The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) released their September crop report last week. The dry winter across many cropping regions was mentioned, but it hasn’t really moved the yield forecasts.

The ABARES Crop Report is the main official update on Australian crop conditions and expectations. Released in March, June, September and December, The Crop Report attempts to forecast major winter and summer crop areas, yields and production.

This year’s crop has always been forecast lower than the previous two records. The exceptional seasons of 2021-22 and 2022-23 have bolstered production and yield averages, with a return to normal now being a massive drop.

There has been plenty of talk regarding the dry season being experienced in cropping regions, mainly in Northern NSW and WA, but it hasn’t impacted ABARES average yields yet.

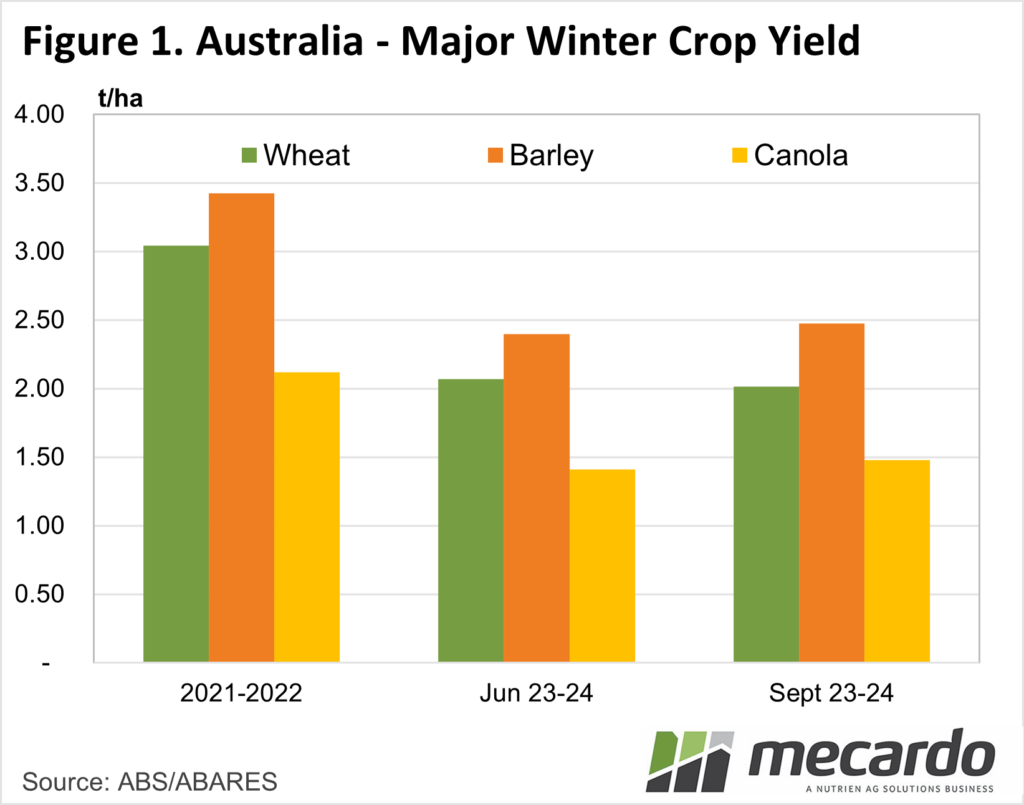

Figure 1 shows forecast yields for wheat, barley, and canola. There was a marginal decline in wheat yields, down to 2.01t/ha, but barley and canola were held largely steady. The fact more canola is grown in southern states and regions contributed to this but it could be said wheat and barley yields above the 10-year average before 2021-22 could be optimistic.

