The extended wet weather, along with shearer numbers, has delayed shearing in many regions. The staple length was going to be long given the good seasonal conditions, with delayed shearing staple length has been extended. This article takes a look at the supply of long merino wool.

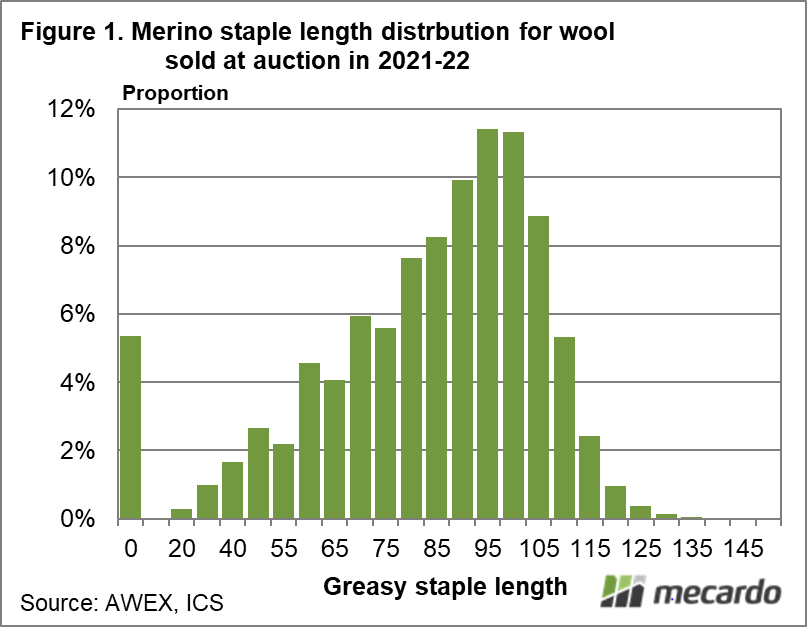

Figure 1 shows the distribution of staple length for merino wool sold during the past year (to September) in 5 mm increments. Cardings, without an estimate of staple length, are grouped in the zero category. The largest categories by clean volume during the past year were 95 mm (93-97 mm) and 100 mm (98-103 mm), with the proportion of wool dropping very quickly beyond the peak length. The supply chain is set up to process an Australian clip as it has been presented in recent years in terms of wool specifications, so a variation in a specification (recently vegetable fault but more often staple strength/mid-point break or fibre diameter) can cause problems with consequent changes in the relative prices (premiums and discounts) within the greasy wool market.

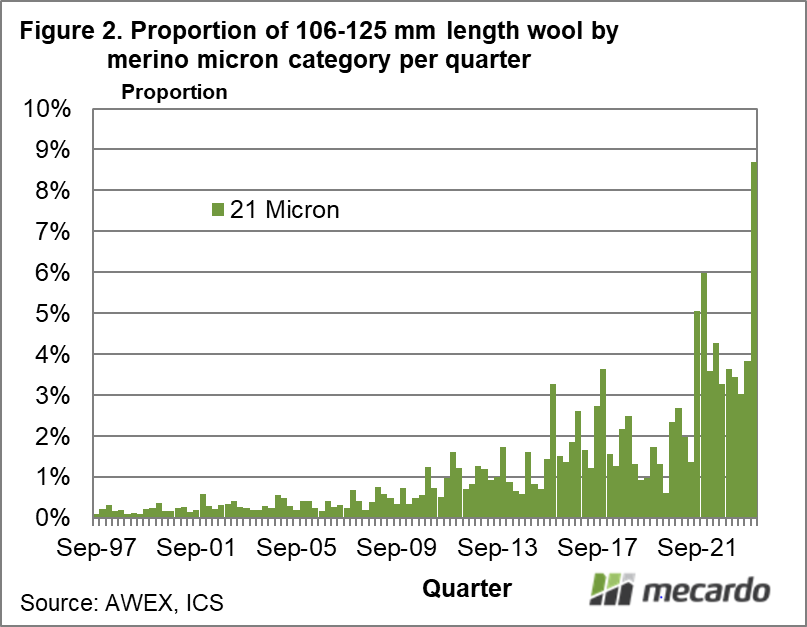

In Figure 2 the quarterly (3 months) proportion of 106 to 125 mm length greasy wool sold at auction for the 21 micron category is shown from the late 1990s to this current quarter (we are only two weeks into it). The proportion of long wool has increased since mid-2021, coinciding with wet seasons and shearer shortages, with the proportion rising from around 1.5% to 3-4% of sales. Note how in the first couple of weeks of October (the latest quarter to date) the proportion has shot up to 8.7%. An extra 5% (if the trend continues) of long wool will test discounts for over length wool.

