Grainfed Cattle prices recently reached record levels, before easing back to what are still very strong prices. Grain prices were expected to come off at harvest but this hasn’t really happened in the big feeding areas. Despite this, lotfeeding margins still look okay.

During November, the Queensland 100 day Grainfed Over the Hooks indicator hit a new record of 614¢/kg cwt and stayed there for five weeks. This was the first time the 100 day steer had moved over 600¢, and it was seemingly due to strong export demand for beef and tight supply of finished cattle.

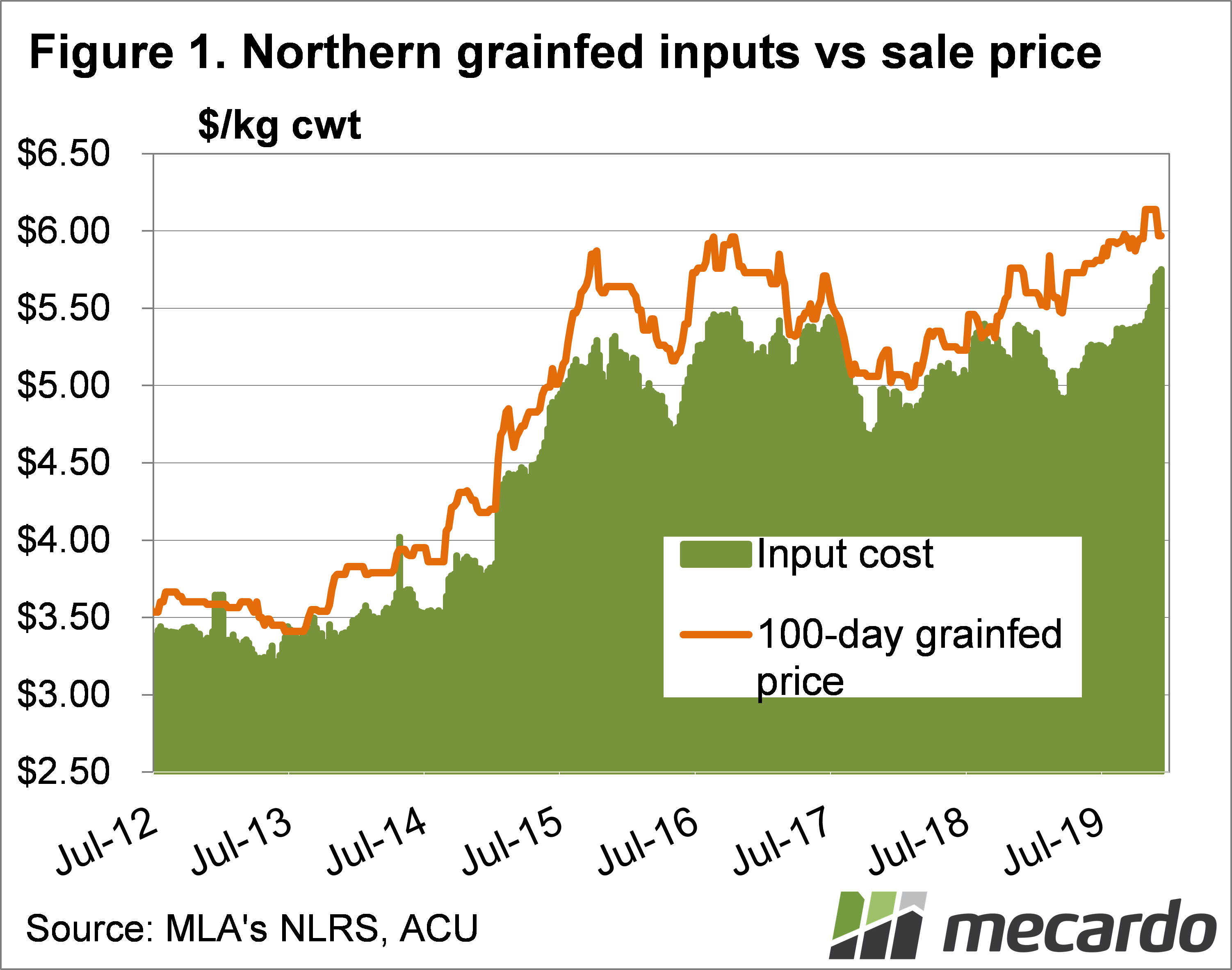

Figure 1 shows that the rising Grainfed prices for much of 2019 were followed by input prices; with a significant spike in the north over the last month. Most would have expected grain prices to remain steady or even fall over harvest, but this is not the case for sorghum on the Darling Downs. Since the start of November, sorghum price gained $50/t and are now close to wheat prices.

In addition to rising grain prices, shortfed feeders out of the paddock have also gained ground. The shortfed feeder indicator is up 9-15¢/kg lwt and now sits at a two and a half year high of 325¢/kg lwt. We can see in figure 1 that while grainfed cattle prices have come off a little, inputs costs have never been higher in the north.

