There are plenty of articles doing the rounds talking about current international economic challenges. In this article we use German manufacturing as a proxy for the tides in international economic activity and through that manufacturing, to apparel and wool prices.

In proportion of GDP terms Germany is the biggest exporter of major economies, so German manufacturing is strongly linked into the world economy. The IFO institute publishes a monthly report on the German economy, included amongst this are some indices on the manufacturing sector. The latest report is due out late this week.

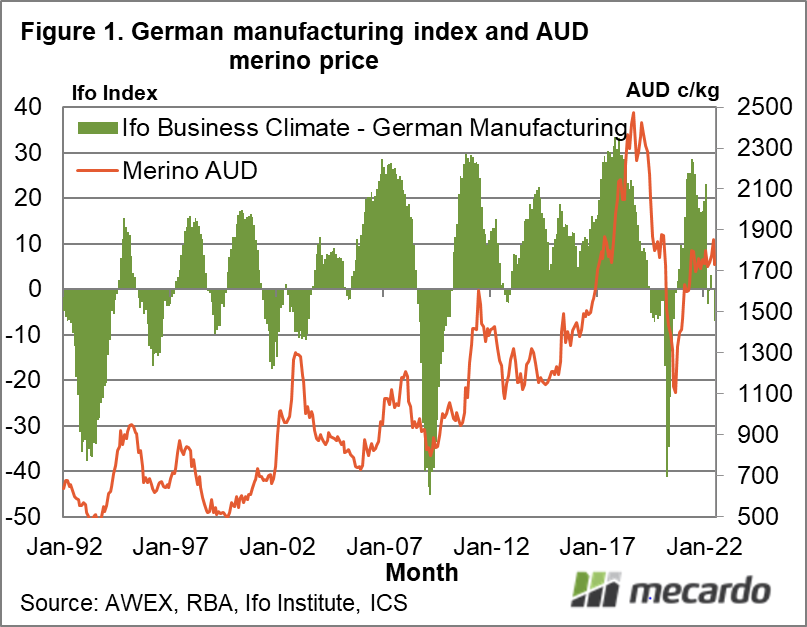

Figure 1 shows the IFO Business Climate (operating conditions not weather) Index for manufacturing from early 1992 to July along with the average merino price in Australian dollar terms. The wool market in the 1990s was a different beast to it is today, as it struggled under large stocks of wool left over from the Reserve Price Scheme. As such this period probably should not be included but has been as a reminder that correlations between the merino price and economic indicators (in this case the Ifo manufacturing business climate index) can change.

If we use the IFO index shown in Figure 1 as a guide to the “tide” in demand for merino wool, it does a reasonable job from 2005 onwards. The 2002 price cycle was an anomaly caused by the liquidation of stockpiles in mid-2001 which was further boosted by a super low Australian dollar. On this point the Australian dollar acts as a shock absorber, which is a good thing, but in doing so clouds the view of the relationship between the merino price and the IFO index.

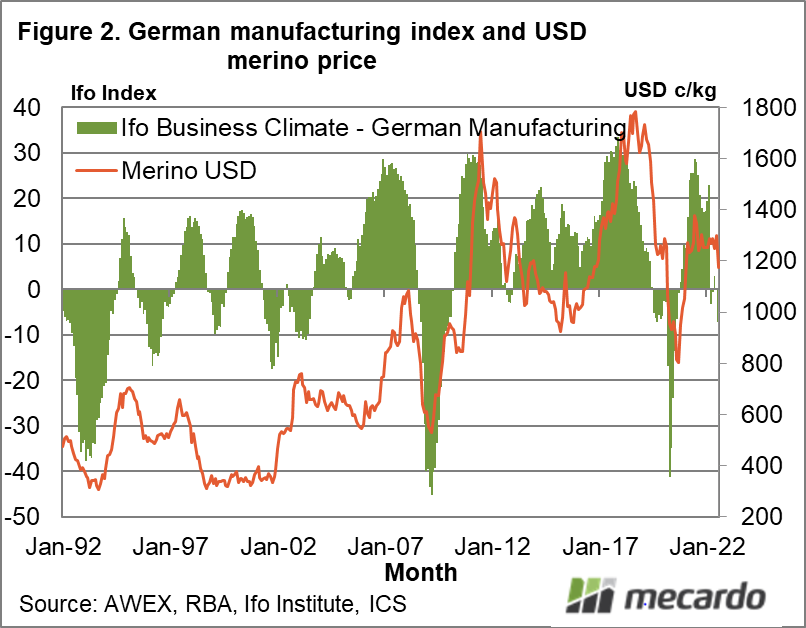

In Figure 2 the merino price in US dollar terms has replaced the Australian dollar series. Now the correlation between the series from 2005 really firms up. Interestingly the Info index peaked and started to weaken early in the 2008, 2011 and 2018 cycles, providing a small forward signal on the subsequent down cycles in the merino price.

So, how does the good correlation between German manufacturing and the merino price during the past 17 years help now? The July IFO report showed a deteriorating business climate index, with high energy prices and a gas shortage weighing on the economy (and the wider economies). The tide in economic activity is going out, so that points to weaker merino prices in US dollar terms at least. The Australian dollar should help absorb some of the effects of this downturn. A solution for the Russian invasion of Ukraine would help solve some of the energy problems but that does not appear likely in the short term.

What does it mean?

The IFO German manufacturing index is a good illustration of how greasy wool prices, in this case merino prices, are a function of international economic activity. When international economic activity weakens, as it doing so now, then as a rule merino prices will also weaken. This linkage is obscured by the floating Australian dollar, doing the very job it is designed to do. At this stage indicators point to weaker economic activity pulling merino prices lower through this season.

Have any questions or comments?

Key Points

- During the past 17 years fluctuations in the IFO German manufacturing business climate index have correlated nicely with the average merino price in US dollar terms.

- In Australian dollar terms the correlation has been weaker, with the floating Australian dollar helping to insulate wool price fluctuations seen in the US dollar price.

- The German manufacturing index is falling, with the key reasons for the fall still in place, so the tide looks likely to be a negative one for merino prices in coming quarters.

Click on figure to expand

Click on figure to expand

Data sources: AWEX, RBA, IFO Institute, ICS