Australian beef exports to South Korea for August 2022 have hit the highest monthly volume recorded since November 2016. Part of this is due to a relaxation of import tariffs, but price premiums for key cuts over our main competitor, the US, have also been shown encouraging trends which predate this period, and may be related to seasonal quality improvements.

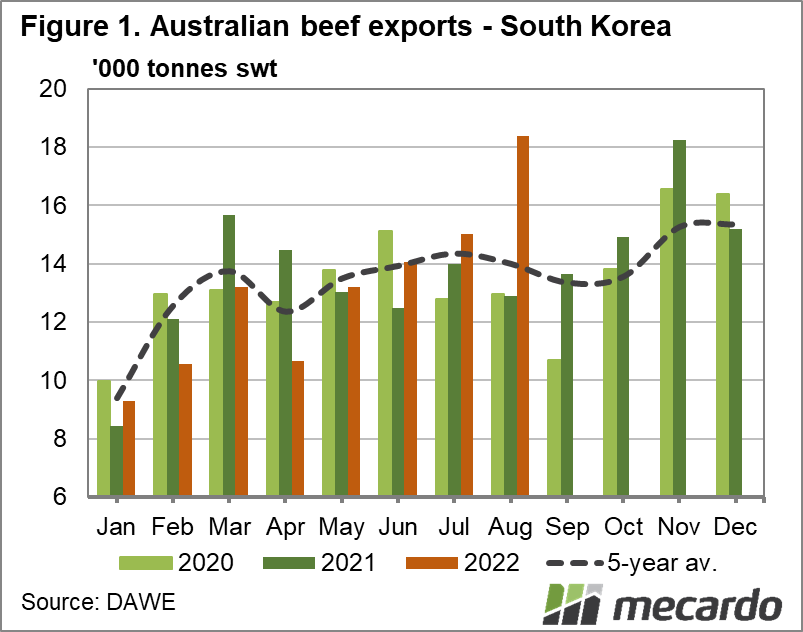

South Korea’s appetite for Aussie beef seems to be insatiable, and on the uptrend. The latest beef export figures released by DAWE for last month indicate that volumes in August 2022 are up 3,356 tonnes , or 22% from July’s figure, to 18,368 tonnes, which is a massive 31% above the 5 year average. (figure 1) Historically speaking, this is the second largest monthly volume of beef exports to south Korea ever recorded in the last decade, with only November 2016 coming in bigger.

With export volumes to South Korea rising rapidly, as an export destination now reaching 18.5% of Australia’s total year to date volumes, South Korea has already toppled the US and China from their positions in the export rankings to officially hold the Number 2 ranking, behind Japan.

A major driver for the increased export volumes seen in August is the South Korea’s move to combat food price inflation through the suspension of import tariffs for 100,000 tonnes of beef from July 2022 till the end of the year. While this has brought down the steep 40% tariff on South American beef temporarily, in relative terms, Australia has gained a bigger advantage compared to the US. The tariff on Aussie beef was 16%, while the US only copped 10.6%, meaning that Australian beef has become relatively cheaper, in addition to the impact of falling finished cattle prices in recent times.

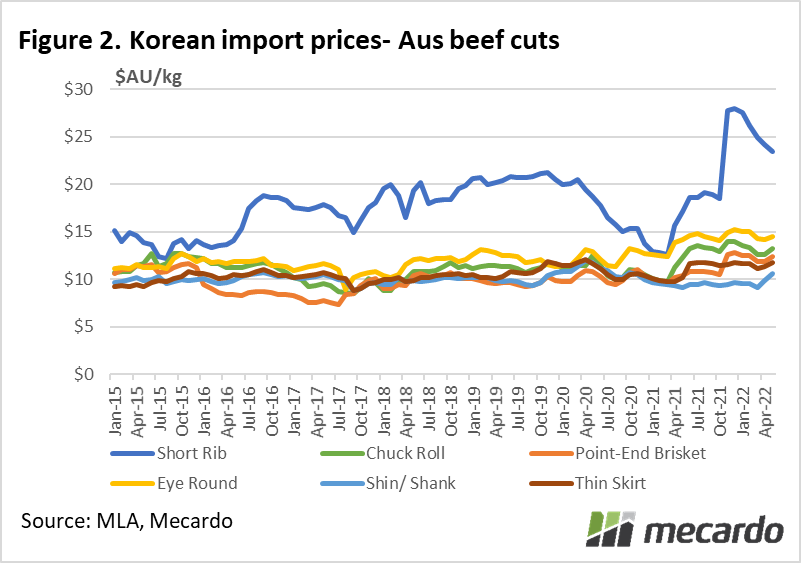

If we dig a little deeper into the breakdown of South Korean beef import pricing information that is available, (which is current up to May 2022) we can examine what cuts the Koreans are paying up for. The standout feature of figure 2 is that we can see that import prices in South Korea for Australian short ribs have skyrocketed by $11/kg, or 86% since March 2021.

While the price of Australian shin/shank meat has remained relatively steady until very recently, and eye round cuts have always commanded premium prices, all other cuts have stepped up in price substantially over time. Chuck roll prices in particular have seen the largest increase since April 2021, of 35%, followed by point end briskets.

The US is the main competitor to Australia in the South Korean marketplace, representing 53% of imports in 2021, and the cattle industry there has been undergoing a major drought fuelled herd liquidation phase for some time.

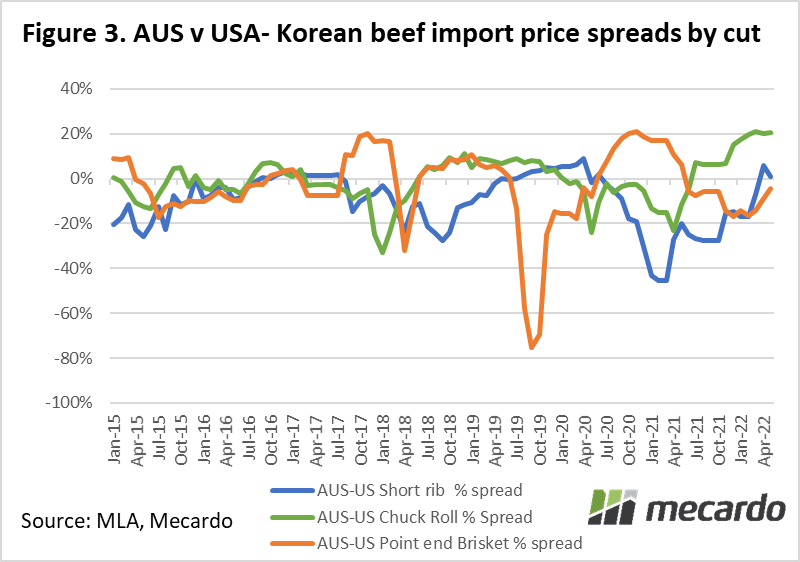

Examining the spread between the Korean import prices for selected cut of Australian and US beef provides some guidance about our competitive positioning. The latest available data indicates that Australia commands a massive 20% price premium for chuck roll cuts over the USA, while Australian short rib prices were historically highly price competitive compared to the US offering, with Australian product trading at up to a 25% discount to the US recently. (figure 3) This turned around in March this year when prices snapped back to a level of parity, to a modest premium to US product. Australian brisket prices have also shown an upward trend, with the former 15% discount to US pricing rapidly shrinking.

South Korean consumers tend to prefer a fattier, grainfed product compared to cheaper, leaner grass-fed South American beef. It is possible that drought related negative changes in the intake condition of US cattle into feedlots may be impacting the quality, and therefore demand for US product in recent times. In contrast, Aussie grassfed cattle comprise over 60% of exports to Korea, and these have probably never been fatter & happier, and therefore more in line with Korean tastes on account of our solid run of exceptional pastoral conditions.

What does it mean?

The temporary suspension of South Korean beef import tariffs, combined with lower Australian cattle prices, appears to have stimulated Korean demand for Australian beef. The increase in price premiums for Australian product is also showing that South Koreans are increasingly willing to pay more for Australian product over that of the USA, and this could be related to perceived quality improvements related to fattier, heavier grass-fed cattle. The issue is that this heightened demand could dry up rapidly once Korean tariffs, and exceptional Aussie pastoral conditions snap back to normal.

Have any questions or comments?

Key Points

- Beef exports to South Korea at near record monthly levels

- Australian beef is rapidly commanding steep premiums to US product.

- South Korea suspending tariffs on beef imports improved Australia’s competitiveness.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, DAWE, Mecardo