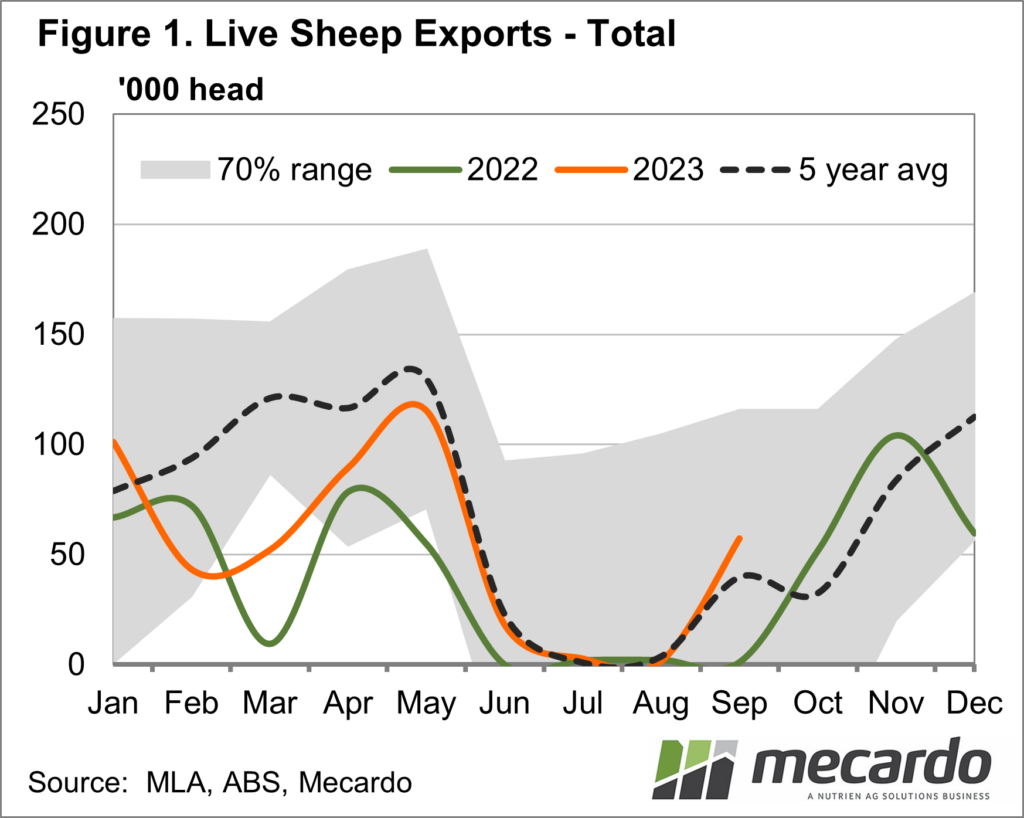

The live sheep export industry is still showing resilience against its impending federal government ban, continuing to trade above year-ago levels. In September, more than 57,000 head were exported, up from less than 2000 in the same month last year.

While calendar year totals so far are still well below pre-COVID levels, there doesn’t seem to be much indication exporters – and those that supply them – are moving away from the industry just yet. In fact, Sheep Central reported just yesterday that the first live sheep export approval to send stock to Saudi Arabia since 2012 has been granted to an Australian exporter.

