Most sheep and wool operations focus on lamb and wool prices, as their main source of income typically comes from these areas. Over the last few years, strong sheep prices have added a bit of cream to profits, but this has abruptly ended in 2023. Here we look a bit deeper into mutton markets.

The only mutton consumed in Australia is via some meat pies, with over 98% of mutton produced sold into export markets. As such it is in export markets where we look to find some information as to how demand is performing.

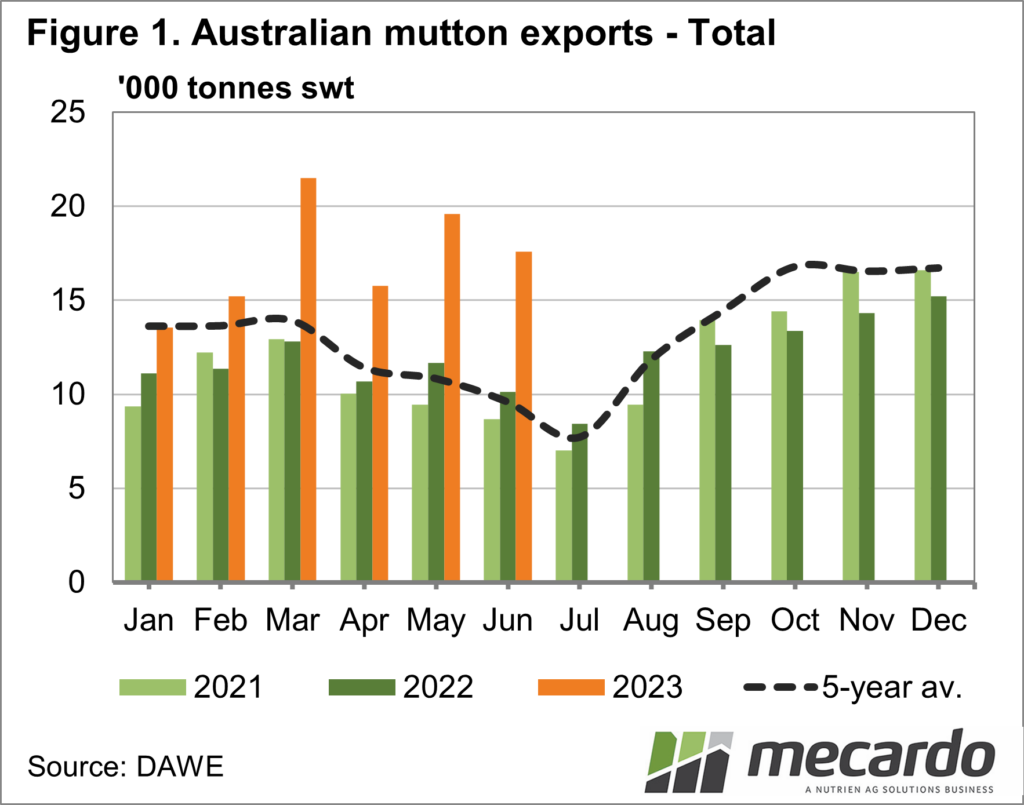

Australian mutton has historically been a cheap source of protein for Asian and Middle Eastern markets. Figure 1 shows exports have been booming in 2023, at least relative to the last five years. Strong supply and cheaper prices have seen year-to-June mutton exports increase by 52%.

China has seen the strongest growth with mutton exports up 95% for the year to June, with the Middle East up 60%. It seems there is an appetite for our mutton, but it needs to be priced right.

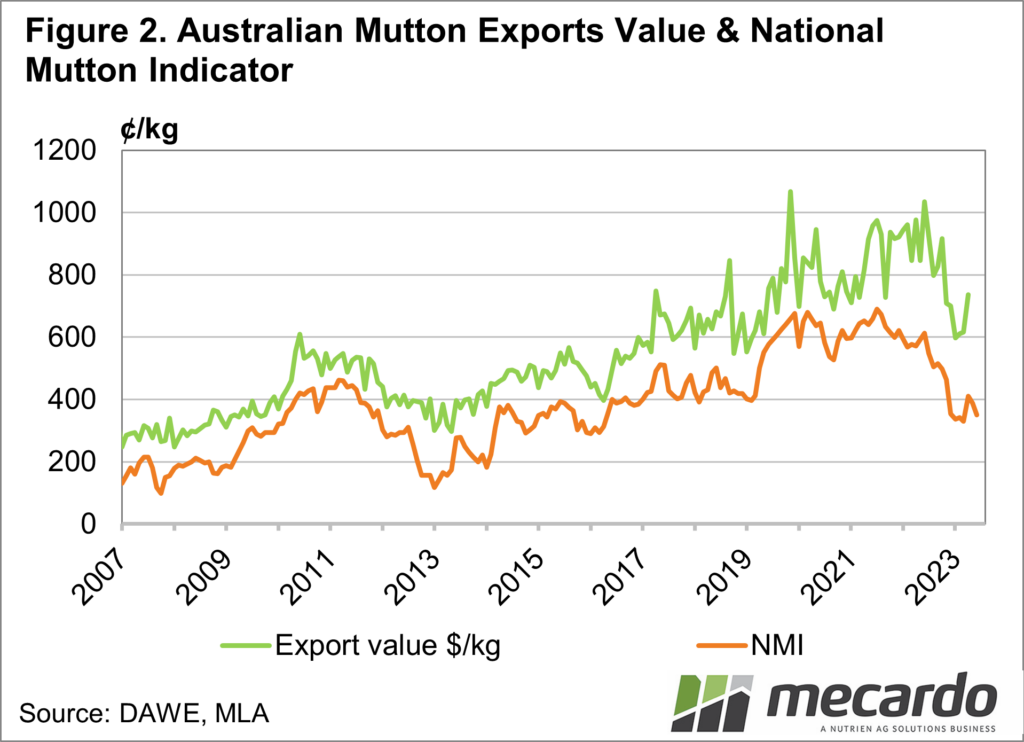

Figure 2 shows the average monthly National Mutton Indicator (NMI) and the average mutton export price. The mutton export price is calculated by dividing the total export value for the month by the total export volumes. The latest export value data available is for April.

We can see that export values have declined markedly in 2023. Falling export values are likely a function of increased supply and cheaper sheep prices. Exporters needing to move more mutton can drop the price and still make a margin.

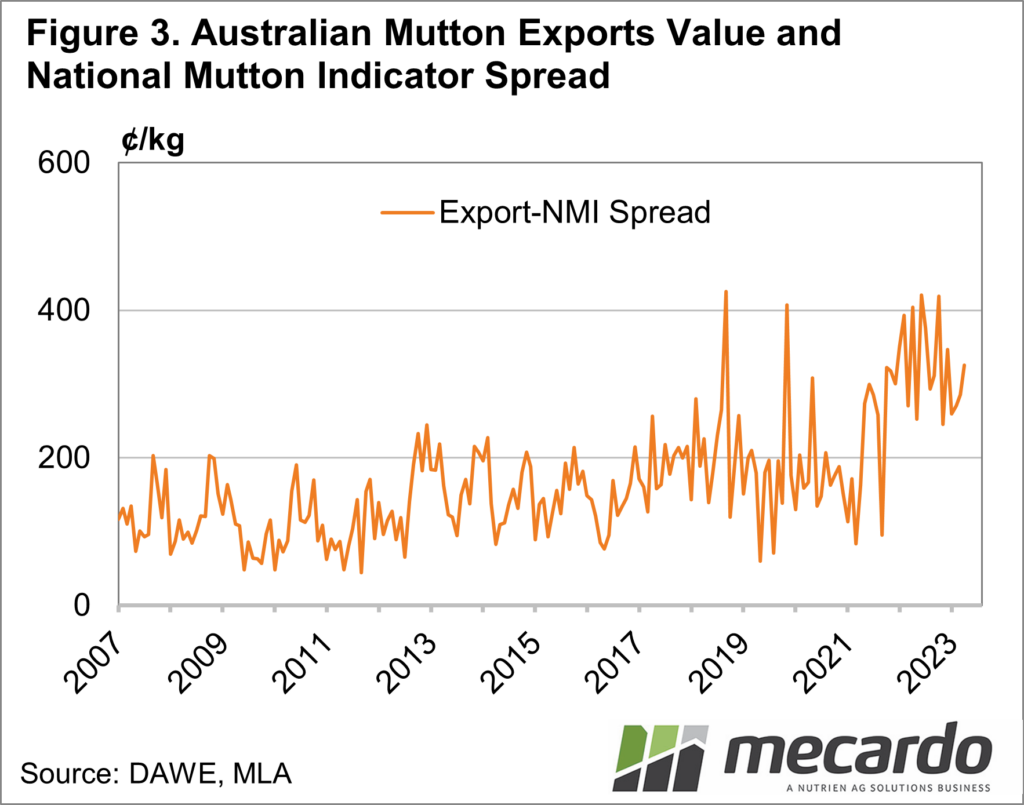

Figure 3 shows the spread between the export value and the NMI. While the spread does bounce around a lot, we can see it is now at a new higher level. A larger spread is likely due to increased costs in the processing sector, rather than hugely increased profits. Interestingly, the spread early in 2023 was similar to that seen in 2022 despite the lower livestock prices.

What does it mean?

Potential increases in sheep prices are going to be a slow burn. Demand increases could flow through from tightening world beef stocks, but supply is also growing. Meat and Livestock Australia (MLA) are forecasting further increases in sheep slaughter numbers out to 2025. There will be little support for mutton values on the supply side.

Have any questions or comments?

Key Points

- Mutton exports have increased sharply in 2023.

- Mutton export values have fallen in line with lower saleyard prices.

- With increased supply upside in mutton prices requires stronger export demand.

Click on figure to expand

Click on figure to expand

Data sources: MLA, ABS, Mecardo