Amid the extreme volatility in sheep and lamb saleyards in recent weeks, there has been a relatively consistent trend of cheap restocker lambs. In theory processing capacity shouldn’t impact restocker lambs so much, so what’s going on?

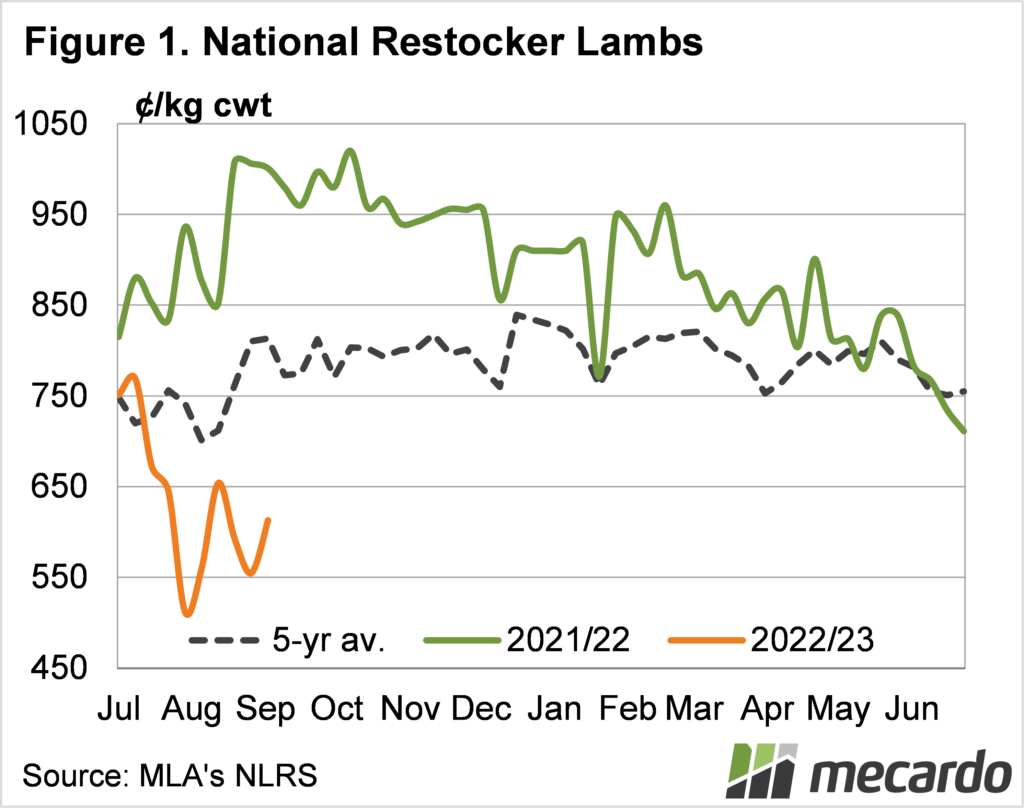

At the start of July restocker lambs prices crashed along with all the other indicators. Figure 1 shows the National Restocker Lamb Indicator fell 33% in four weeks to record a seven year low of 512¢/kg cwt.

Precipitating the fall was obviously falling slaughter values, the Eastern States Trade Lamb Indicator (ESTLI) fell 20% over the same period. Light slaughter lambs were heavily affecting, losing 40% in July.

Following the heavy fall in July restocker lamb prices have bounced and declined and bounced again making sending them to saleyards like a trip to the Casino. This week the restocker lamb indicator has rallied again, back to 613¢/kg cwt early in the week.

Figure 1 shows it’s not unusual for restocker lamb prices to be at an annual low in mid-winter. It’s as much a quality issue as supply, as the last of the old season lambs hit the market in unfinished condition. Slaughter buyers aren’t interested in them, and restockers and feeder run the risk of lambs cutting teeth, and trying to sell into a market where new season lambs are coming fast.