In the south, lotfeeders are finding it easier. Grain prices are nearly $80-90/t cheaper than in the north. Wheat prices have been around $350/t for much of the last four months in the Rivenrina, while feeder steer prices have been also been steady, at 330¢/kg lwt.

The southern supply of export feeders has followed its usual seasonal trend and risen in the spring and early summer. This has meant lotfeeders have been able to keep prices steady in the face of improving grainfed prices.

Figure 2 shows a widening gap between grainfed prices and finished cattle values, with southern lotfeeders enjoying wider margins for the first time since autumn.

What does it mean?

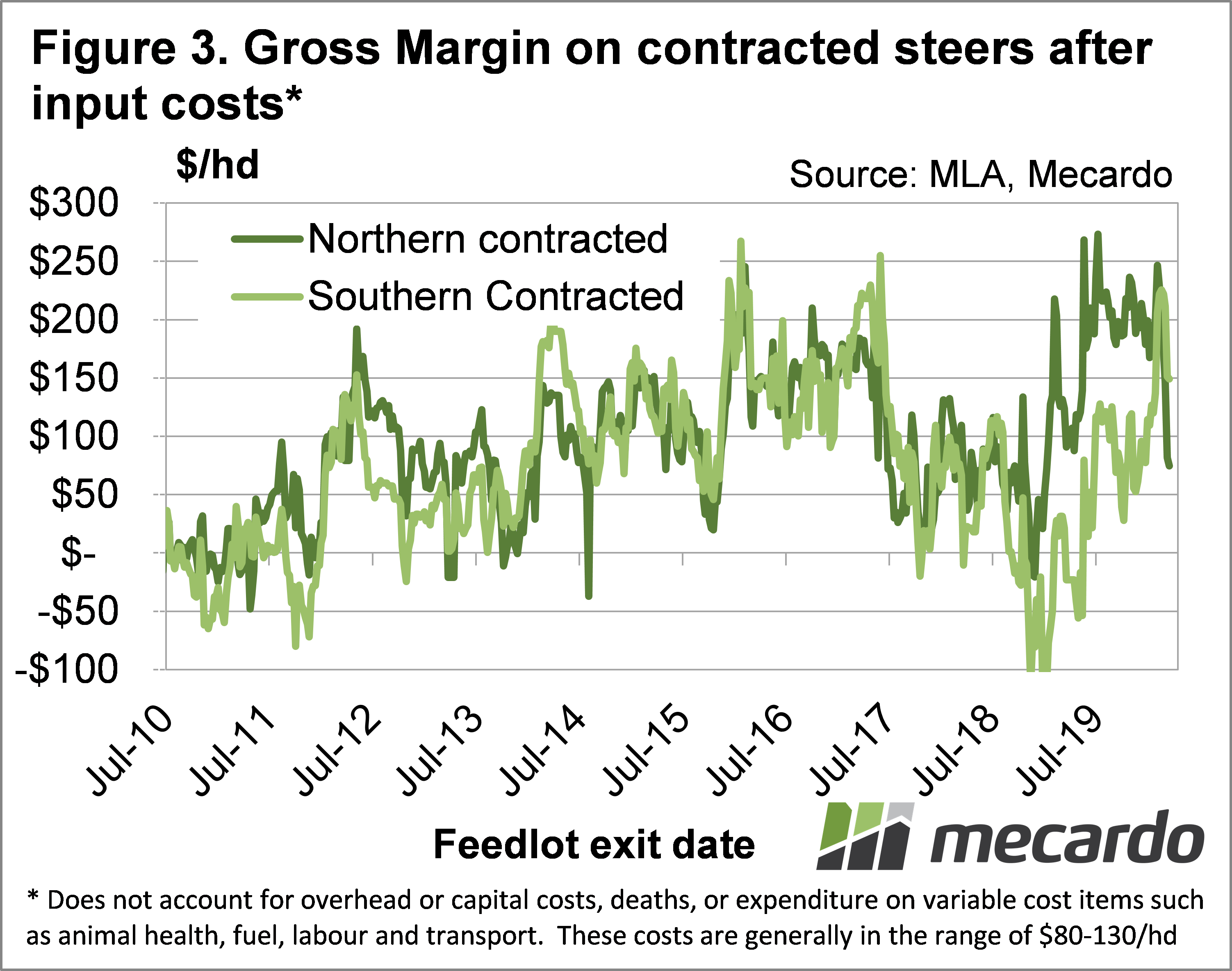

November saw reasonably strong margins for lotfed cattle in both the north and south (Figure 3). With easing grainfed prices, margins have come off but are still good in the south, and close to breakeven after overheads in the north.

We know the easing in grainfed prices has been partly due to very strong cattle supply, thanks due to another round of herd liquidation. When the supply of cattle eases, we could see grainfed prices rally back above 600¢/kg cwt again and this might take feeder values with it.

Have any questions or comments?

Key Points

- Grainfed cattle prices reached a new record in November, moving above 600¢.

- Lotfeeder input costs have been rising in the north, but steady in the south.

- There is room for higher feeder prices in the south, but things are tighter in the north.

Click on graph to expand

Click on graph to expand

Click on graph to expand

Data sources: MLA, Mecardo