Predicting what the cattle market has in store for 2024 is a much more positive experience than it would have been a month ago. But that said, it might be now even tougher to predict how the market will progress in the new year, with the downward spiral that has been cattle prices reverting to an upward spike in the past month.

What a difference a

rainfall event can make. Producers are now finding themselves with more options

than they previously thought, with a significant jump in yardings last week

showing some are keen to get in on a rising market. Similarly, there are anecdotal

reports of cattle being pulled out of sale this week as sellers gain more

confidence in the market moving forward.

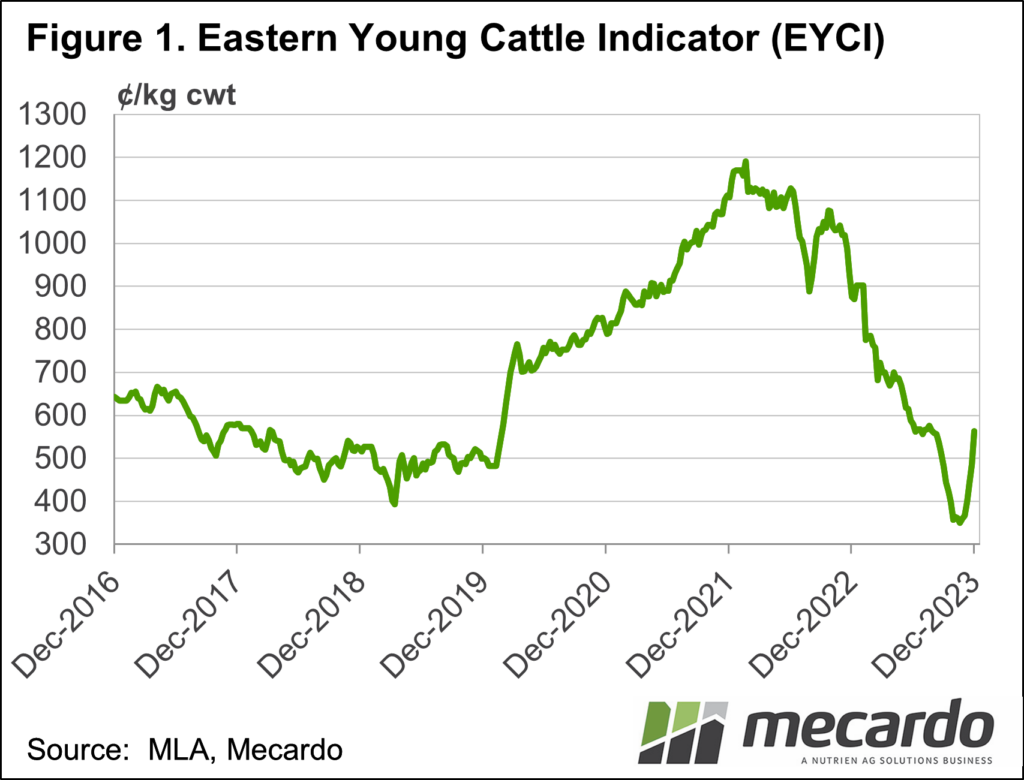

Historically, it is hard

to compare current outcomes with the medium and long-term trends, as it didn’t

take an actual drought episode for the confidence to leave the cattle market

this time around, only the promise of one. As we can see from the Eastern Young

Cattle Indicator chart, it was just the forecast of widespread rainfall in the

east that turned this year’s trend around. That said, the EYCI, which averaged

a touch above 560¢/kg last week, is now relatively in line with figures from

the same time in 2017-2019 when the herd was last in a destocking phase.

Looking into the new

year, our recent analysis of the ABS slaughter data showed that while the

female slaughter rate has surpassed the usually referred to herd liquidation

marker of 47% (it was 49% for the September quarter), it certainly hasn’t

skyrocketed as it did in the 2018 period. This could indicate producers have

been better placed to ride out both much lower prices and a dryer spring than expected,

and the lift in cattle price indicators across the board over the past few

weeks backs this up.

Price-wise, a change in

weather and market sentiment at the beginning of 2020 created a turn-around of

the EYCI for that year. While this time around, it has come a month earlier, it

is a good sign prices will continue their current trajectory early in 2024, albeit

at a slower pace. Whilst there is little to indicate it will double again as it

did in 2020, it will likely work its way up to the 10-year annual average of

just above 610¢/kg in the first half of the year. We’d have to get widespread favourable

weather conditions and assistance from global factors for it to get within

reach of the five-year annual average of nearly 750¢/kg however.

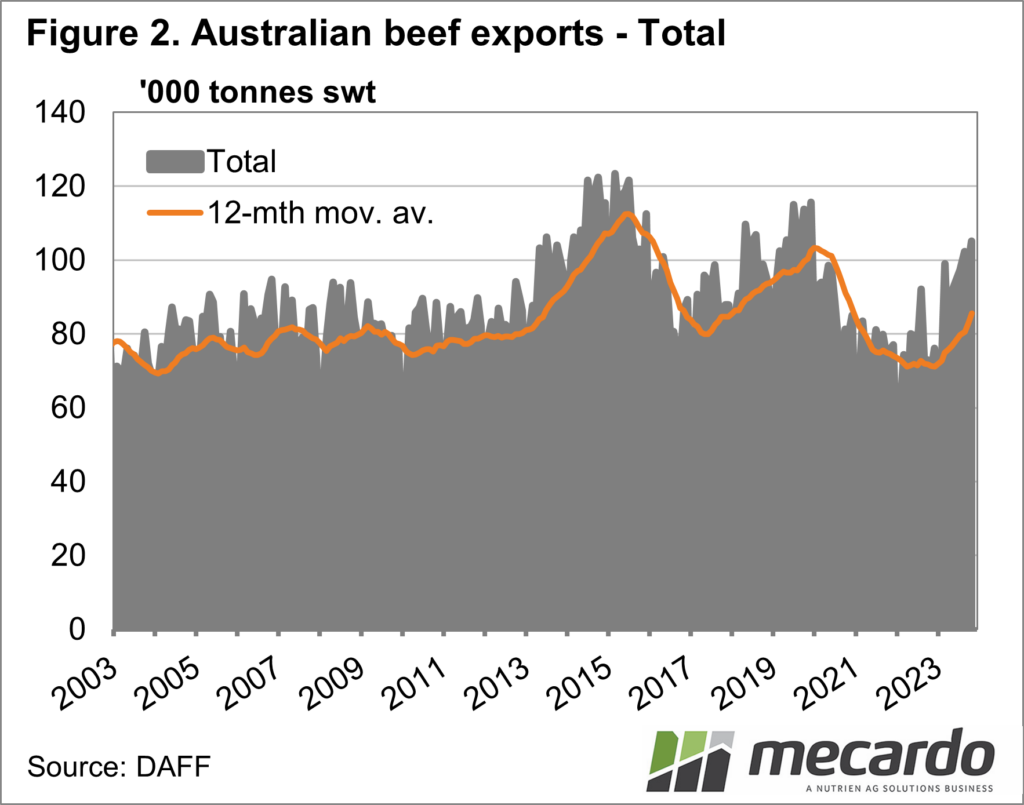

Internationally, beef

trade is expected to hold fairly firm in 2024, with steady consumption and production

increases (and therefore exports) from Australia and Brazil being offset by

herd rebuild and lower production in the US, particularly for the type of beef

the US imports.

What does it mean?

Domestically, restockers and feeders have returned to the market and pushed prices back in a positive direction for the first time all year, and this confidence is likely to continue early in the new year – especially if drier-than-average conditions don’t eventuate.

This would create a strengthening market in the short to medium term. One limiting factor to upside next year will be softer consumer demand globally and inventory in the supply chain which is potentially still full, however, Australian beef export volumes have still been on the up throughout 2023, and look to keep on that trajectory in the new year as US production declines.

Have any questions or comments?

Key Points

- East Coast rain has boosted the cattle market by about 40% over the past month, creating industry confidence as we head into 2024.

- EYCI is now in line with price levels for the destocking phase, however, herd liquidation is still limited, pointing to price upside in coming months.

- International markets are expected to remain at current levels in the new year.

Click on figure to expand

Click on figure to expand

Data sources: MLA, Rabobank, Mecardo