Grass fever and high prices looks to be enough to encourage plenty of confidence in the sheep industry, despite uncertainty surrounding export markets due to Covid-19 and trade tensions, both for sheepmeat and wool.

The national flock rebuild is now underway and looks set to pick up more steam next year. This is according to the early results from Meat & Livestock Australia and Australian Wool Innovations most recent Wool and Sheepmeat survey. While the full results are yet to come in – they are meant to drop this week – the data released so far points clearly to even fewer ewes being sold off in the new year, as those producers that have now experienced a good season reach a more comfortable position to retain.

The October survey found 42% of producers intend to increase their ewe flock, while 52% intend to at least maintain their current numbers. Putting that in perspective, last October just 26% of producers intended to increase their flock. And it will be through retention with 56% of producers looking to increase supply will build flock numbers in the first quarter of 2021, according to the survey. No doubt because at more than $400 a head for scanned-in-lamb first-cross ewes, buying them in seems out of reach for many. They are still a good investment, however, which you can read about in our article here.

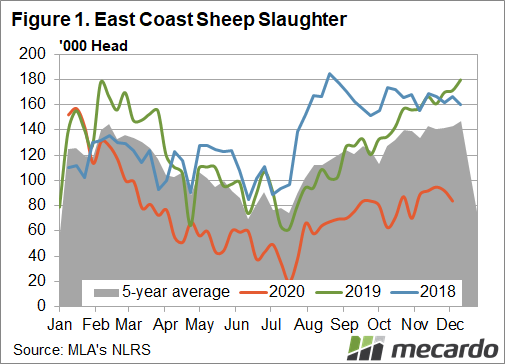

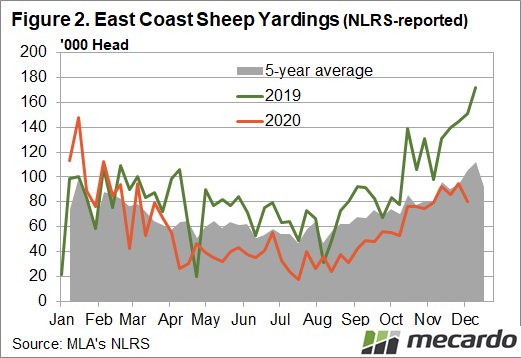

Most will not need the charts to be reminded of how different the sheep turn-off trend was for 2018-19, compared to 2020. With just a week of figures left to come for this year, sheep slaughter is down more than 40% from 2019, and 38% below the five-year-average. Also not surprisingly, this has sent prices in the opposite direction, with the national over-the-hook mutton price for medium sheep (18-24kg) averaging 13% more for the year compared to 2019. The saleyard indicator for mutton has increased even further, up 17% year-on-year. Mecardo’s annual average National Mutton Indicator model predicts an average price in 2021 of 561¢/kg.

What does it mean?

Producers in the south-east who had a good season and sheep or lambs to sell likely achieved good returns this year, and so have been keeping anything that can breed in the paddock, which will assist in lifting the national flock from its historic lows of recent years. There are plenty of cautious forecasts because of potentially lower export demand, but the domestic eagerness to get sheep numbers back on track will offer plenty of support in the short term.

Have any questions or comments?

Key Points

- Clear confidence in the sheep industry, with 42% of producers intending to increase their flock.

- Sheep slaughter down 40% from 2019 for the year-to-date, with only a week left of figures to come.

- Latest rural confidence survey shows 40% of sheep producers are confident the industry will improve over the coming year, up from just 10% in the last quarter.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: Mecardo; Meat & Livestock Australia; Australian Wool Innovation