Lot-feeders are feeling the pinch of input costs just like the rest of the industry but have made the most of young cattle prices decreasing from their record highs. Feedlot capacity and the number of Cattle on feed both lifted in the December 2022 quarter and grain-fed slaughter hit a record high of 47% of Australia’s national cattle slaughter.

While the grain-fed sector hasn’t yet built back up to the record-high numbers of cattle on feed seen in the first quarter of last year, the consistency of numbers shows it wasn’t a flash in the pan.

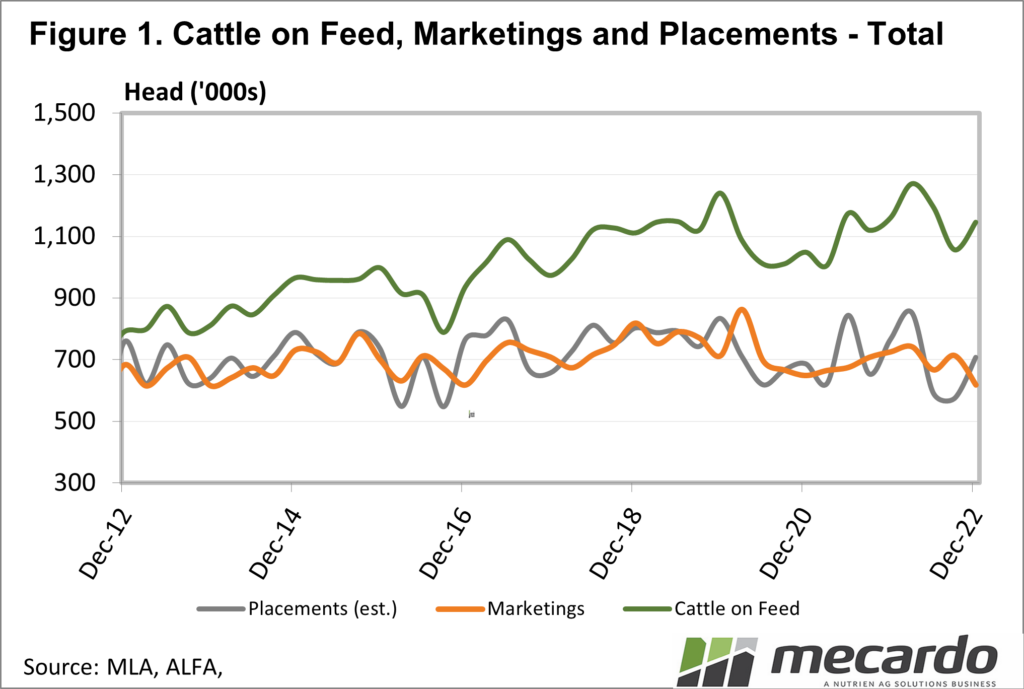

According to Meat and Livestock Australia and the Australian Lotfeeding Association’s latest survey data (collected from October-December 2022), cattle on feed numbers climbed 8.4% from the September quarter to 1.145 million head. This brought the figure back above the five-year average by 3.5%, however, this is still slightly lower (1.3%) year-on-year for the quarter.

Due to the record number of cattle on feed in the March quarter of 2022, total cattle on feed numbers for 2022 reached a new high of 4.66 million head, nearly 7% above the five-year average and more than 7% higher than 2021.

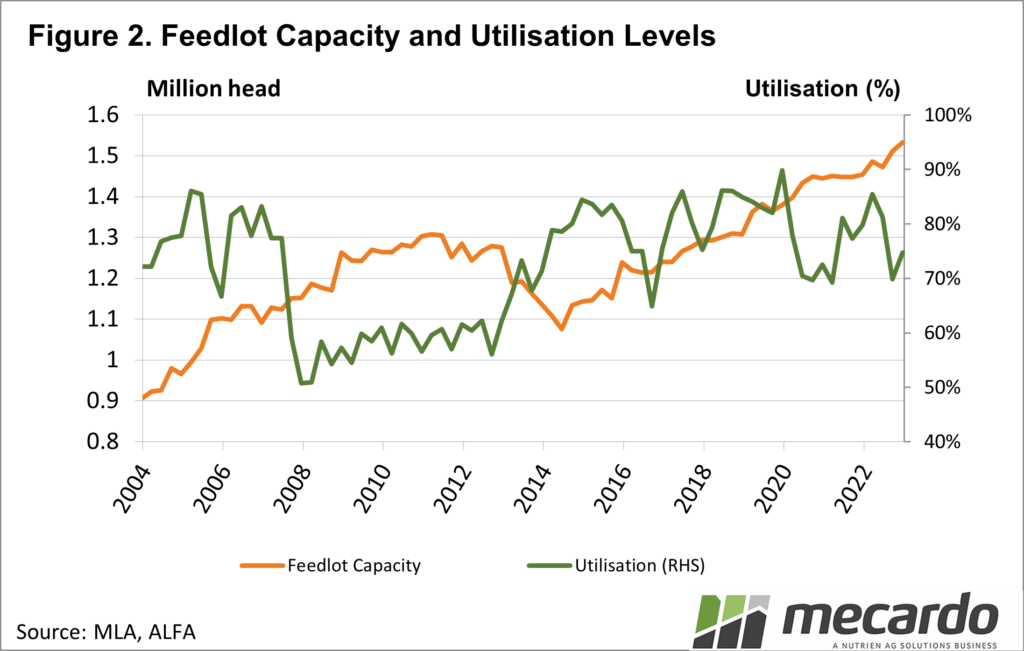

The other indicators we look at for the sector are capacity, utilisation, placements, and marketings. As we can see from figure 2, capacity has slowly been on the rise since 2014, and reached a new high of 1.532 million head in the December quarter. This was an increase of 1.5% on the previous quarter, with room for an extra 79,000 cattle made in 2022. Capacity has climbed by more than 100,000 head since the start of 2020.

Utilisation also rose from the previous quarter, up to 75% from 70%, but it has trended lower for the past two years of stronger young cattle prices, with 85% being the highest point it reached since the December 2019 quarter.

Marketings, (grain-fed turnoff), were down to their lowest volume since the December quarter in 2013, about 14% below both the December 2021 quarter, and the five-year average for the quarter. For the 2022 year, however, marketings were back just 3.5% on the previous year. In turn, placements were up 23% on the previous quarter, but still nearly 8% lower than the same quarter year-on-year. Additional supply of yearling feeder steers in the December quarter (up 40% on the September quarter) saw the price dip 5¢/kg, to 487¢/kg live weight. That was more than 10% lower than 12 months prior.

What does it mean?

Lot-feeding capacity clearly demonstrates that despite young cattle price pressure in recent years the long-term outlook for the sector continues to be positive. While lower turnoff in the December quarter was behind much of the utilisation increase, an increased supply of feeder cattle in 2023 should keep prices in check and move more cattle into feedlots. The big change that indicates increased prominence of lot-feeding in the industry is the slaughter percentage having reached a record despite good seasonal conditions, suggesting grain-fed cattle numbers will stay high not just in dry times.

Have any questions or comments?

Key Points

- Cattle on feed numbers lifted in the December quarter to 1.145 million head.

- National feedlot capacity reached a record high of 1.532 million head by the end of 2022.

- Grain-fed cattle made up 47% of national cattle slaughter last year, with space in the sector for this to increase further.

Click on figure to expand

Click on figure to expand

Data sources: MLA, ALFA, Mecardo