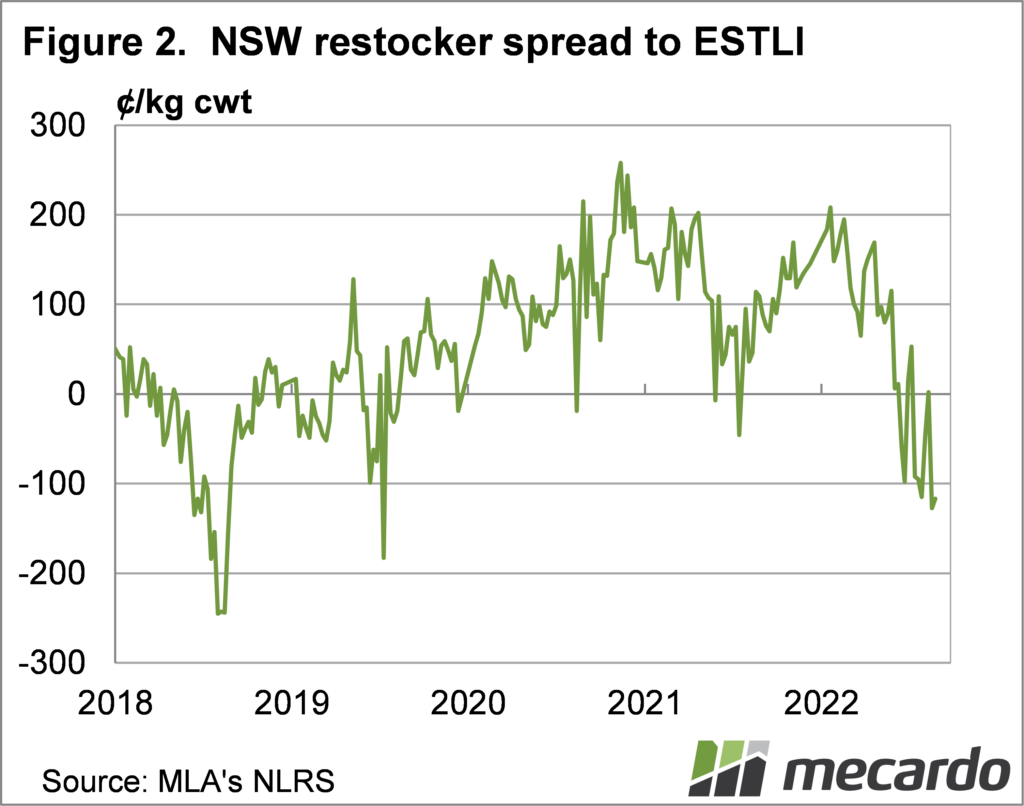

Figure 2 shows the NSW Restocker Lamb Indicator spread to the ESTLI. Restocker lambs are this year at a larger than normal discount to the ESTLI, and there could be some demand factors associated with this.

The demand for light slaughter lambs has reportedly been weak, with processors preferring trade or heavy lambs. There are plenty of trade lambs available at the moment, which is unusual for this time of year. With little competition on the lighter end, restockers are getting lambs cheaper than normal, relative to the ESTLI.

Looking at new season restocker lambs selling on Auctionplus we can see it is a completely different market. Last week crossbred wether lambs traded around 850¢/kg cwt, a massive 33% premium to saleyard indicators.

What does it mean?

The depressed restocker indicator appears to be more due to the oversupply of old season lambs this year, rather than a demand affect. Demand for new season lambs is strong, with expectations finished lamb prices will hold in the spring.

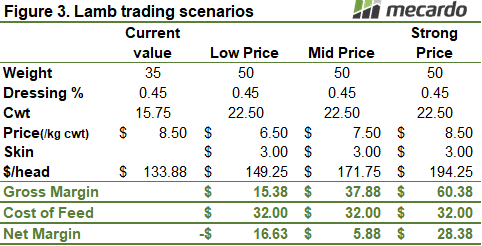

Figure 3 shows a basic lamb trading table, and even at 850¢, or $133/hd restocker lambs are reasonable buying for those looking at abundant spring feed. There is plenty of variation in price expectations, and there won’t be much in the trade if a flush of lambs sees prices lower than 650¢. There is a feed cost included in the table to show it’s tight for feeders at anything under 800¢.

Have any questions or comments?

Key Points

- Restocker and light lambs have been very cheap in absolute and relative terms since July.

- New season restocker lambs are at a strong premium to saleyards.

- There is still margin trading restocker lambs if prices hold this spring.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo