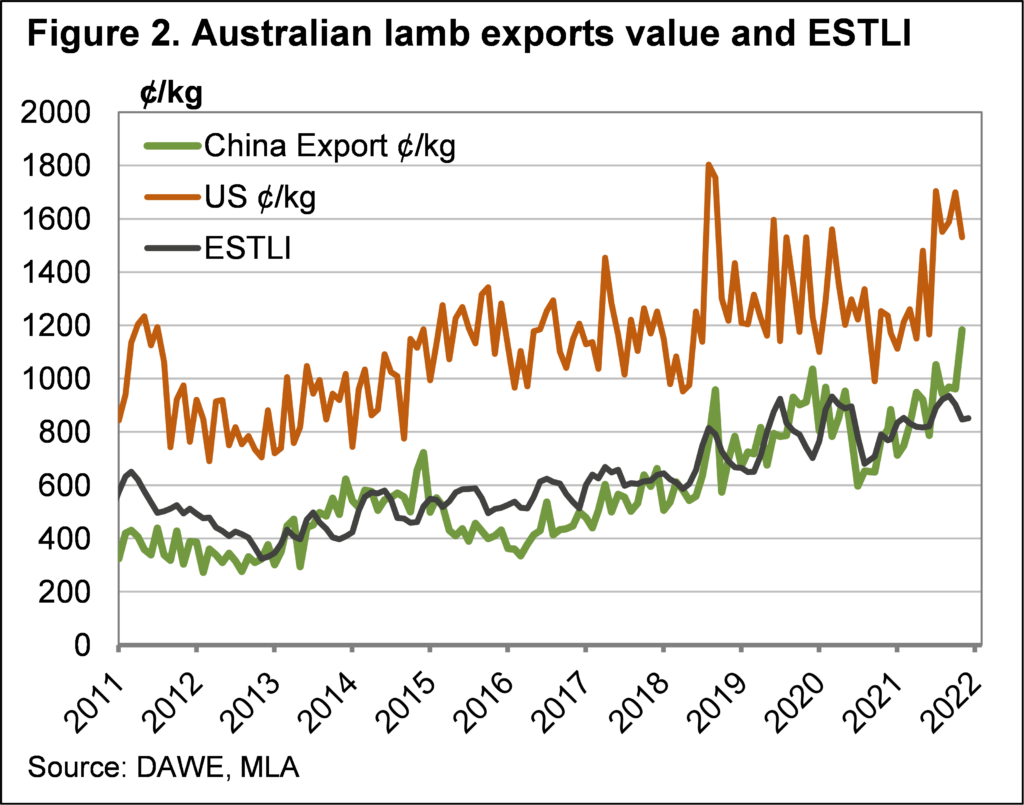

Dividing the lamb export value by export volume gives a ȼ/kg price of export lamb. The data is split by destination, we can see how much different markets are paying. Figure 2 shows the ȼ/kg value of lamb exported to China and the US, along with the Eastern States Trade Lamb Indicator (ESTLI).

After jumping higher in July 2021 export values to the US have maintained their strength, sitting around the 1600ȼ/kg swt level. This is 33% higher than the Covid induced doldrums of 2020/21 and 16% higher than values prior to that.

China is the other major market for lamb exports, and their price has lifted as well. We won’t know for a while if the 1200ȼ/kg achieved in November is sustainable, but prior to that the 1000ȼ/kg was already record highs.

What does it mean?

The good news for lamb producers is that we know the US consumer is comfortable with the new high price level, and China is playing catch up. The ESTLI has remained relatively steady while export values have been rising, which means export processors are making increased margins between buy and sell price.

We don’t know what costs have done in processing, but there is little doubt they have increased with Covid compliance and logistical issues, but a widening gap between export values and lamb prices only points to upside for lamb when processing rates are back to normal.

Have any questions or comments?

Key Points

- Lamb export values have maintained the strength gained in mid 2021.

- The US and China were both paying close to record ȼ/kg prices for lamb late in 2021.

- The widening gap between export values and saleyard prices points to upside for growers.

Click on figure to expand

Click on figure to expand

Data sources:

MLA, World Trade Atlas, Mecardo