The opening numbers for sheep and lamb sales were particularly unimpressive for those holding stock over the Christmas/New Year break. The only highlight was heavy lambs, with everything else holding or easing. A closer look reveals that Victoria is dragging the chain in terms of price, so we take a look at how southern producers might best allocate feed this summer

Long-time readers will know that we don’t like to just measure the value of livestock off current price versus historical levels. We also like to look at how the price of a particular segment of the market is trading versus its substitutes.

You wouldn’t really call mutton or restocker lambs substitutable for trade lambs at the retail level, but at the farm level, they are. With feed quality diminishing in Victoria, many restocker lambs and cast-for-age sheep are being pushed onto the market, and they are both now at a stronger-than-normal discount to trade lambs.

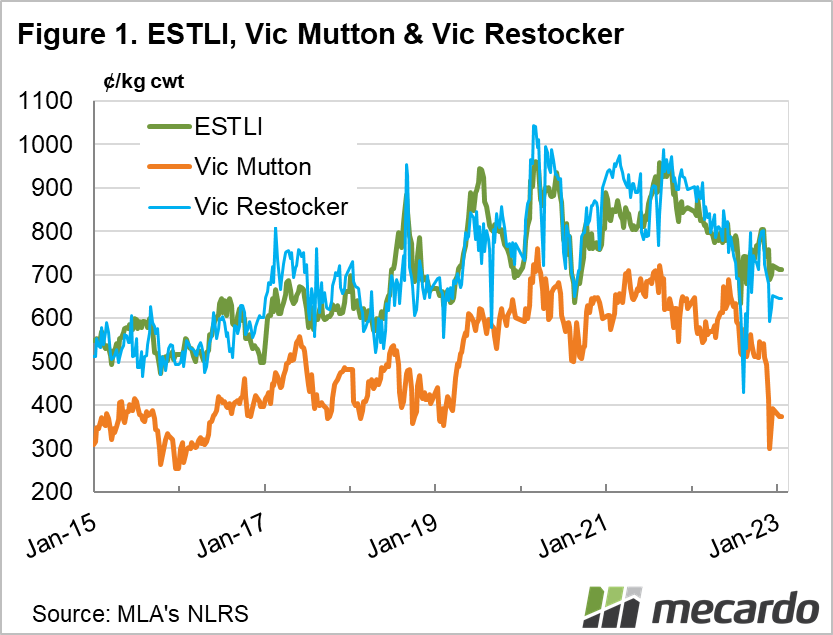

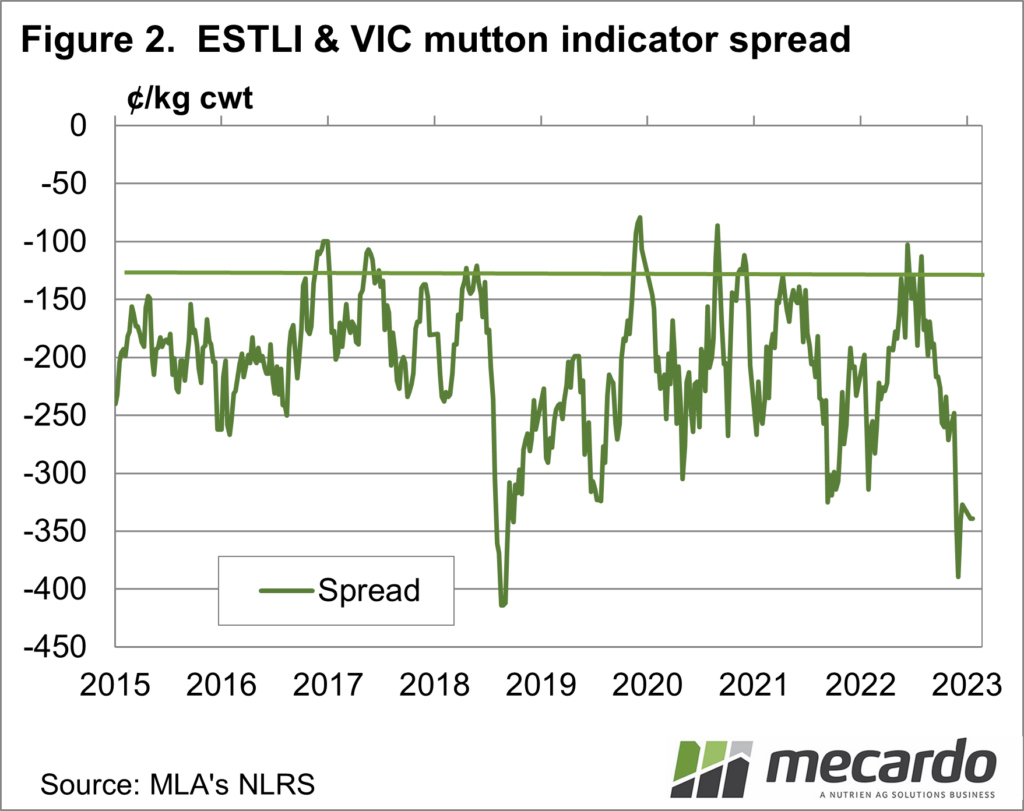

Figure 1 shows that any discount for restocker lambs is unusual, as they normally trade at a premium. For mutton the historical discount to the Eastern States Trade Lamb Indicator (ESTLI) ranges between 100 and 300c (figure 2), it’s now at 340c, suggesting mutton is cheap.

Given store lambs and mutton are relatively ‘cheap’ we’ll take a look at some trading options for those holding, or looking to buy one or the other.

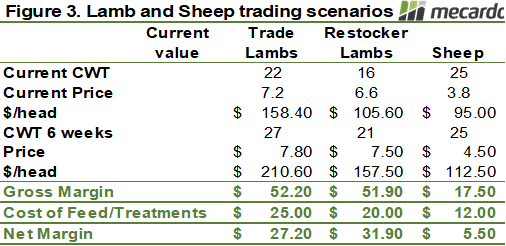

The ‘back of the envelope’ calculations in figure 3 shows why we are seeing an influx of sheep especially. Holding sheep for a potential price rise of 18% doesn’t really pay off very well if they have to be fed to be maintained. The fact absolute values are so low means that price rises don’t add significant value.

There is good money in holding or buying restocker lambs to grow out to trades if producers are set up for supplementary feeding, or have managed to get summer crops up for grazing. The money isn’t much better than holding trades to grow out to heavy lambs. If you add in the cost of shearing (which isn’t included here) things start to get a bit tight.

What does it mean?

Obviously, the numbers in figure 3 will vary widely across the east coast, and each producer will need to crunch their own numbers and include costs. But it does show why sheep are still flowing despite weak prices. We can put the heavy restocker numbers down to the record October and November rain delaying summer fodder crop sowing, and producers being stuck with unfinished lambs. Those set up to feed light lambs are best placed to ride out the current lower prices. This might be one of the years when the cost of setting up containment feeding is paid for by the margin in growing out lambs.

Have any questions or comments?

Key Points

- Victorian mutton and restocker lambs prices are cheap relative to trade lambs.

- Even with potential upside, there is little incentive to hold on to sheep.

- There is good margin in growing out trade or store lambs, if set up for it.

Click on figure to expand

Click on figure to expand

Trading scenarios are indicative only and should be used with your own inputs.

Data sources: MLA, Mecardo