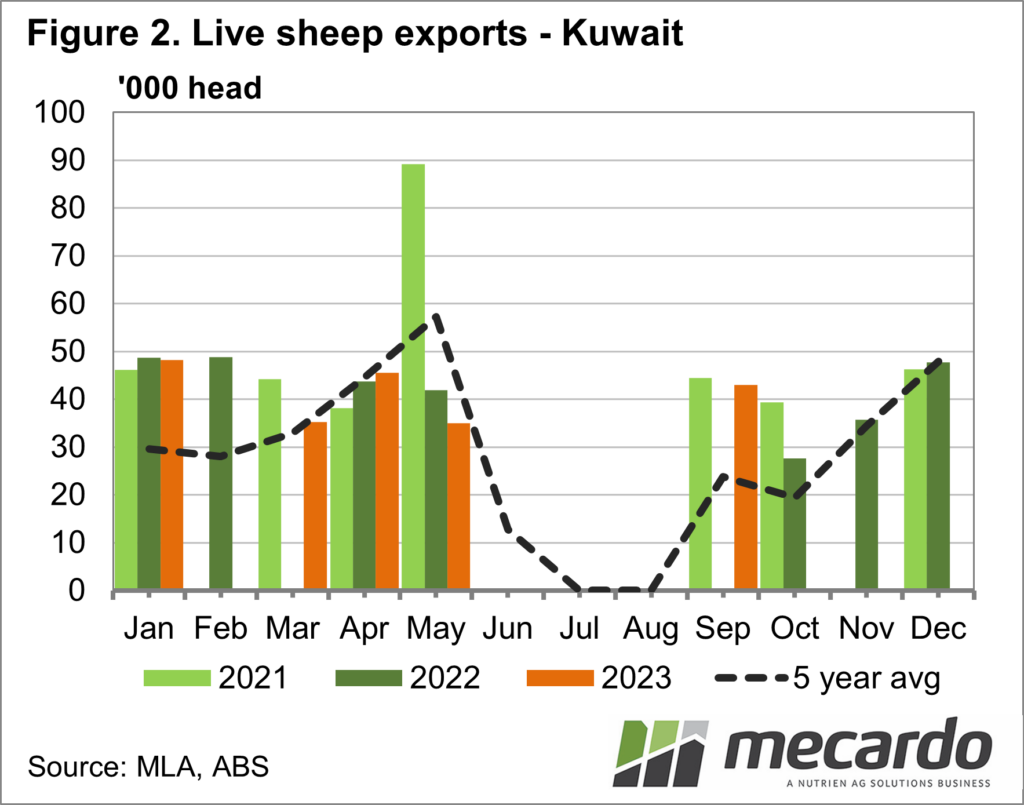

Looking at the latest monthly data, September live sheep exports were above the five-year average by more than 17,000 head. However, that average figure was skewed by the very low number sent in September 2022, and this September was very much in line with the figures from the three years prior to that. For further context, we must look further back, however, and compare the 57,311 head sent last month with the five-year average for the month from 2013-2017, which was 167,600 head. Kuwait took three-quarters of the Australian live sheep exported in September, with smaller loads going to Malaysia, Jordan, and the UAE.

For the year-to-date, Kuwait remains the largest market for Australian live sheep, lifting its share to 43%, and taking 13% more sheep than the same period last year. With total live sheep exports up 40% for the January to September period year-on-year, most markets have obviously lifted their intake, with Israel up a significant 139%, and increasing market share to 19%. With more than 91,000 head imported by Israel so far in 2023, this is the highest number headed to this country in the past 10 years. However unfortunately there could be serious disruptions to this market for the foreseeable future. Jordan, Oman, and the UAE, which make up the next three largest markets, are all also operating at much higher levels than in 2022, while trade to Qatar remains non-existent.

Australia’s live sheep export totals are essentially all Western Australian sheep as we know, with 97% of all stock coming out of the Fremantle port this year, so it gives us a clear indication of how much of that production system is reliant on the trade. Their flock has grown along with the rest of the country, and while Eastern States transfers were up 72% year-on-year for the 2022-2023 financial year period (but still a fraction of the volume that was getting sent during the post-drought restocking period of 2020-2021) what is interesting is the breakdown of that stock. Just 27% of the sheep headed interstate for 2022-23 were adults, with the remainder lambs picked up by processors from the east with more capacity and higher prices for producers.

What does it mean?

Live sheep exports have not regained pre-covid momentum, despite the significant growth to the flock, but with domestic demand so substantially diminished, especially in that west-to-east trade of adult sheep, the 480,000 head live exported so far this year has no doubt played an important role in the current supply and demand equation in sheep.

It would also be promising to producers that both the exporters and the export markets haven’t quit the trade just yet. With supply and price what it is, the uptick in live sheep export should continue through to the end of the year.

Have any questions or comments?

Key Points

- Live sheep exports are off to a strong start for spring, with more than 57,000 head sent offshore for September.

- Total live sheep exports for January to September 2023 are up 40% year-on-year but remain 21% below the five-year average for the period.

- Major market Kuwait has increased its market share to 43% for the year-to-date, with Israel the next largest market at 19%.

Click on figure to expand

Click on figure to expand

Data sources: MLA, WA DPIRD, DAWE, Mecardo