Back in December mutton prices tanked to their lowest levels since 2016. Increased supply was largely to blame for the mutton decline, but we’ve seen some recovery in recent weeks. Here we look at whether the upward trend is set to continue, and whether it’s pointing towards better lamb prices.

It was somewhat of a shock for sheep producers to find themselves selling sheep at a value cheaper than during the most recent drought. The heavy supply which hit the market seems to be a hangover from the flock rebuild, which saw record prices for much of 2020-22, and it certainly gave those selling sheep a financial headache.

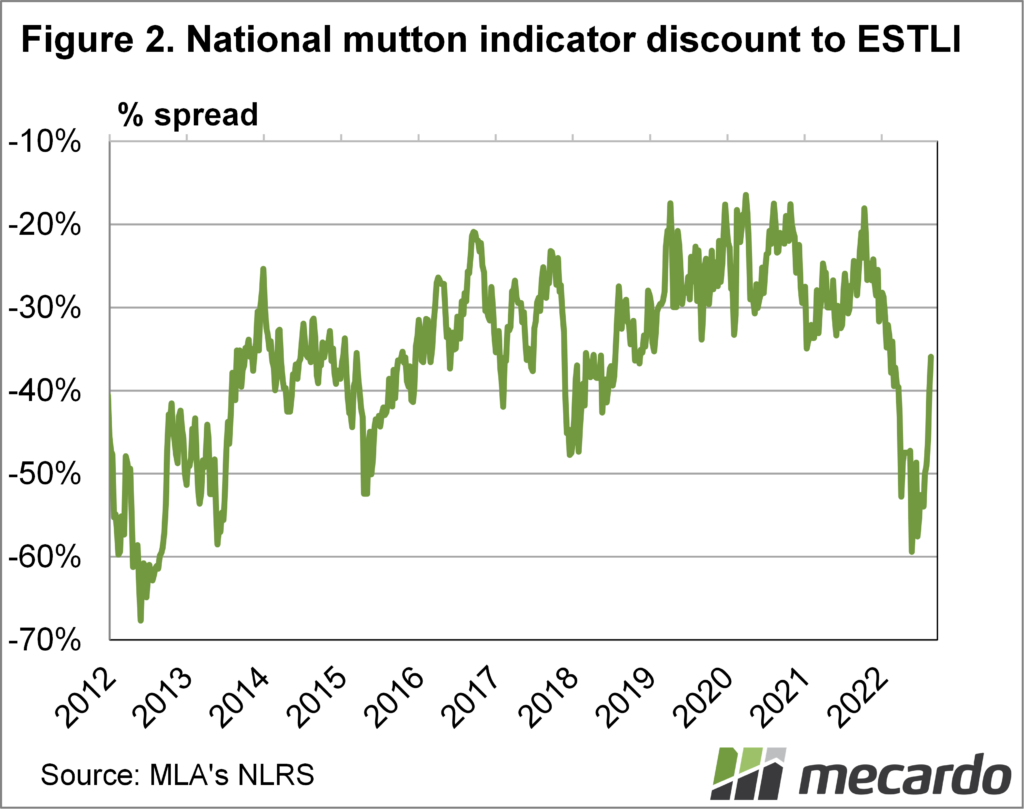

The price of sheep relative to the export value of mutton, and the trade lamb price indicated that we were in for a rebound at some stage. Interestingly, the price recovery has come during a spate of short slaughter weeks, but it might also have something to do with an early autumn break in the south.

