There have been rumours swirling of forward contracts for lamb in the range of 650¢/kg being offered up for the new year. While I haven’t set eyes on these supposed contracts, it has prompted plenty of chat about what the lamb market might have in store for the next couple of months.

At 650¢/kg, producers could be feeling much more positive about the sheep market. But that’s a long way from where we are right now. What we have seen is a grid for 560¢/kg for crossbred lambs, 26-34kg. Which is better aligned with what the historical data tells us.

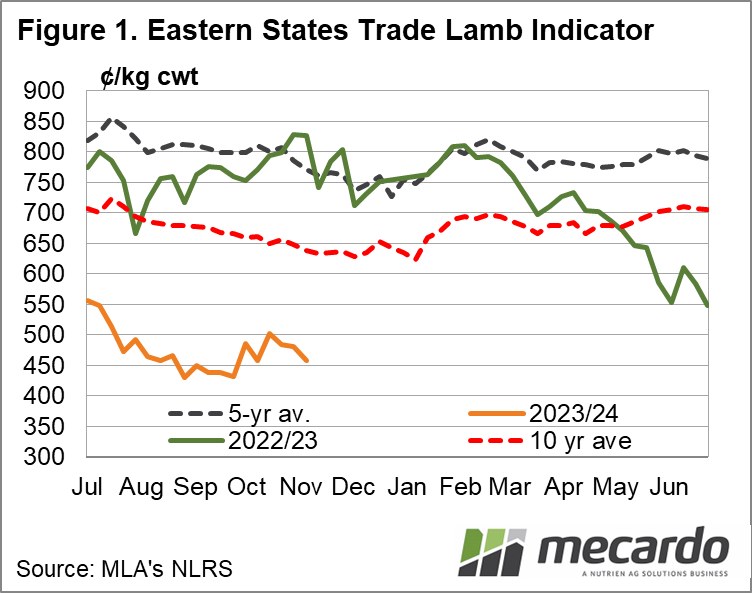

The Eastern States Trade Lamb Indicator averaged 482¢/kg last week. Which is 288¢/kg lower year-on-year, and historically the lowest price for that corresponding week since 2014. It’s 35% below the five-year average, and 20% less than the 10-year price too. Despite forecasts of the increased flock numbers and the El Nino putting downward pressure on the sheep and lamb market, very few would have budgeted for quite the decline in prices experienced since July.

That includes industry pundits. Meat and Livestock Australia’s sheep industry projections, last released in July, used input from six different industry analysts and forecast the National Trade Lamb Indicator would be at 553¢/kg by September, and 537¢/kg come the end of the year. In actuality, the NTLI was at 431¢/kg at the end of September, and yesterday sat at 459¢/kg. $30/head difference for a 24kg lamb.

Looking ahead, if we use the 10-year-average of the ESTLI, the price increase between now and the first weeks of both January and February is 34¢/kg, which would bring the ESTLI to 516¢/kg come the new year. Better than the 430¢/kg we started this spring at, but a far cry from 650¢/kg. Current prices are more aligned with the five years prior to 2015 when the ESTLI was averaging 428¢/kg. The average for the first week of February for that period is 499¢/kg, about 70¢/kg higher. That would bring the ESTLI to 553¢/kg; pretty close to that 560¢/kg grid that is on the table for January/February.

What does it mean?

Producers, especially those that haven’t received any October or early November rain, indicate they are weighing up every option. Not just for the lambs they haven’t yet offloaded, but whether to put rams out for next year’s drop. Many are probably wondering where the line between optimism and realism falls in terms of expectations. History, and processors, are telling us the price will be on the up come 2024 as usual, but this will likely still be well below five and 10-year averages.

Have any questions or comments?

Key Points

- The Eastern States Trade Lamb Indicator is 35% below the five-year average for the week, but still operating at 2015 and prior levels.

- Downward pressure from record slaughter and a lack of rainfall have pushed prices much lower than predicted mid-year.

- An increase in returns early in the new year is still looking likely, but pricing will still be well below recent historical averages.

Click on figure to expand

Data sources: MLA, Mecardo