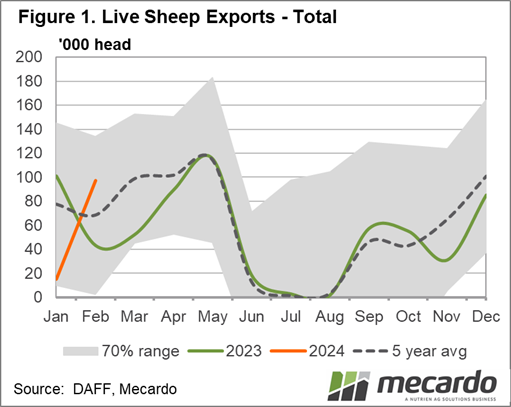

Live sheep exports rose year-on-year for the first time in five years in 2023 but were still historically low. And while good numbers headed offshore in February, year-to-date figures for 2024 are still quite sluggish.

Some markets have been improving,

with Saudi Arabia continuing to be active after importing Australian sheep for

the first time in a decade in December, and Jordan increasing their intake by

more than 400% in 2023. However, Australia’s biggest live export market,

Kuwait, has taken 30% less sheep for the year so far.

Looking back at last

year, total live sheep exports rose 23% from 2022 to 652,299 head but were

still 11% below the five-year average. This year got off to a very sluggish

start, with less than 15,000 head exported in January – 81% below the five-year

average for that month. This figure was likely impacted by a boat that set sail

on January 5, but had to turn back some two weeks later due to unrest and

potential danger in the Red Sea. February made up some of this shortfall, with

live sheep exports 30% above the five-year average for the month, but together

they are still 22% lower than the same period in 2023.

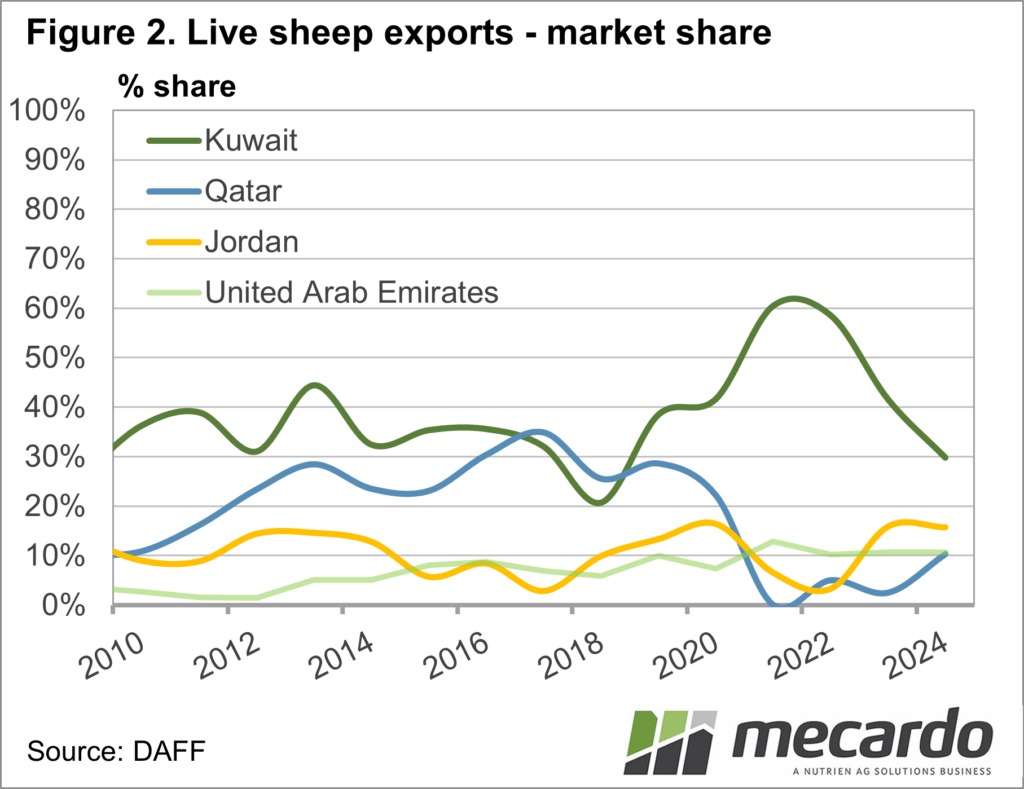

The domestic back and

forth regarding live sheep export phase-out in Australia hasn’t seemed to deter

particular markets from increasing their intake of Australian sheep. Jordan,

for instance, has previously been an important market, taking up to 16% of the

share in 2020. However, by 2022, that had fallen to 3%, or just 16,521 head.

For the 12 months ending February 2023, Jordan imported just shy of 100,000

sheep from Australia, which was an increase of 162% year-on-year, and the

biggest increase. This year, they are back up to taking 16% of the market

share, however, that is still 18% less than the volume of sheep they took for

the first two months of 2023.

Kuwait has remained the

biggest market for Australian sheep so far in 2024, having made up nearly half

of all exports last year, or more than 270,000 head. However, figures for

Kuwait did fall year-on-year in 2023, down 8%, further showing the importance

of the emerging – or re-emerging – markets. This year Kuwait has made up 30% of

the market for the January-February period, and while February numbers were

above the five-year average, the year-to-date total is still down 31% on the

same period last year.

Saudi Arabia is the

other market to watch, having imported Australian sheep for the first time in

more than 10 years in December of 2023 when 5000 head were sent there. They

took a further 22,265 head in February, making them the second biggest market

for the month behind Kuwait. The fourth largest market behind the above three

mentioned was the United Arab Emirates, which imported 12,000 sheep from

Australia in February, double the five-year average for the month and a 100%

increase year-on-year.

What does it mean?

Meat and Livestock Australia forecast in their February sheep industry projections that Australia’s live sheep markets in MENA (Middle East/North Africa) had a growing appetite for the product, and that appears to be the case, especially if the trade continues on its current trajectory.

The re-emerging markets, alongside opportunities in some new markets we haven’t discussed, are helping trade, as are Australia’s lower domestic prices and high supply. However, the uncertainty of the future of the trade, along with potential international conflict distributions, will be what holds it back from lifting back to the levels of last decade.

Have any questions or comments?

Key Points

- Live Sheep exports lifted in February, but have still had the slowest start to the year on record.

- Total live sheep exports ended 2023 at the highest numbers since 2020 but were still historically low.

- Previously strong markets re-emerging despite domestic uncertainty around the sector.

Click on figure to expand

Click on figure to expand

Data sources: Meat and Livestock Australia; LiveCorp, Mecardo