It is three years since Mecardo looked at the mohair market, which at the time had been following similar trends and cycles (albeit is very different price levels) to the crossbred market in Australia. This article has a look at how that correlation has fared.

In the previous article we used mohair top prices from WTiN. In this article we use closely correlated but earlier stage prices from Mohair South Africa which publishes a market report for the 14 or so mohair auctions held each year in South Africa.

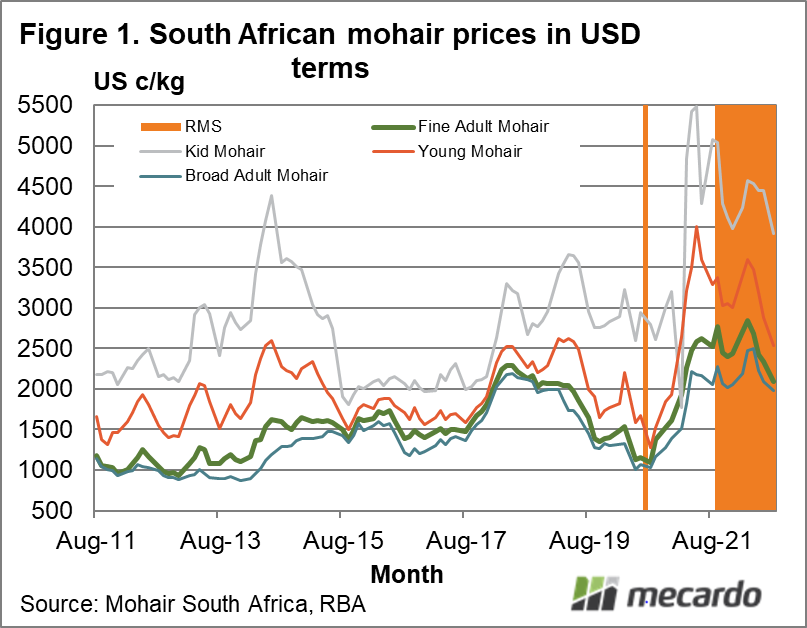

Figure 1 shows the Mohair South Africa quotes for four grades in US dollar terms from 2011 onwards. In addition the shaded area shows where the market reports indicated the publication of RMS (Responsible Mohair Standard) in mid-2020 and where the auction volumes accredited to the standard were reported ranging between 60% and 76%, which is an even faster take up than by the South African merino producers.

The publication of the Responsible Mohair Standard corresponded with the pandemic low in the mohair market. Mohair prices enjoyed the strong bounce out of the pandemic lows, as did many markets including merino but excluding crossbred, with prices rising well above 2011 and 2018 highs. Prices peaked in mid-2021, again like many markets, and then trended lower. The difference to the merino market is that while prices trended lower, they still remain at the levels of 2018.

