This week will see the re-opening of the Bourke, NSW, goat processing facility now under the ownership of Thomas Foods International. The plant aims to process up to 3000 head of small stock a day by the end of the year, with this primarily being goats. TFI has said consistent good seasons, and a move to more ‘semi-managed’ goat operations, means the goat industry should be moving away from the undersupply then oversupply cycle it has seen in the past.

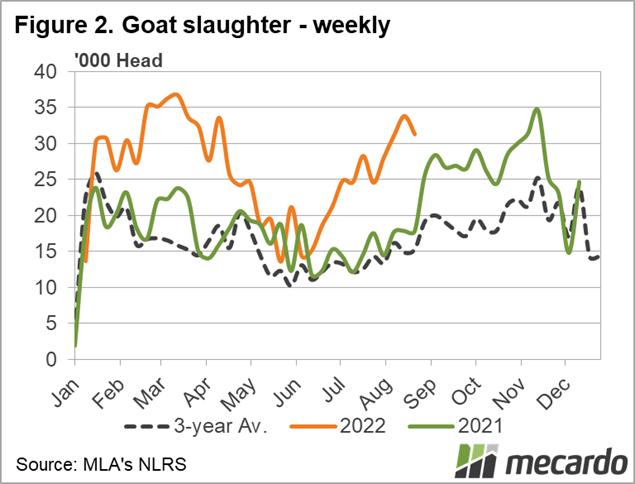

Goat slaughter has been on the rise over winter, averaging more than 32,000 head a week for the past five weeks. In comparison, the same weeks in 2021 averaged just above 21,000 head, while in 2020 it was about 12,500 head. Year-to-date goat slaughter is 32% higher than the previous year, which equates to about an extra 30,000 goats killed.

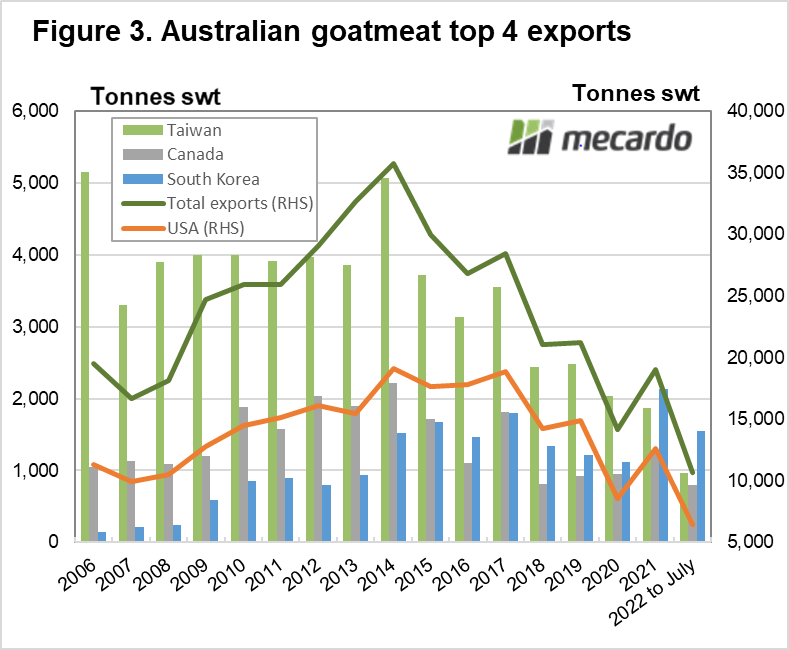

End of the financial year Australian Bureau of Statistics (ABS) data shows goat slaughter was up 52% 2021-22. In terms of goat meat production, it was up slightly less, due to lower carcass weights, but still rose 47% to 24,091 tonnes. Production was up with all states except Tasmania by at least 41%, with Western Australia’s production rising 3538% year-on-year. Goat export volumes were up 24% for 2021-22, with the US taking 64% of the market share, and South Korea increasing their import volumes of Australian goat by 51%.

Export volumes have also been on the rise this calendar year, with year-to-July goat exports up 31% year-on-year. The US remains the biggest market, having taken 7345 tonnes shipped weight for the first seven months of 2021, 28% more than the same period last year. South Korea, the second biggest goat meat market, has taken just 1843 tonnes for the year-to-July, however this is a 40% increase on last year. Total Australian goat meat exports of 12,146 tonnes for January to July are higher than the past two years, and about on par with 2019. To put this into a longer-term context, however, year-to-July volumes this year are still lower than any in the decade prior to 2019. (figure 3)

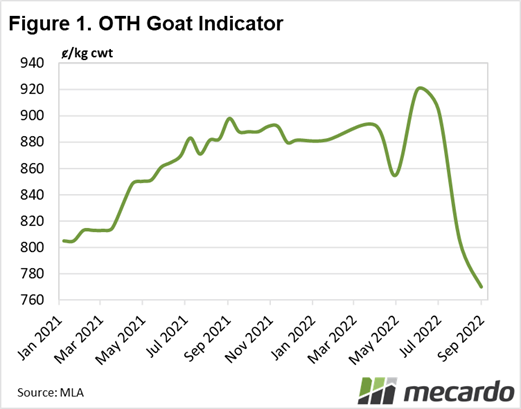

Price wise, the significant slaughter rise has seen it tumble since it peaked at the beginning of winter. The average over-the-hook goat price hit a new high at the start of June at 920¢/kg. This had fallen to 770¢/kg by the start of September, a price level not seen since mid-winter 2020. Historically, goat prices only broke through the 700¢/kg mark for the first time in May 2019, and the five-year-average for 12-16kg carcass goats is about 750¢/kg.

What does it mean?

Despite the significant drop-off in goat prices in the past two months, historically, returns for goats are still strong, trending above any rates pre-2019. Significant increases in slaughter volumes correspond with the current fall in returns, however rising exports indicate demand should generally be able to keep up with supply. More consistent supply out of Australia as new processing opens up and supply chain and labour issues are addressed could open up more market opportunities overseas.

Have any questions or comments?

Key Points

- Goat production on the rise as slaughter tracks 32% higher for the year-to-date

- Goat exports up year-on-year, but still tracking at third lowest level since at least 2010

- Over-the-hook goat prices peaked in June before rapidly falling to mid-2020 levels

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo