A couple of weeks ago we received a request to look at Australian pulse production and whether the increased supply was outstripping demand. Here we take a look at pulses produced this year and potential markets.

Data on pulse production is relatively easy to find, but data on exports is a bit more difficult. The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) produces data on the plantings and production of the major pulses.

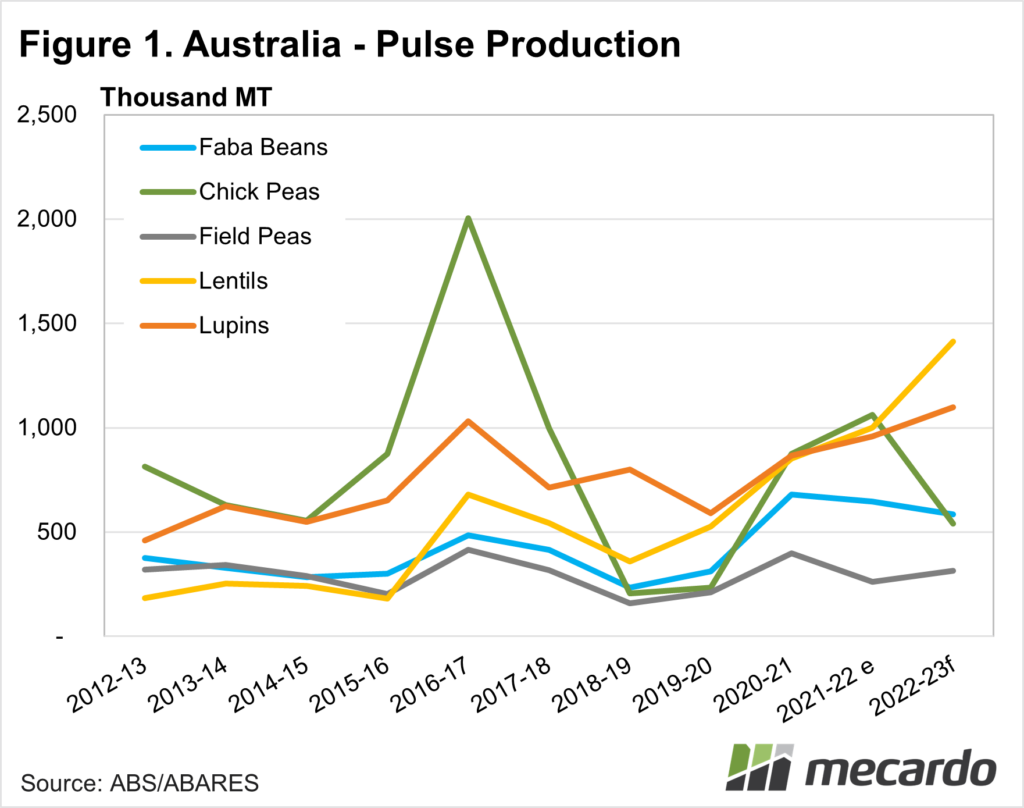

Figure 1 shows Australian pulse production for the last 10 years. The 2022-23 cropping year is expected to produce record volumes of lentils and lupins, with the favourable season boosting plantings and yields. Chickpea production is expected to be much lower, mainly due to declining plantings.

The growth in lentil production has been strong over the last 10 years. Australia is expected to produce 665% more lentils in 2022-23 than it did in 2012-13. In that same period, lentils’ share of winter cropping area has grown from 0.8% to 6% last season. This is huge growth.

Lupins, faba beans, and field pea cropping areas have been relatively steady over the last 10 years, with changes in production reflecting seasonal conditions.

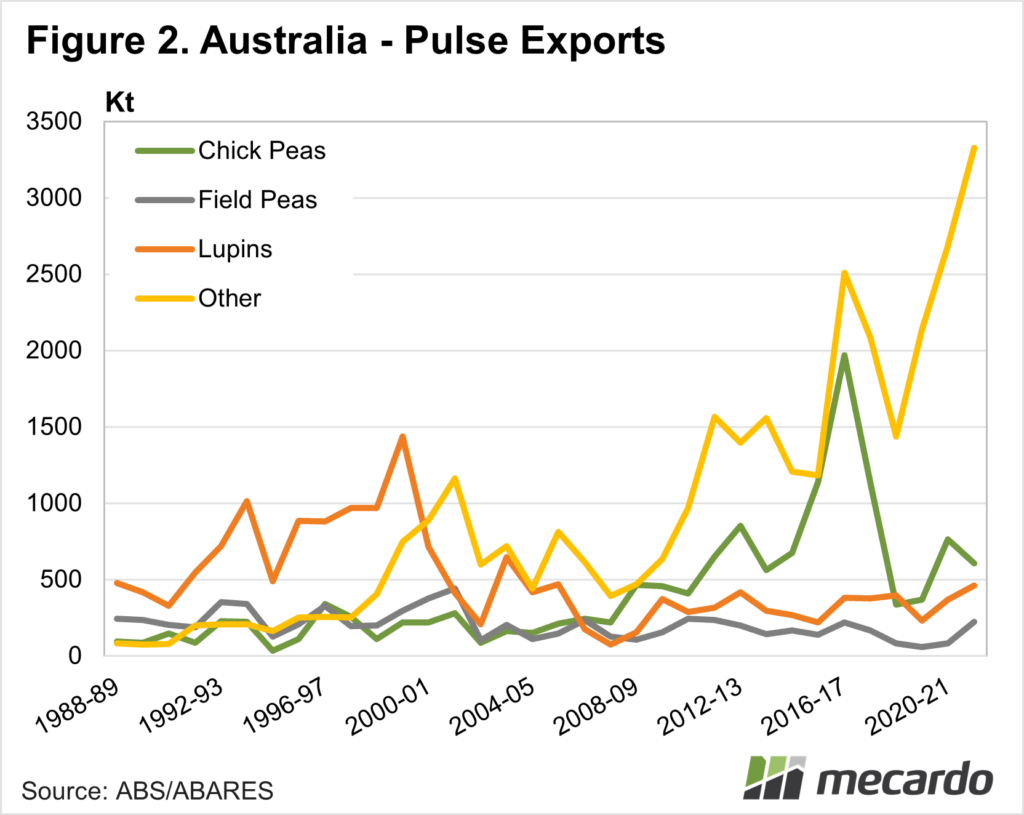

A vast majority of Australia’s pulse production is exported. Figure 2 shows Australia’s pulse export volumes for the past 30 years. ABARES doesn’t report lentil exports separately in their pulse data, but it’s safe to say they make up most of the ‘other’ column.

The export data in Figure 2 also includes ‘reexports’ with total pulse exports coming out higher than production in many years. The export data does show that when Australian pulse production increases, there is good demand from importing nations to take the extra supply.

The secondary market for pulses that don’t meet export quality is the local feed market. Pulses make a good protein supplement, but due to limited supplies and high prices over many years they have been replaced in rations by canola meal or other proteins.

What does it mean?

With a big pulse crop last year, and a wet harvest seeing quality downgrades, feed pulses were selling relatively cheaply. With a more normal season, we would expect feed pulses to move back to premiums to cereals.

Have any questions or comments?

Key Points

- Australia produced its largest winter pulse crop on record in 2022-23.

- A majority of Australia’s pulses are exported, but there are stringent quality requirements.

- Pulses were relatively cheap in feed markets this year but should recover with a normal season.

Click on figure to expand

Click on figure to expand

Data sources: ABARES, ABS, Mecardo