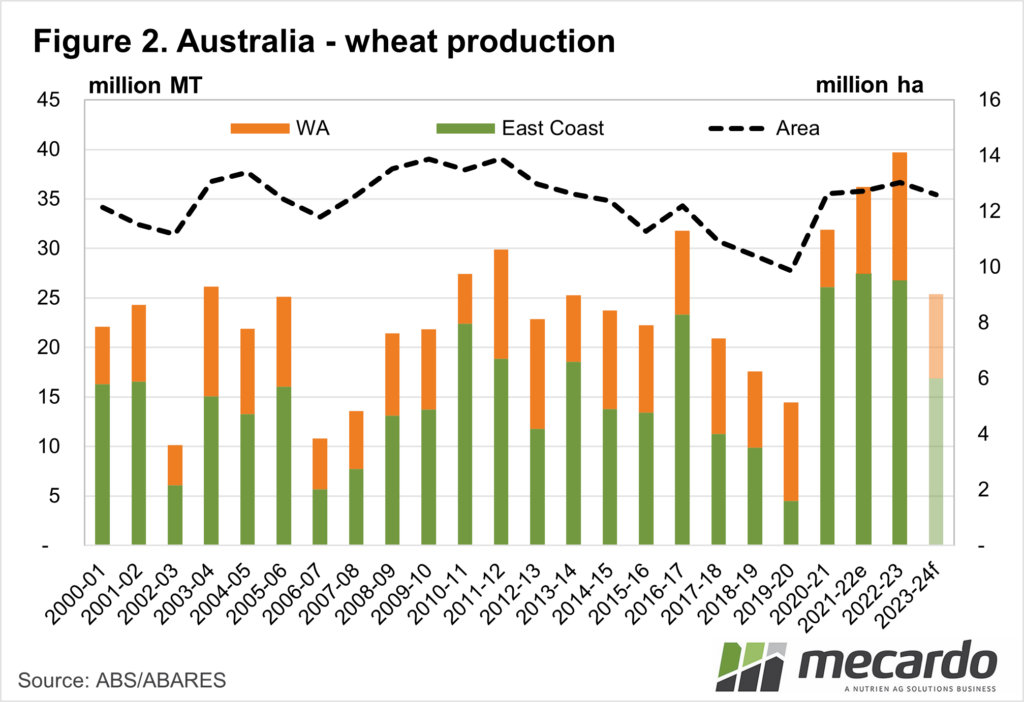

Figure 2 shows how wheat production is expected to shape up this year relative to the past 20. Wheat production is still expected to be historically strong this year at just over 25mmt, ranking fifth highest out of the last 10 years should this eventuate.

Barley production was forecast to be a little higher than the June Crop Report had previously pegged it. At 10.5 million tonnes, barley production will be well down on last year, but again, still the fifth highest of the last 10 years.

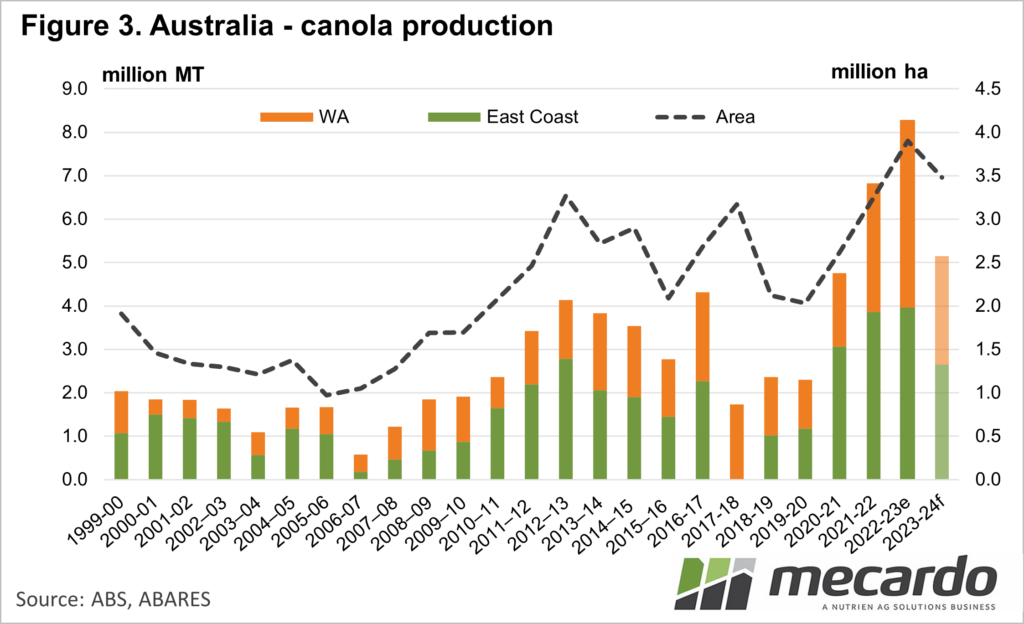

Canola production was also forecast to be a little higher than the June report. A small increase in area and steady yield led to a forecast of 5.15mmt (Figure 3). While canola production will be well down on last year, again, it is still forecast to be historically strong.

What does it mean?

There doesn’t appear to be much upside from these ABARES forecasts, and potentially plenty of downside. A dry spring will see yields drop in some areas, while a normal spring will see crops likely reach potential. Markets are already factoring in lower yields than those forecast. Our prices relative to international markets are much stronger than last year, but there could be more upside to come.

Have any questions or comments?

Key Points

- The ABARES Crop Report has forecast little change in major winter crop yields from the June Report.

- All major winter crops are expected to be much lower on the production front than last year, but still historically strong.

- Markets appear to be factoring in lower yields than those forecast by ABARES.

Click on figure to expand

Click on figure to expand

Click on figure to expand

Data sources: ABARES, Mecardo