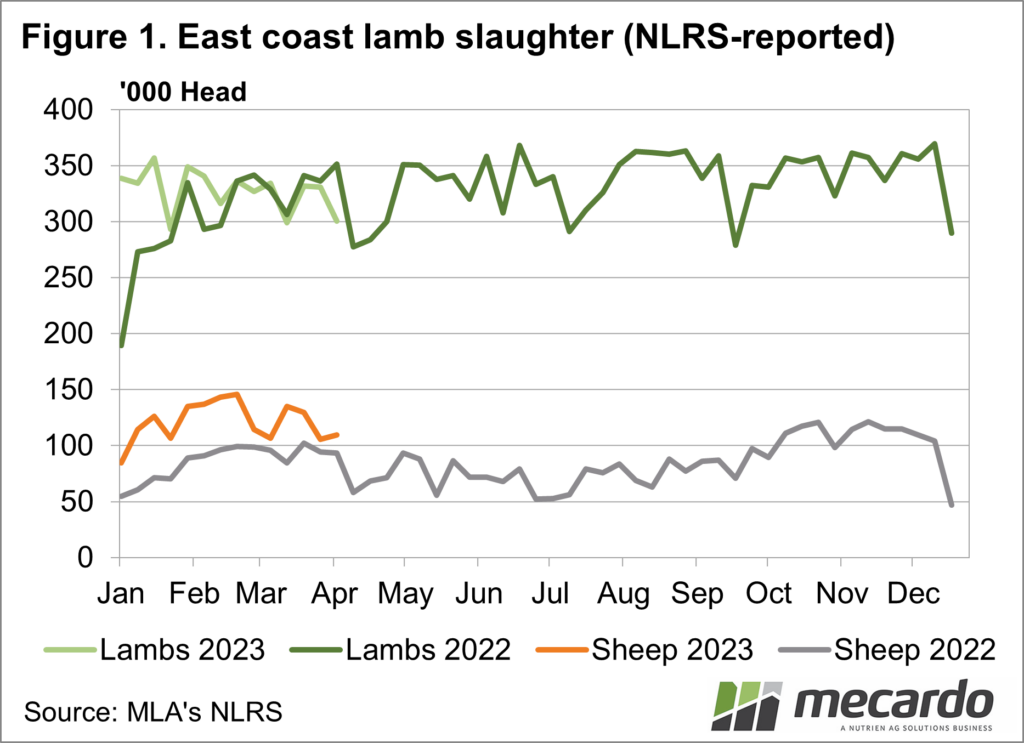

Figure 1 shows east coast sheep and lamb weekly slaughter data. We can see that sheep slaughter has been running 41% higher than last year during summer and autumn to date. Meanwhile, lamb slaughter has been similar to last year from March onwards.

There is still a limit on processor space due to labour shortages in the aftermath of COVID. With plenty of sheep, processors could decrease prices and still buy sheep. Additionally, the heat has come out of the restocking market, with older sheep no longer sought after for breeding, they become available to processors.

Figure 2 shows the National Mutton Indicator (NMI) response to the heavy supply and weaker restocker demand, by moving to its largest discount to the Eastern States Trade Lamb Indicator (ESTLI) since 2013. The recent bounce in mutton prices has sent the discount back into what has traditionally been a more normal range.

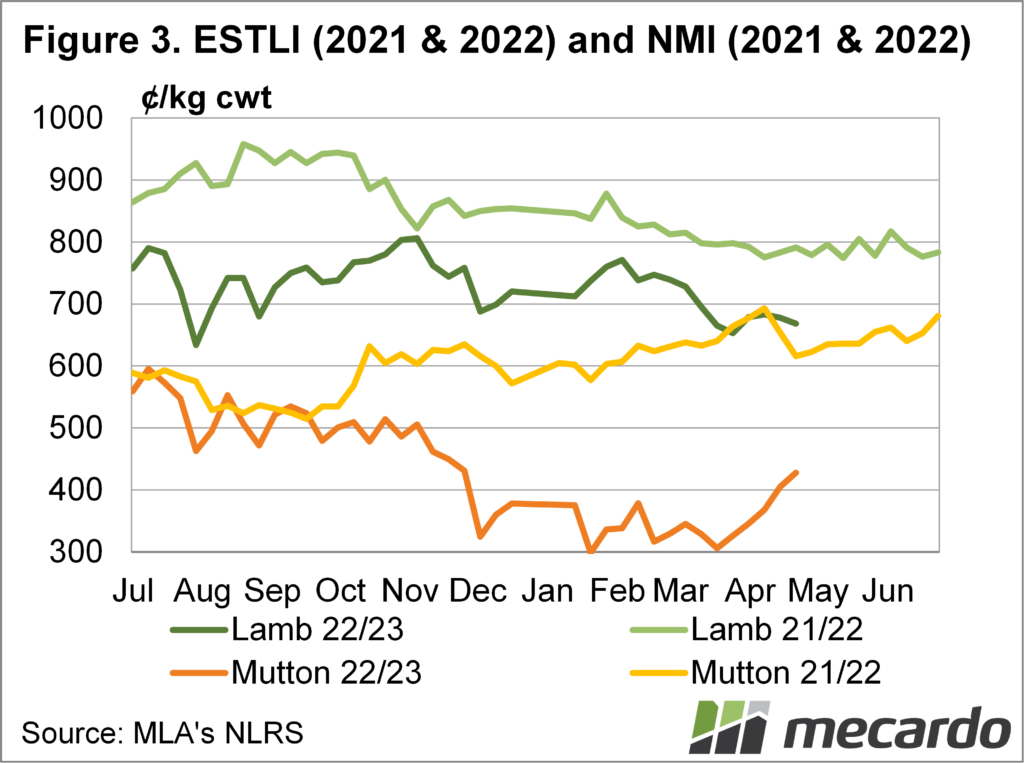

Figure 3 shows that despite the recent jump, the NMI is still well below this time last year. With the lack of restocker demand, we don’t expect mutton prices to get to last year’s level, especially while lamb is priced around that level.

What does it mean?

The rally in mutton prices is positive, but it is likely to pull up unless supply tightens further, or lamb has a rally. Supplies of lamb are yet to slow, but there is hope that things might pick up when we are past the short weeks.

The good news is that the improvement in mutton prices should provide support for sheep values as we move towards winter, and the sheep supply flush should be over until we hit the spring.

Have any questions or comments?

Key Points

- Mutton prices have rallied strongly in recent weeks, but are still well below last year.

- The mutton discount to lamb is back in a more normal range, after being very cheap.

- Further mutton upside is likely dependent on lamb prices improving.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo