Last week, Meat and Livestock Australia (MLA) released its latest projections for the Australian sheep and lamb flock. With a growing flock and stronger lamb slaughter forecasted what does this mean for price? Here we investigate how lamb slaughter and price have historically correlated, and put forward some forecasts.

All markets are governed by supply and demand, with sheep and lamb no different. The higher the supply of stock, the lower the price, and vice versa. Australian lamb and sheep producers have been fortunate to have seen increasing demand for the last 20 years. The latest supply forecasts suggest that demand will need to strengthen to see prices rise further.

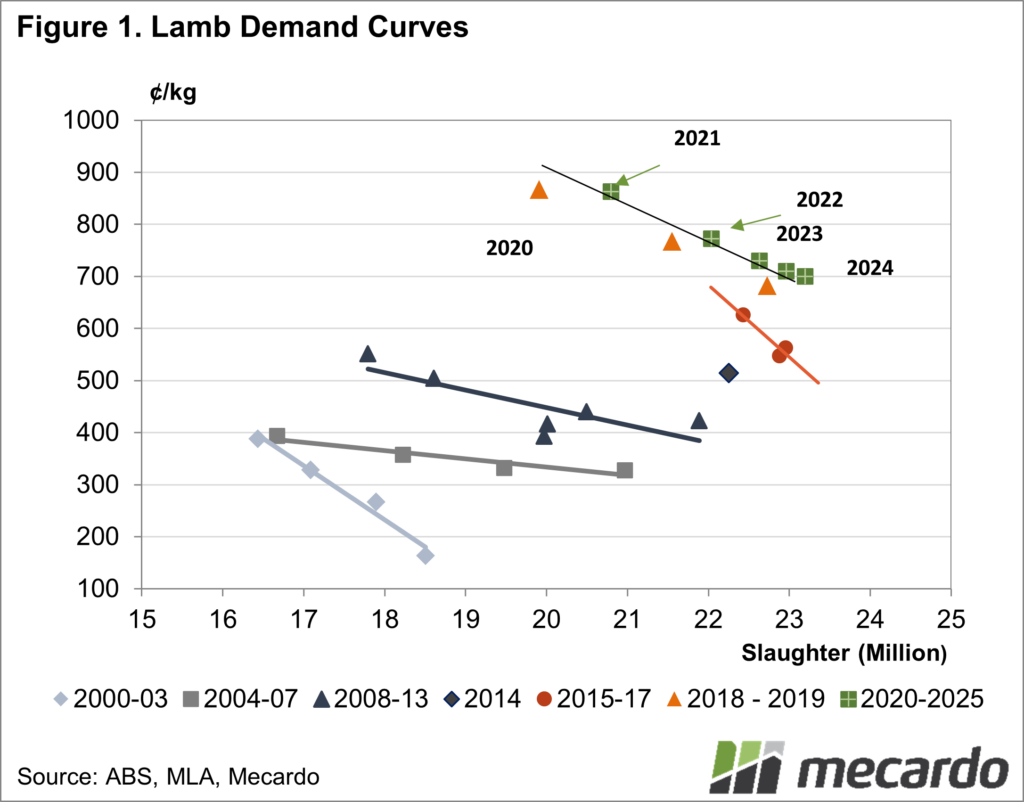

So, how do we know demand is increasing? When we plot annual slaughter against the average annual Eastern States Trade Lamb Indicator (ESTLI) in figure 1 we can see over time the data points have moved to the right and up. That means that supply has been increasing, but prices have also increased.

The stronger demand occurs in steps, with years grouped together, and demand stepping up creating a new curve. The 2020-2025 curve has actuals for 2020, 21, and 22, and estimates for 2023-25. It’s interesting to see the current ESTLI very close to the forecast for 2023, which suggests demand remains relatively static on last year.

While lamb slaughter is forecast to increase in 2024 and then be similar in 2025, the increasing numbers are not huge. At the current demand rate, the ESTLI will average just over 700¢/kg cwt, with slaughter rates around 23 million head.

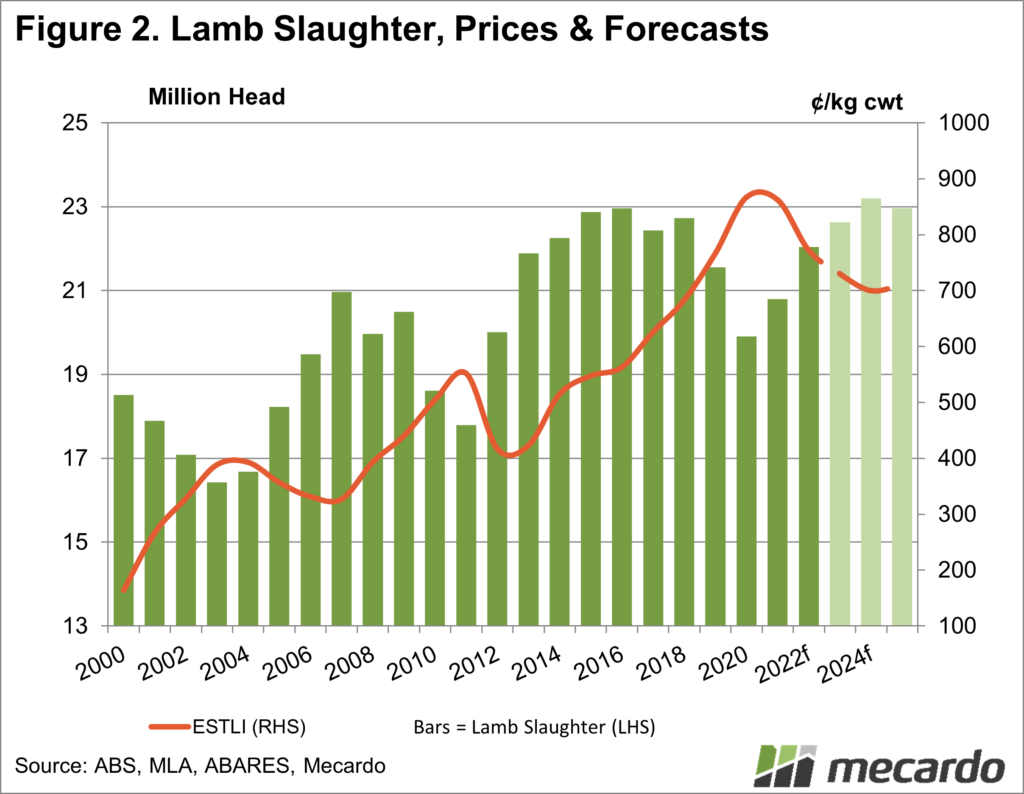

Figure 2 shows the same data in a different format. Lamb slaughter will be at record levels, just above the peaks of 2015-16 in the coming years. Improving demand should, however, see prices at levels around 25% stronger than in those years.

What does it mean?

As supply increases, lamb prices should continue to trend downwards until 2024, but the difference should be relatively minor. For stronger prices, we will need to see improving demand, and this isn’t out of the question. With a smaller flock in New Zealand and the United States, along with the likelihood of a cattle herd rebuild in the US, some demand could shift to Aussie lamb. Historically demand has stepped up every 5-6 years, so we could be due.

Have any questions or comments?

Key Points

- MLA is forecasting increasing lamb supply this year and next.

- Rising supply should see prices continue to trend downwards, but not sharply.

- There is scope for stronger demand to result in a step-up in price.

Click on figure to expand

Click on figure to expand

Data sources: ABS, ABARES, MLA, Mecardo