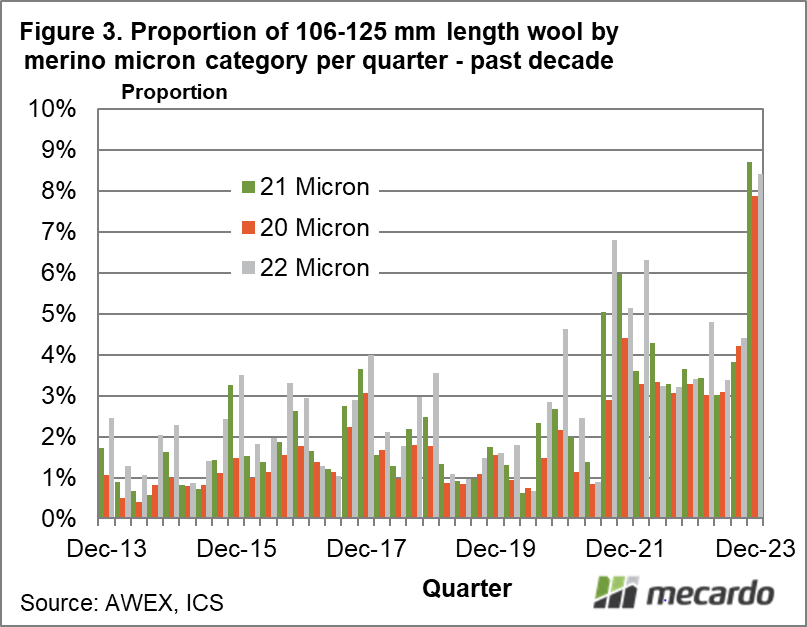

Figure 3 shows the proportion of 20 through 22 micron wool sold which was 106-125 mm long during the past decade, by quarter. The story seen in Figure 2 for 21 micron is basically the same for 20 and 22 micron. The recent switch in focus by Chinese mills to the broader merino categories will be a blessing for these long staple wools as the traditional Chinese fleece types tend to be focussed on full length fleece wools.

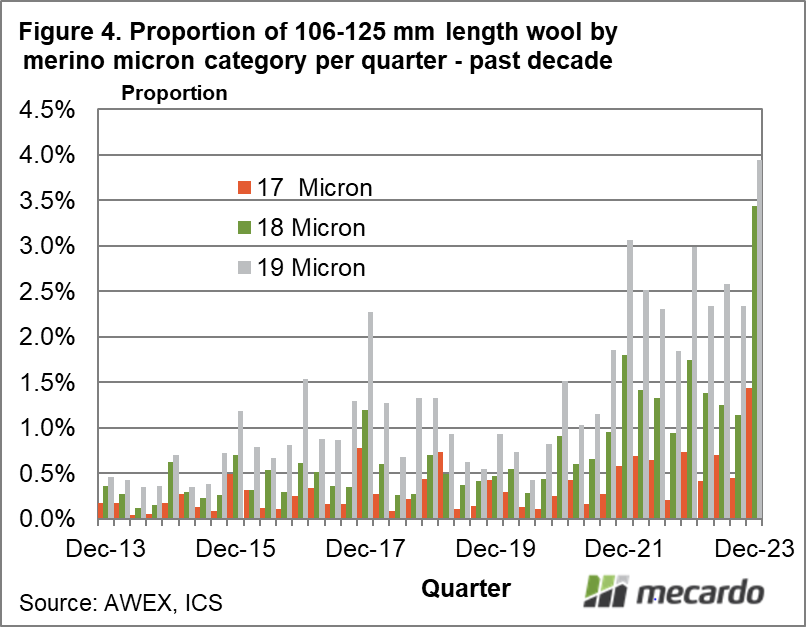

Finally, in Figure 4, the proportions of 106-125 mm wool for 17 through 19 micron are shown for the past decade. The proportion of 18 and 19 micron over length wool has lifted in recent weeks. So has the proportion of 17 micron but it remains under 1.5%, a fairly easily manageable level.

What does it mean?

If we go back two decades, less than 0.5% of 21 micron wool sold at auction was 106-125 mm long. In recent weeks it is close to 9%. The bulk of the merino wool sold in Australia is 80-105 mm long, so the long staple lots will not fit easily into standard consignments. They need to be squeezed into blends somewhere, some into China types and some into knitwear types. The point of the article is that there is significantly more long staple volume to squeeze into consignments so the relative price is likely to ease (discount increase).

Have any questions or comments?

Key Points

- The proportion of 106-125 mm length merino wool lifted in late 2021, corresponding with wet seasonal conditions and shearer shortages.

- The proportion looks to have lifted to another level again in recent weeks, although it is very early in the December quarter.

- The rise in long staple wool looks to be mainly in the average to broader merino micron categories.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: AWEX, ICS, Mecardo