In an article last week Mecardo looked at the increasing supply of long staple merino wool, as a function of circumstances this season (and last season). This week we take a look at the price effect of long staple length in merino wool.

As the article last week showed there is a natural range of staple length in the merino clip, which the supply chain uses in a range of processes. At some point staple length increases to a point where the wool is recycled back into the knitwear (short staple) sector because the wool staple breaks during processing or it is deliberately cut. In this market that is reported to be happening certainly to 120 mm and longer merino fleece. As such the value per kg of the wool, all else being equal, is less than for wool which will be used in standard worsted system.

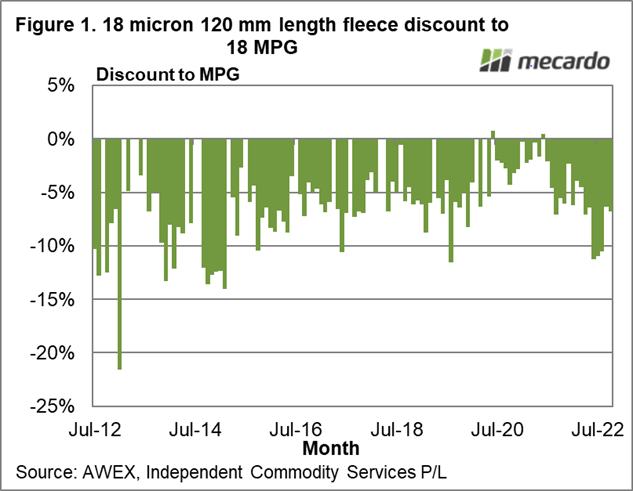

Figure 1 compares a price series for 18 micron 116-125 mm (120) length merino fleece to the 18 MPG monthly for the past decade. The median discount has been 7%, and if we assume the very extremes are a function of mismatched timing (within the monthly average sales data), the discounts has ranged from around a small 3.5 to a large 17%. The current discount is at the median levels, so there is room for it to widen in the coming months as supply increases.

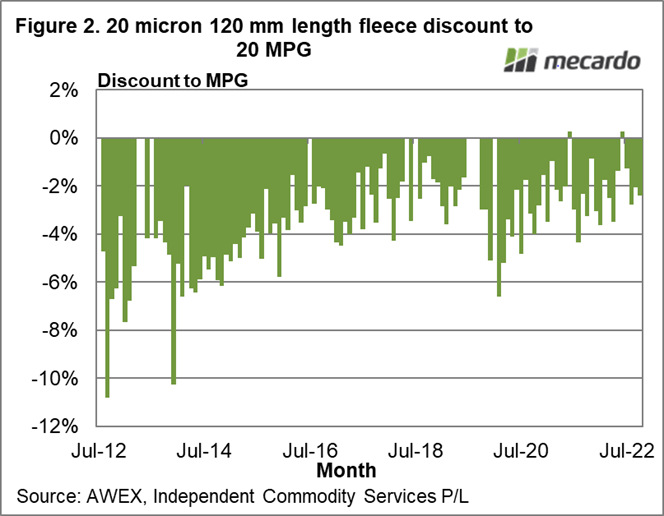

Figure 2 repeats the exercise on the broader side of the merino micron distribution, for 20 micron. The median discount is smaller (3%) with the range from near parity to a discount of 6-8%. This shows the discount for 120 mm length wool is not punitive for 19 micron and broader merino wool.

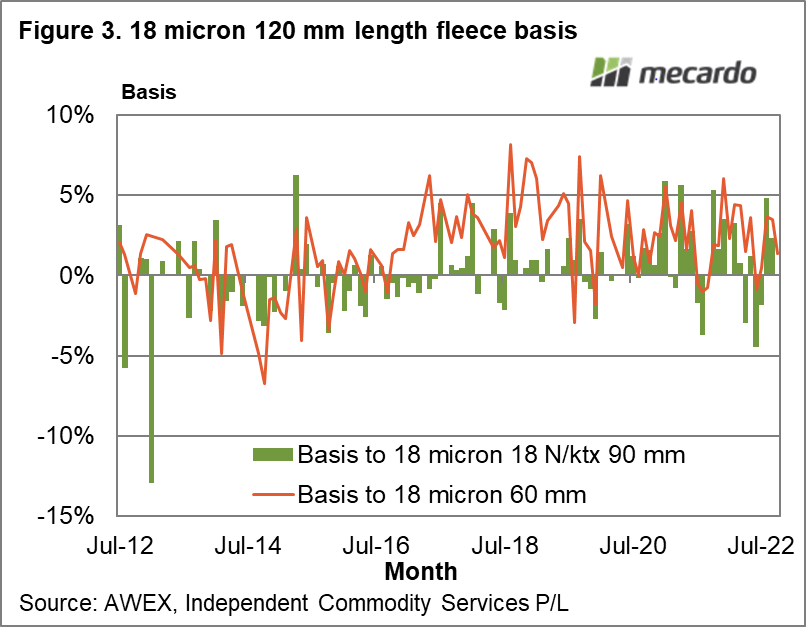

If the over length wool goes into knitwear, then it should have similar prices to short staple wool and very low strength fleece. Figure 3 compares the 18 micron 120 mm length price series to an 18 micron 60 mm length price series (actually 58-63 mm length) and to an 18 micron low staple strength (21 N/ktx and less) 90 mm length series. The 120 mm length series lines up with the low strength series (median difference in price is zero) better than the 60 mm series (the 120 mm length series has a median premium of 2%).

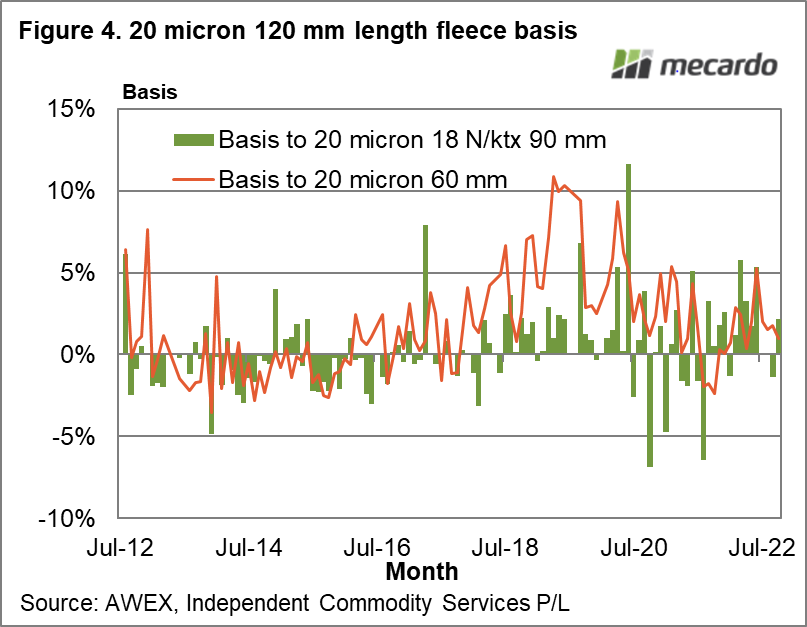

In Figure 4 the exercise carried out in Figure 3 is repeated for 20 micron wool. Again, the low staple strength series has a better correlation with the 120 mm series. In 2018-2019 the 120 mm basis to the short 60 mm series lifted to relatively high levels, before coming falling back in 2021.

What does it mean?

The supply of long merino wool at present is happening mainly in the average to broader merino micron categories, where discounts tend to be mild. In the finer micron categories, discounts for 120 mm wool are larger and can widen to substantial levels. If you are stuck when valuing such wool, prices for very low staple strength wool in the same micron category can help as a guide

Have any questions or comments?

Key Points

- Discounts for long staple wool (120 mm in this instance) are on average not very large.

- For the broader merino categories, the wider levels of discounts are still mild.

- For the finer merino categories, discounts have widened to sizeable levels during the past decade.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: AWEX, ICS Mecardo