Spring is right around the corner, and with it comes new season lamb sales. Producers with plenty of lambs on the ground thanks to good seasonal conditions this year (so far) would no doubt have been doing their sums in recent weeks, and significantly scaling back expectations of returns from recent years.

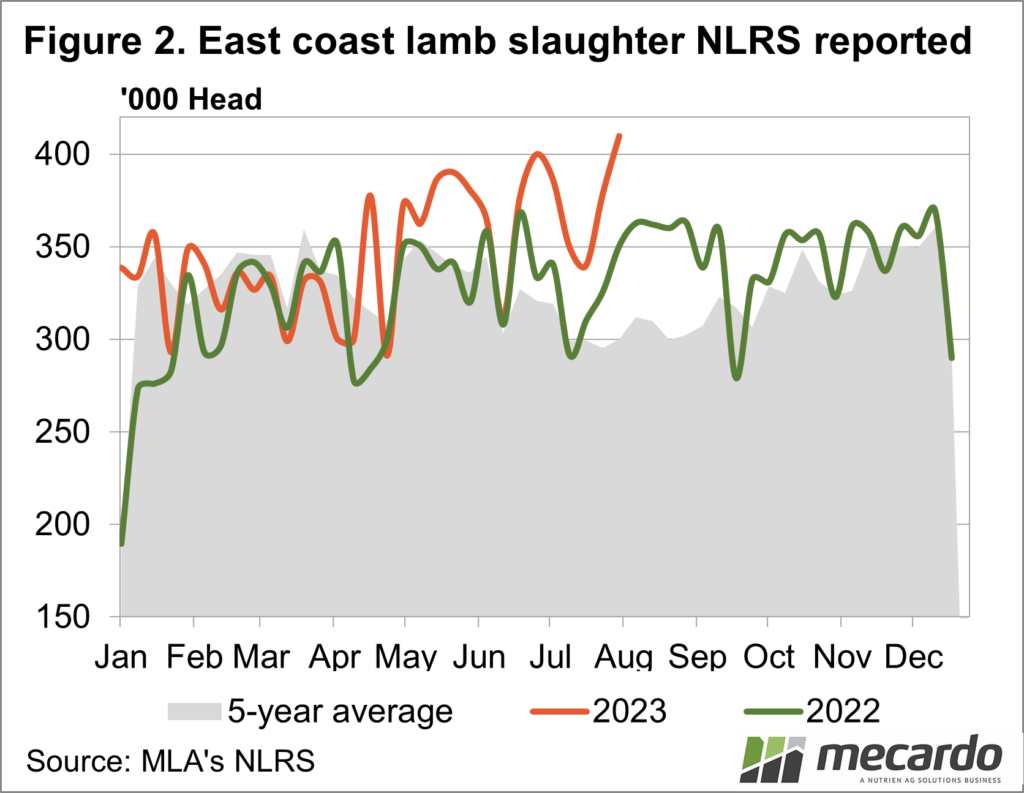

Supply of old season lambs hasn’t dried up in recent months, and despite reports of suckers hitting saleyards much later than they have traditionally done, slaughter remains sky high. Team this with the subdued demand we looked at last week here, and there isn’t much to look forward to for prime lambs.

Meat and Livestock Australia have reported last week’s combined sheep and lamb slaughter was the highest August week on record, with more than 577,000 head being processed. Lamb slaughter was 17% higher year-on-year, and at the highest level since January 2021, which was a week impacted by Covid-caused Victorian abattoir backlogs. Looking longer term, the previous week’s reported slaughter was 27% higher than the five-year average, and 24% higher than the 10-year kill. Weekly lamb slaughter is averaging 7% higher than the short-term average so far in 2023.

MLA has also noted that this supply rise hasn’t been driven by new season lambs as it usually would have by this time of year. In fact, by the start of August, we are usually seeing significant numbers. For instance, in 2020 more than 15,000 young lambs were yarded that week, compared to just 164 this year. Numbers have started to pick up slowly now, there were more than 4000 at Forbes last week, and 2500 at Wagga Wagga.

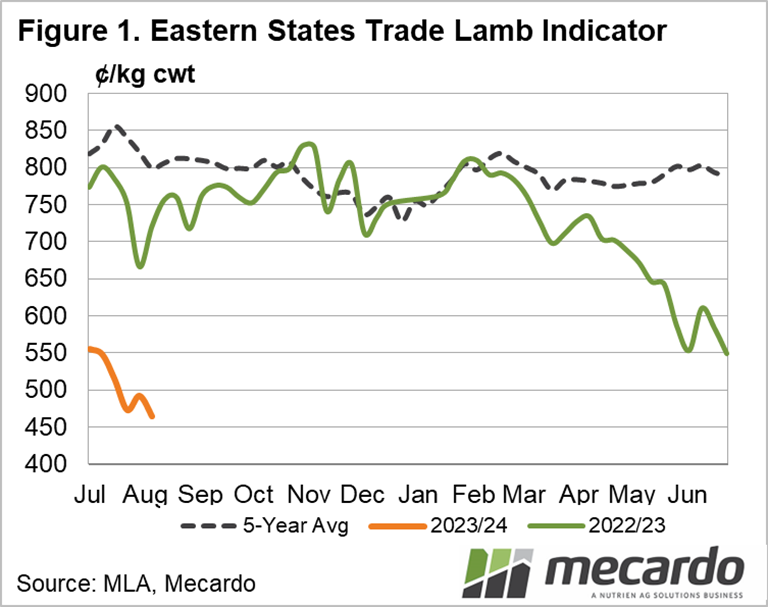

So where has that left prices? Looking at the Eastern States Trade Lamb Indicator first, it is currently at just shy of 464c/kg, which is about 260c/kg below last year and 42% lower than the five-year average for the same week. If you have a 22kg new season lamb sold at the ESTLI price last year it would have made $172. This year, that same lamb will return $102. Heavier lambs are still down 41% on the five-year average but are faring slightly better year-on-year, back about 230c/kg, currently trading at 470c/kg. This means if you have a 28kg lamb, you would have made $196 last year and can expect about $131 this year. Despite a jump in price last week lifting the restocker indicator to 352c/kg, an 18kg restocker is making about $40 less per head year-on-year.

What does it mean?

Supply is only set to head one way as more and more new season lambs from what is predicted to be a bumper lamb crop this year hit the market, whether that be through the saleyard or direct to processors, it will have the same impact on price.

Wherever they are getting them, buyers are unlikely to need to set their sights any higher than current rates to secure the lambs they need.

Have any questions or comments?

Key Points

- Lamb slaughter continues to skyrocket, up 27% on the five-year average for the sale week.

- Old lambs are still making up a majority of saleyard throughput, as new season lambs are increasing in number later in the year than they have historically.

- At current indicator pricing, trade and heavy lambs are returning about $70 less than the same time last year.

Click on figure to expand

Click on figure to expand

Data sources: MLA, Mecardo