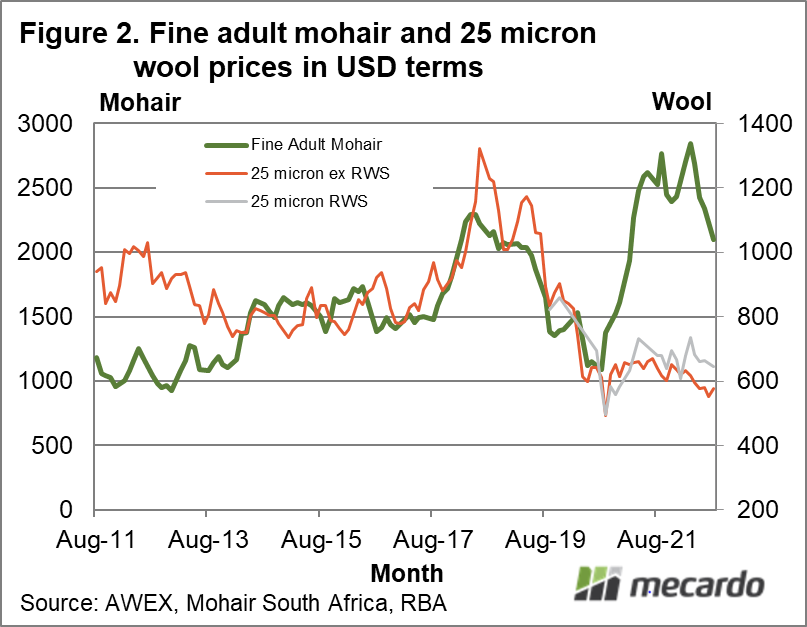

Figure 2 compares the price for fine adult mohair (left hand scale) and an average price for 25 micron wool (all in) split into non-RWS and RWS (right hand scale) in US dollar terms from 2011 to this month. While the two series had a good correlation from 2013 through 2019, the lack of recovery from pandemic lows by the crossbred categories has broken the correlation completely. Even a premium for RWS accreditation in the 25 micron category hardly makes any difference to the divergent trends between the two series.

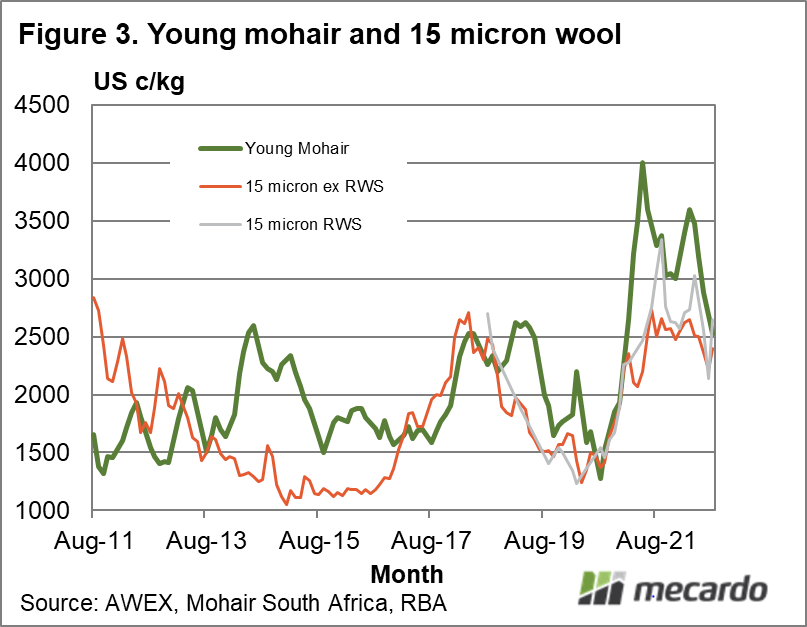

In Figure 3 we switch out of crossbred wool to 15 micron (combing fleece averages) to compare with the South African young mohair series, all in US cents per kg terms. The 15 micron wool series is split into non-RWS and RWS lots. Since 2017 the mohair and wool series have followed similar cycles and trends, with the RWS 15 micron price series exceeded its 2018 highs in 2021 although not as enthusiastically as mohair did. The other point about Figure 3 is that the mohair and wool price series are on a common scale.

In summary mohair prices have followed a similar price pattern to the luxury end of the merino market during the past five years, with a strong adoption of the RMS helping their market as is often mentioned in the South African mohair market reports.

What does it mean?

Mohair is one of the stable of “noble” or luxury fibres, so its comparable performance to 15 micron prices in recent years makes sense. The correlations between mohair and wool (of different categories) prices have varied with time, and presumably will continue to do so in the future. The adoption of RMS by the majority of South African mohair sold at auction seems likely to be advantageous as it will encourage planning by the supply chain to use this fibre.

Have any questions or comments?

Key Points

- The mohair market in South Africa has enjoyed extremely strong prices during the past couple of years.

- Some 60%-76% of mohair sold at auction is reported to be accredited to the RMS, which is a fast take up as the RMS was only published in mid-2020.

- In terms of similarity with wool prices, we have to go to the very fine end of the merino market to find comparable price movements to mohair during recent years.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: AWEX, Mohair South Africa, WTiN, RBA